M1nd-set releases latest impact on travel retail revenues due to COVID-19

Swiss research agency m1nd-set has released the latest impact analysis on air traffic across affected countries, following the United States’ unilateral travel ban on air traffic from Europe, the UK and Ireland and in the event of a total shutdown of international flights to and from Italy following the country’s lock-down.

The analysis draws on data from a new module in its Business 1ntelligence Service (B1S) traffic tool, created specifically by m1nd-set since the COVID-19 outbreak to help partner companies assess the impact of specific travel restrictions on travel retail revenues in countries and at specific airports.

The analysis shows traffic impacts, demonstrating losses in actual passenger numbers and not just seat capacity, and highlights the key categories in travel retail that will be affected.

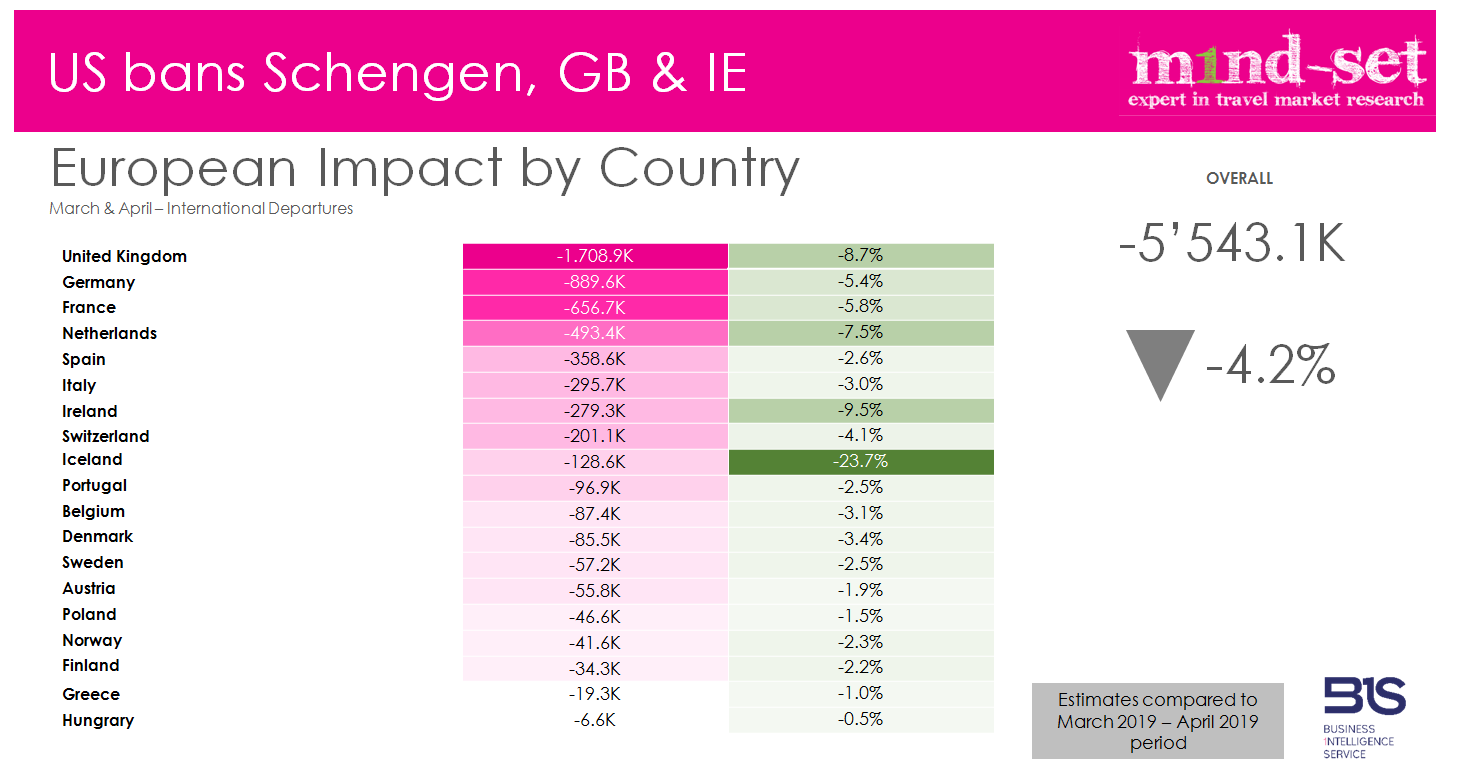

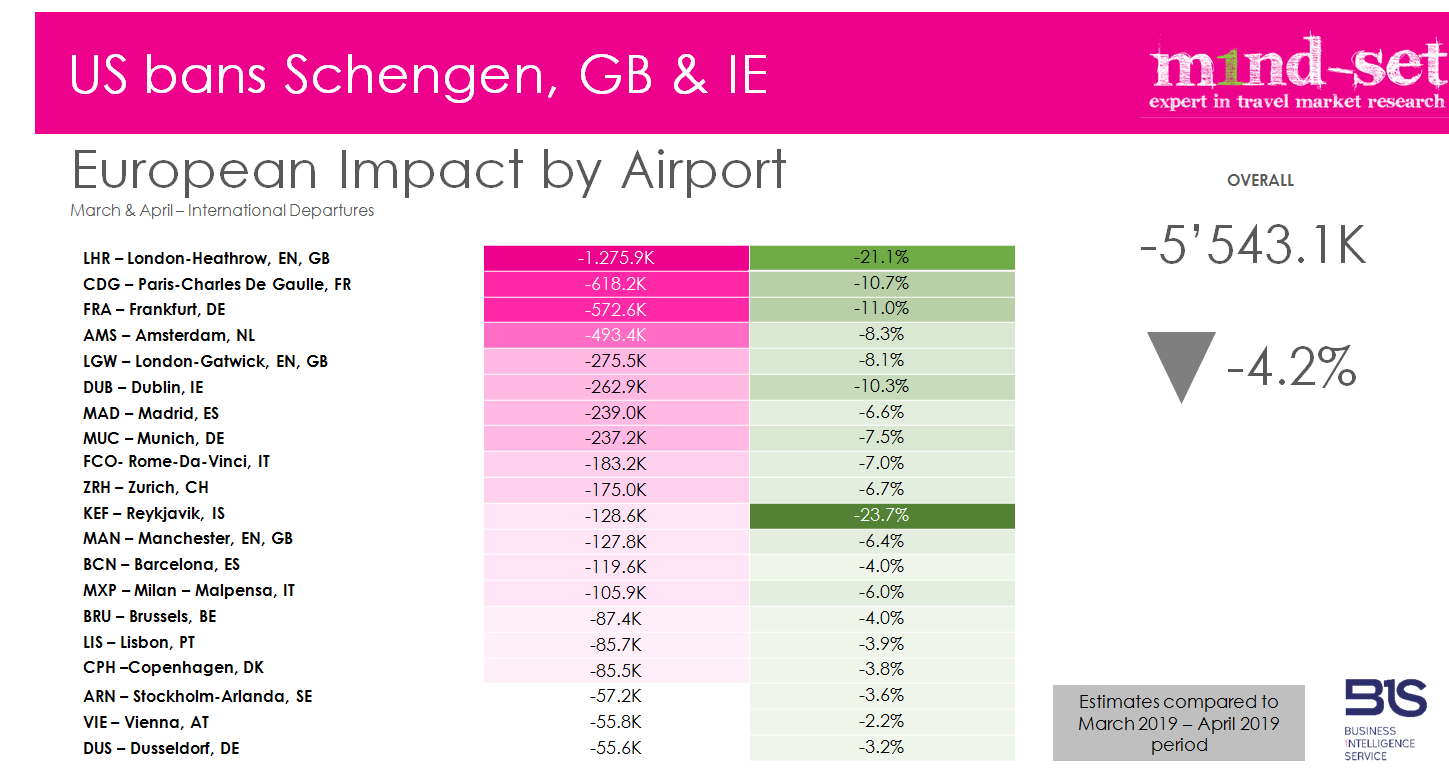

Comparing traffic data across March and April 2020, compared to the same period in 2019, the B1S analysis demonstrates the US ban on traffic from the UK, Ireland and Schengen countries across Europe will result in drop in traffic of over 5.5 million passengers, a 4.2% decline over the two month period, compared to the same period in 2019.

Most affected countries by traffic

UK will be the most affected country as it sees a traffic decline by 8.7%, equating to more than 1.7 million passengers. Not far behind, Germany, which will see a decline of 890,000 passengers (-5.4%), France with a loss of 657,000 passengers (-5.8%) and the Netherlands where traffic will fall by just under 500,000 passengers representing a 7.5% decline in overall traffic compared to the same period in 2019. In percentage terms, Iceland will experience the largest decline with a 23.7% drop in passengers over the same period in 2019, a loss of circa 128,000 passengers.

The airports in Europe most affected by the US ban are London Heathrow, Paris Charles de Gaulle, Franfkurt and Amsterdam. London Heathrow will see a significant fall in traffic over the two month period of 21.1%, losing 1.275 million passengers, Paris CDG will see a 10.7% fall in traffic, losing over 618,000 passengers over March and April, Frankfurt will lose over 572,000 passengers representing a decline of 11%, while Amstermdam Schiphol’s traffic will fall by 8.3%, just over 493,000 passengers. The largest percentage decline is again Iceland with Rekjavik Airport suffering the aforementioned 23.7% drop in passengers.

