ACI releases economic impact assessment of COVID-19 on airport business

With global travel restrictions, suspension of flights, and borders and airports in some degree of closure in almost every country in the world, the COVID-19 pandemic has affected no industry as it has travel. Airports Council International (ACI) has released an economic impact assessment that suggests half of all passenger traffic and more than half of airport revenues will have been wiped out by the end of 2020.

The industry is in survival mode as both supply and demand are suppressed; flights are suspended and travel is restricted, and passenger demand has collapsed, due not only to these restrictions but also fear of contracting the virus and economic concerns.

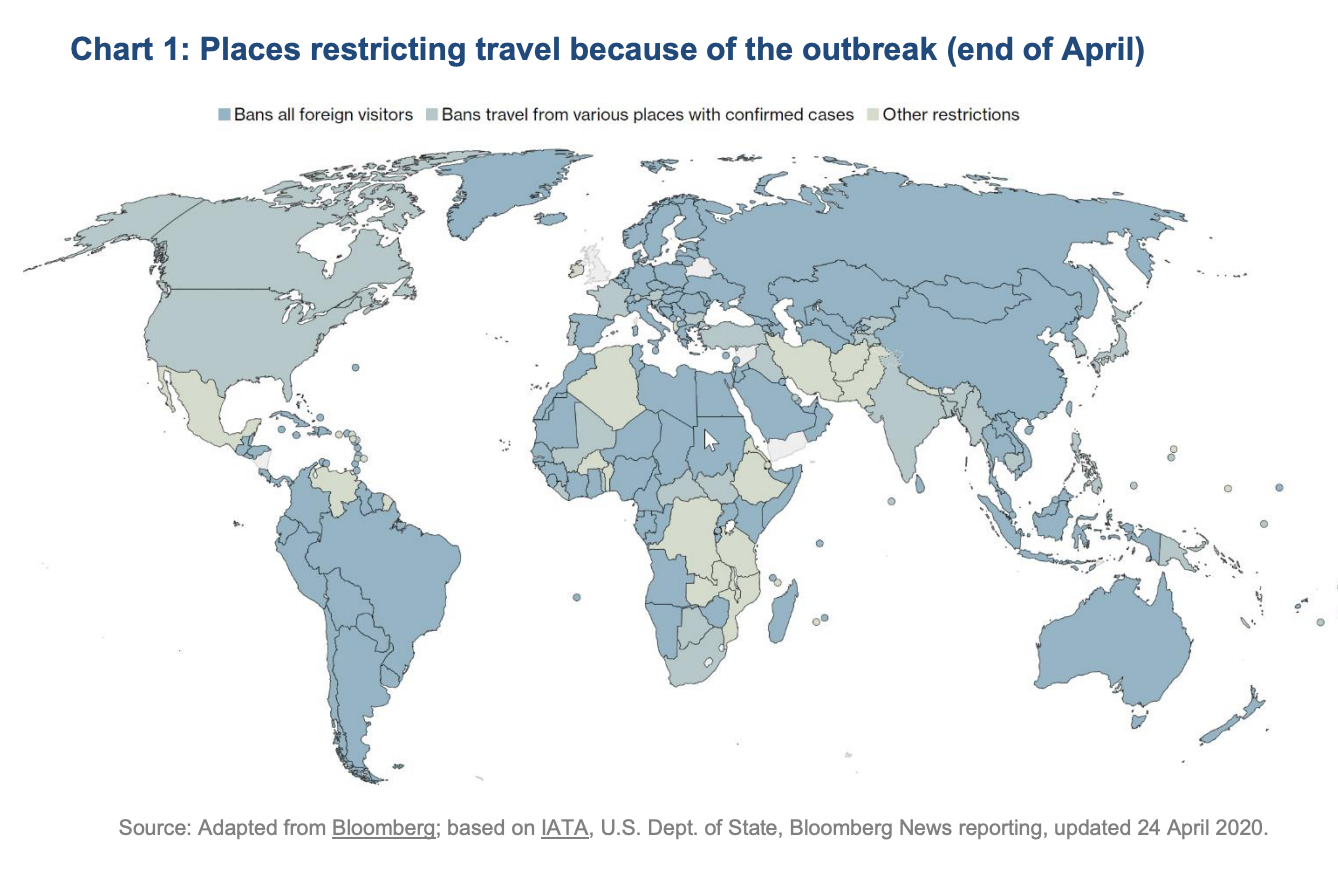

Travel restrictions

According to the recently released report from the World Tourism Organization (UNWTO), the United Nations’ agency for tourism, as of end of April, 100% of destinations now have travel restrictions in place, and 83% of destinations had already had restrictions for four weeks leading up to that time.

• 45% of destinations have totally or partially closed their borders for tourists

• 30% have totally or partially suspended international flights

• 18% are banning the entry for passengers from specific countries of origin or passengers who have transited through specific destinations

• 7% are applying different measures, such as quarantine or self-isolation for 14 days and visa measures

Economic fallout

