Consumer lifestyle changes will drive beauty trends

Selfie point in Heinemann’s LookLab at Copenhagen Airport

Beauty in travel retail continues to increase in importance. In 2017, the category had grown to 37% of the US$70 billion sales in the channel (source: Generation Research), more than double the size of the next biggest product sector.

It is not hard to see why. In new locations such as Istanbul New Airport, where Gebr Heinemann and Unifree have opened shops, perfumes and cosmetics have a huge and powerful presence. Last year at another global hub – Paris Charles de Gaulle – the retail joint venture of Lagardère Travel Retail and Groupe ADP chose the beauty category to unveil its ‘New Age’ retail concept.

Such investment requires innovation. Big travel retailers and suppliers are generally on top of domestic beauty trends, and are good at bringing them to airports. From the rise of niche fragrances; the augmented reality of ‘magic mirrors’ for testing color cosmetics ‘looks’ without actually trying them on; or the experiential services of live make-up artists, the channel has been very active.

But where is beauty going next? Below are four developments that are influencing the beauty consumer right now, and will continue to do so into the future.

1. Sustainability and packaging

Shoppers are more attentive to the environmental impacts of their purchases and beauty players know this. This is not a trend but a fundamental lifestyle change. Mintel research shows that 44% of US natural/organic personal care consumers, who buy both mainstream and natural/organic brands, say they live sustainably, while in China, 58% of well-educated, sophisticated consumers (aged 20-49) say they are willing to pay more for ethical brands. L’Oréal have already begun to offset their carbon footprints in travel retail while Unilever has pledged to use 100% recyclable, reusable, and compostable plastic by 2025. Such moves will gain momentum.

2. Natural beauty

This segment has been outperforming ‘conventional’ beauty for a while and taking market share in the process according to Nielsen. In 2013, products using natural claims represented 2.1% of the US personal care market share with sales of just $230 million. In 2017 the share was up to 3.1% but sales had rocketed to $1.3 billion. The beauty (as opposed to personal care) market has been slower to shift (with natural products taking only 1.4%) in 2017. Part of the problem may lie in the relative lower pricing of many natural beauty brands which retailers worry will cannibalise luxury lines.

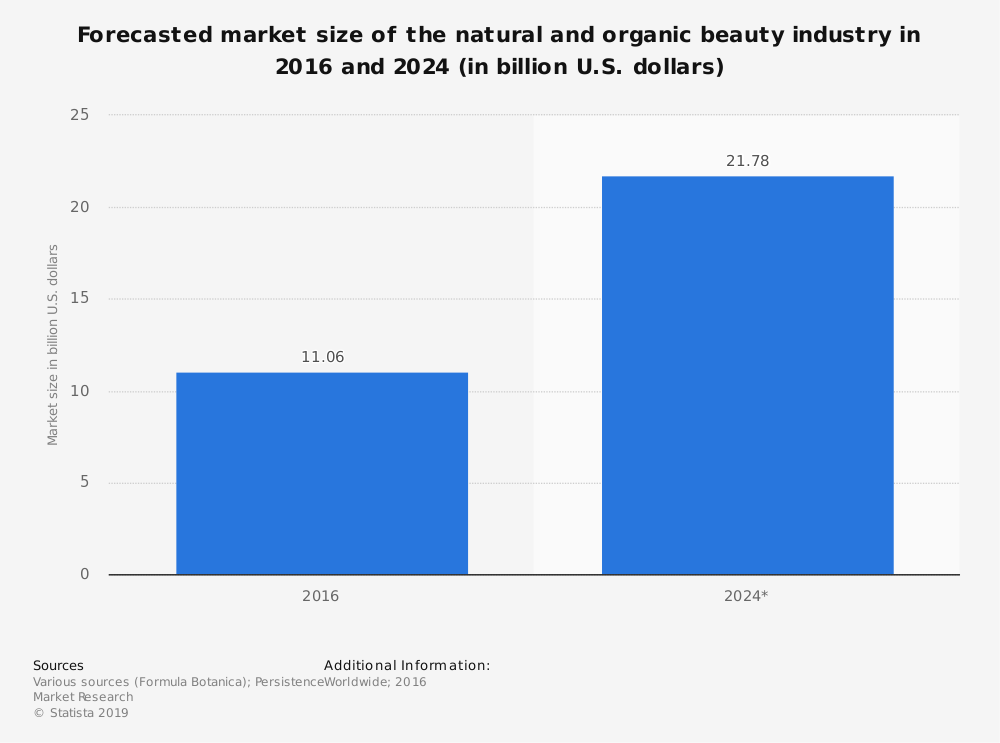

Global natural and organic beauty forecasted market size 2016-2024

Like the food we eat, consumers want to know what exactly they are putting on their skin too – and not just the active ingredients or what’s left out (like parabens, DEA, palm oil etc). The Soil Association recently named-and-shamed certain beauty brands that used the term ‘organic’ on their labels in a misleading way. Kezzler codes (which give items a secure and traceable identity) offer one solution to ingredients transparency which can also help drive consumer engagement.

4. Smart tools

Technology is merging with beauty. In travel retail, brands such as Foreo and Clarisonic already fuse beauty products with technical application tools. In-store, brands are also offering app-driven consultations, while social media experiences – especially in Asia – are making beauty more interactive. Expect to see even more of these activations, supported by an increasing band of online influencers.

.jpg?&resize.width=322&resize.height=483)