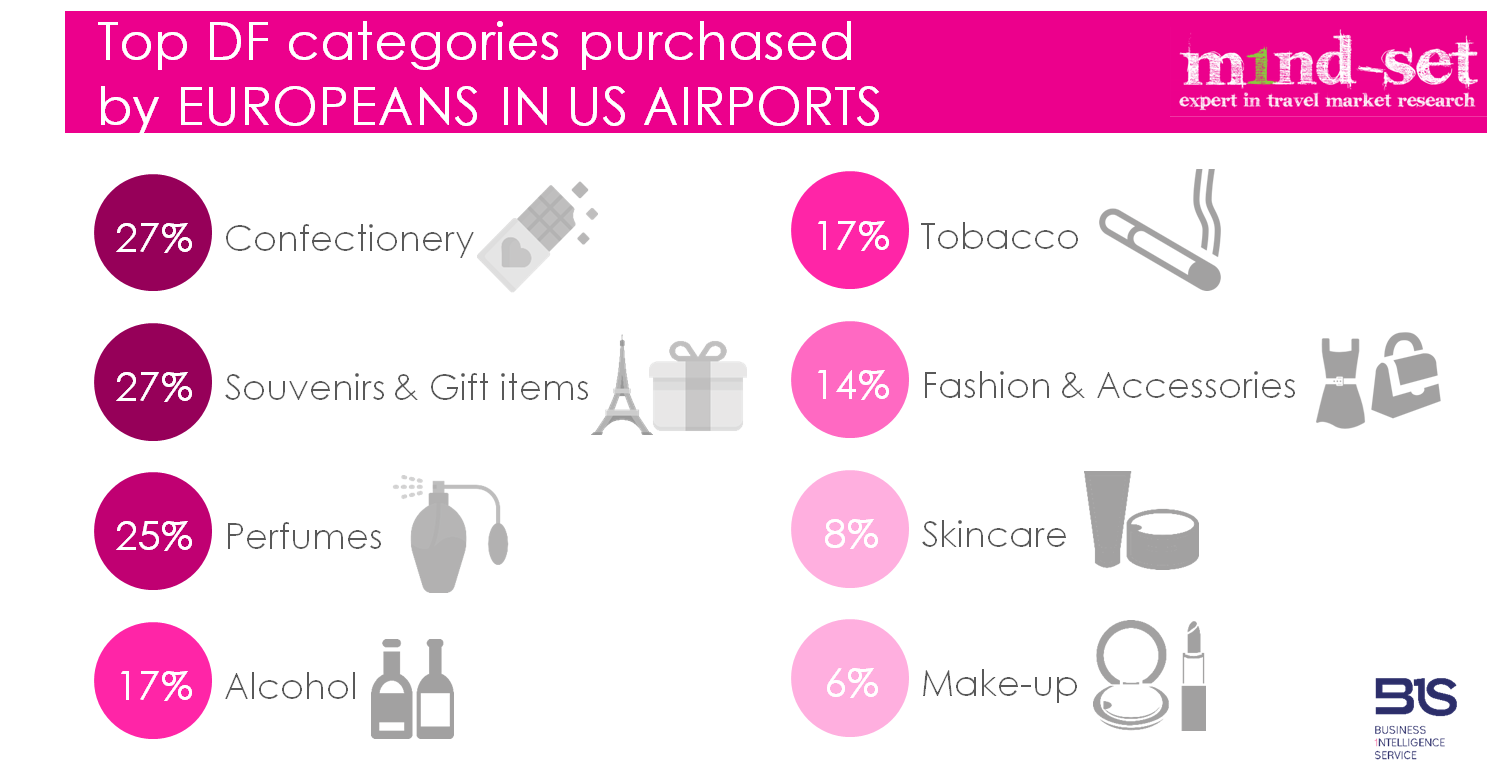

Category specific loss

The percentages vary across categories with Confectionery and Souvenirs & Gifts set to suffer the biggest impact, as 27% of travelers from the region purchase these categories at US airports. 25% purchase Perfumes, 17% buy both Alcohol and Tobacco, 14% purchase Fashion & Accessories, 8% buy Skincare products and 6% purchase Make-up.

“Given the unprecedented situation, we are being inundated with enquiries from companies, eager to understand the potential impact on sales. We have to be candid, the outlook is quite worrying. We can analyse the direct impact on traffic from our B1S traffic data tool and, when we combine this with the data from our extensive shopper insights database, we’re able to provide accurate estimates of the overall impact on sales following traffic bans, like this US ban on flights from Europe, UK and Ireland, shares m1nd-set’s CEO and owner Peter Mohn.

He continued, "The same applies with markets such as Italy where, notwithstanding the suspension of flights by some airlines, international flights are still operating. In the event of a total shutdown on international flights to and from the country’s airports, we’re able to make an accurate estimate of the impact on sales, both in Italy and destination markets for Italian travelers and source markets for Italy-bound travelers.”

Pablo Saez-Gil, B1S Director at m1nd-set added: “The impact of a total shut-down on international flights to and from Italy would result in a fall in traffic of around 14% - more than 18 million passengers - over the next two months for the top 20 destination airports. The main airports impacted outside Italy will be Paris Charles de Gaulle, which will see a decline of 443,000 passengers, Madrid, which will lose 417,000 and Barcelona, 384,000 passengers over March and April. The airport which will see the largest overall percentage decline is Tirana in Albania, where nearly 60% of the airport’s passengers travel to and from Italy.

“The current scenarios we are looking at are just two of many we are looking at currently. Saez-Gil concluded. “B1S users are able to enter any number of scenarios and combinations themselves and extract the potential or real impact analysis.”

.jpg?&resize.width=322&resize.height=483)