The recent figures from the International Monetary Fund (IMF) published in the April 2020 Update of the World Economic Outlook (WEO) illustrate the economic fallout, with an estimated decline in Gross Domestic Product (GDP) of at least 3 percentage points on a global scale.

The brunt of this decline will be concentrated in the advanced economies, though emerging markets and developing economies will not be immune to the economic ramifications (-6.1 and -1 percentage points respectively).

See Table 1, below.

The situation for air transportation is catastrophic. This economic impact assessment takes an evidence-based approach in portraying the current status of the industry in terms of passenger traffic and revenues taking into account the latest data collected from world’s airports and an array of other inputs from ACI regional offices and industry experts.

Former growth trajectory

In the last two years, global passenger traffic grew, to 8.8 billion passengers in 2018 and then increased to more than 9.1 billion passengers in 2019. This represented growth of +6.4% and +3.4% year-over-year, respectively.

ACI had originally forecast that global passenger traffic would reach the 9.5 billion passenger mark in 2020, reflective of a +4.6% forecasted growth year-over-year, though that number had been revised to 9.3 billion passengers, equivalent of +1.6% growth year-over-year.

The COVID-19 outbreak itself ensured that this figure would not be possible. Once the overwhelming majority of national governments implemented strict confinement measures, which eventually resulted in what the IMF later characterized as the “Great Lockdown”—the worst economic downturn since the Great Depression — it was apparent that these forecasts were far from the realm of possibility.

