Omnichannel beauty is coming to an airport near you

As the lead product category in the travel retail market– with close to a 40% share – beauty represents a big opportunity for omnichannel sales. Major multinationals such as Estée Lauder Companies and L’Oréal Group have invested heavily in e-commerce platforms and/or partners, and they are seeing very high sales growth in the online sphere.

Travel retail is also seeing some joined-up thinking in this space. Frankfurt, London Heathrow and Auckland airports have all partnered with tech company AOE whose Omnichannel Multi-Merchant Marketplace (OM³) platform is making it easier for passengers to shop across a mixed bag of retailers at an airport.

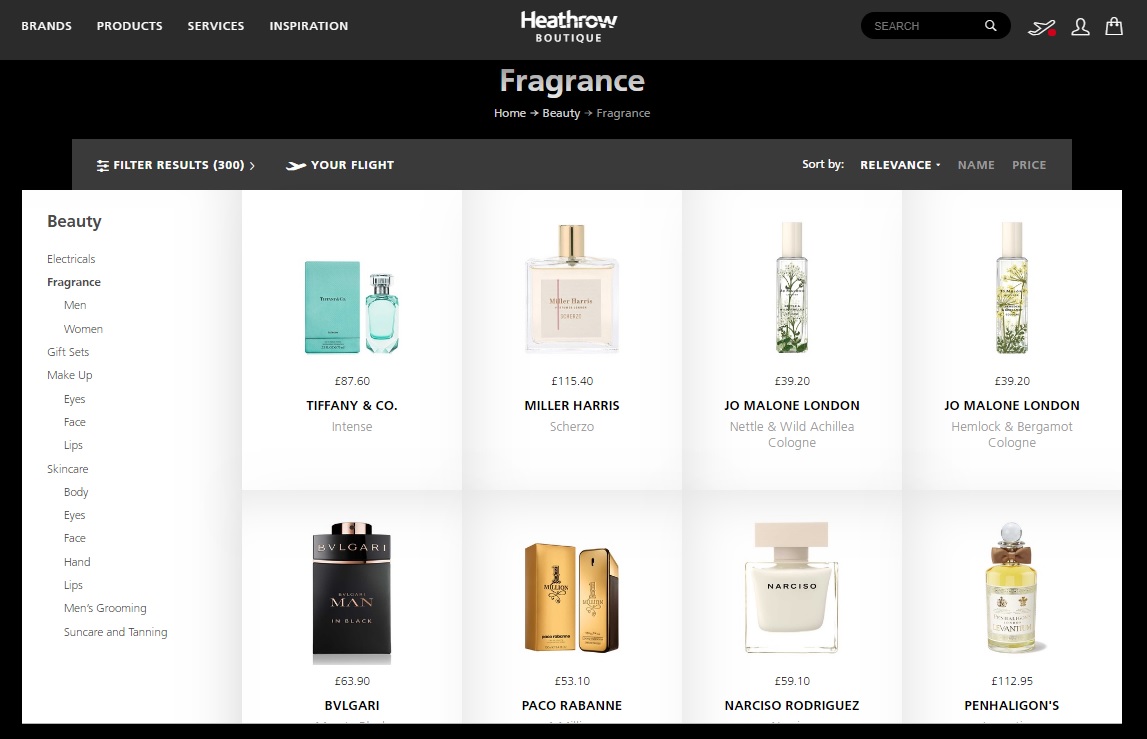

For example, Heathrow Boutique (pictured below) (the airport’s digitally-enhanced online portal) had 52 brands/retailers offering a reserve and collect service by the end of 2018 with retailers such as World Duty Free having a very wide beauty selection of more than 1,200 products online.

According to AOE “passengers are using the platform to research and reserve luxury items” with an average basket value of close to £400/US$515. That is five times the airport’s retail average claims the tech group.

Such developments are not just happening in developed markets. Earlier this year at TFWA China’s Century Conference, China Duty Free Group President Charles Chen pointed out that online luxury sales grew by +37% to reach CNY36bn/US$5.35bn.

Smartphone-using Chinese travelers (which is almost all of them) do their retail research and often their buying/ordering (if they can) online. Beauty is the top searched-for category so it is no surprise that online sales of cosmetics are booming.

In 2017 the total cosmetics market in China was worth around CNY359bn/US$53bn of which e-commerce platforms made up 23% of the sales channels. “But this percentage is growing due to the expanding usage of online platforms,”s ays specialist Chinese-focused market research and management consulting firm Daxue Consulting.

The rapid online rise has happened in parallel with declining department store sales. However, this is not necessarily the case for luxury beauty where consumers want the experience of the store and brand environment, especially when sourcing a new line or product.

This is one reason why CDFG has teamed up with Chinese e-commerce giant Alibaba. According to Chen, the companies will “jointly create a new tourism business model with online and offline integration” as part of what he calls “a ‘new retail’ era that will be people-oriented and data-driven”.

This is now the thought process for travel retailers everywhere: harness data from passengers that they volunteer through promotions, online platforms or loyalty schemes – something already established by Gebr Heinemann (Heinemann & ME) and Dufry (RED by Dufry) – and then build up a picture of their shopping habits. In such cases, travelling shoppers can be exposed to offers or services that are tailored to them and not be spammed by generic messages.

But in the rush to online, one important message to note from analyst Euromonitor: “Bricks-and-mortar stores are more important than ever. Although online plays a crucial role in the path to purchase, the physical store brings a brand to life in a way that e-commerce cannot. Human interaction and advice from beauty consultants is especially important for beauty, and key in building customer loyalty.”