Q1 2020

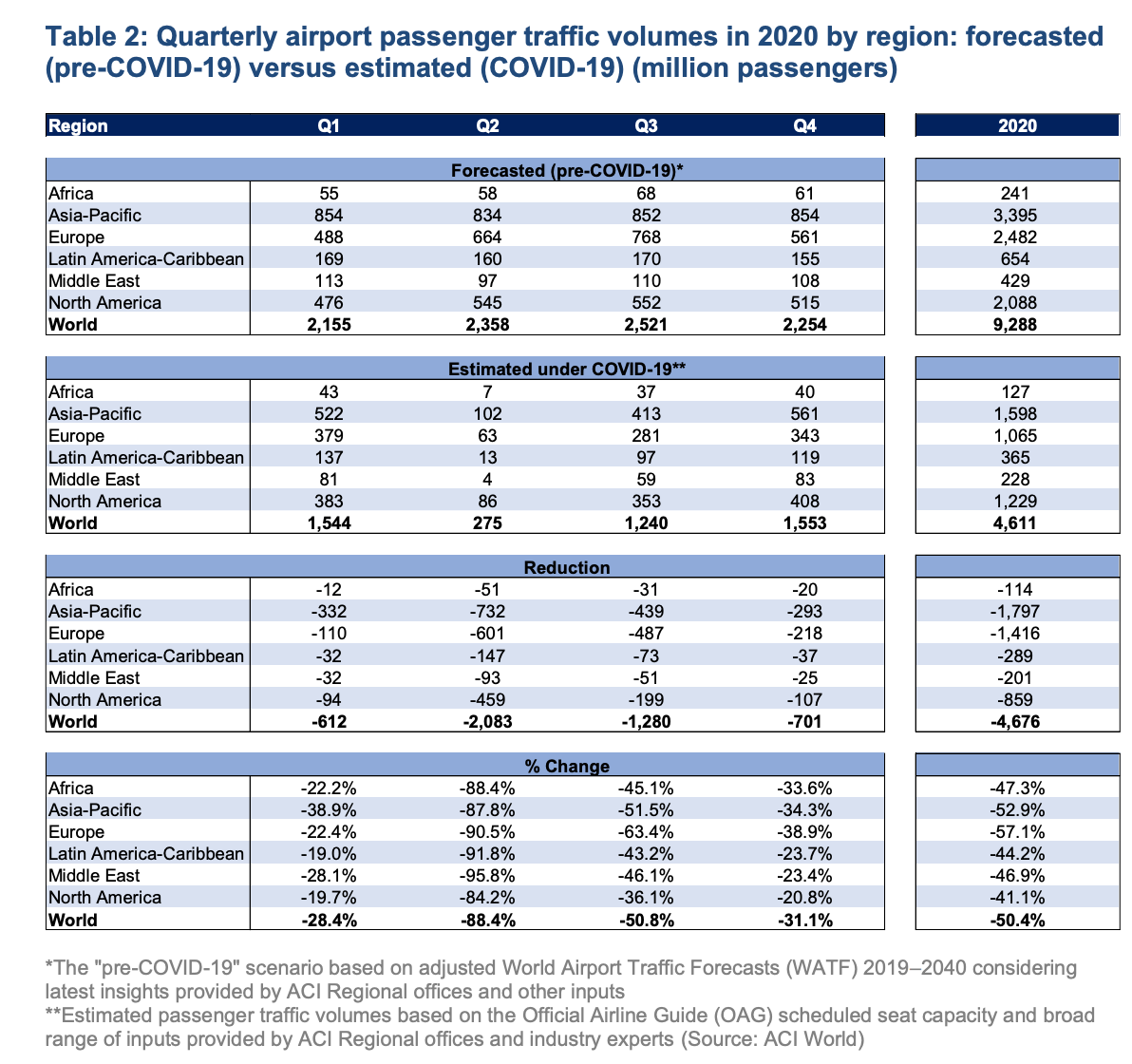

The year began modestly, as passenger traffic grew by just +2% in January 2020, down from +3.7% a month prior and below the average growth rate recorded in the preceding six months (+2.6%). Decreased traffic volumes were more apparent in the Asia-Pacific region at -1.5%. The decline in February was even more pronounced, as Asia-Pacific witnessed a substantial traffic loss of –38.4% and the world’s airports recorded a combined decline of -10.7%.

The imposition of travel restrictions and national lockdowns brought aviation to a virtual standstill by the end of March. Passenger traffic declined by -56.8% in the month of March year-over-year and by -58.6% as compared to the previously projected volumes under a pre-COVID-19 baseline on a global basis, with Q1 final figures of -28.4% versus previously projected volumes and by -26.2% year-over-year as compared to 2019. The steepest reductions were recorded in Asia-Pacific, Middle East and Europe of -38.9%, -28.1% and -22.4% respectively.

Q2 2020

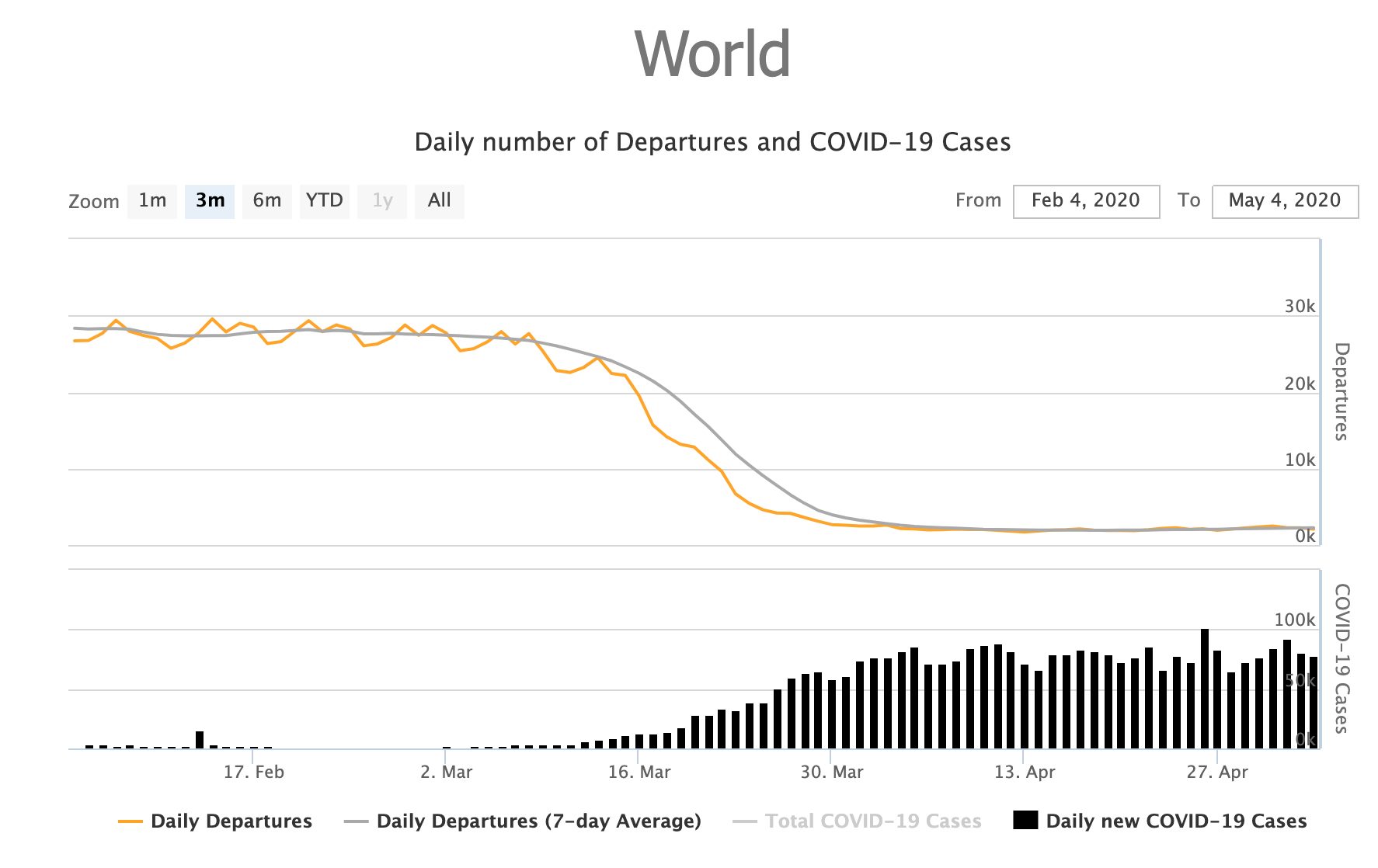

As Q2 began during the global lockdown, 17,000 jets, or about two-thirds (64%) of the global fleet, were grounded.

Air traffic in most regions declined by more than -80%, with regional movement declines varying from a -90% decline in South America to a -56% decrease in North America — this figure testament to the strength of domestic travel in larger countries. This traffic report does not account for the near-empty aircraft, however.

Passenger traffic volumes declined by 90% in April on a global scale, ranging from -97% in Europe to -70% in Asia-Pacific.

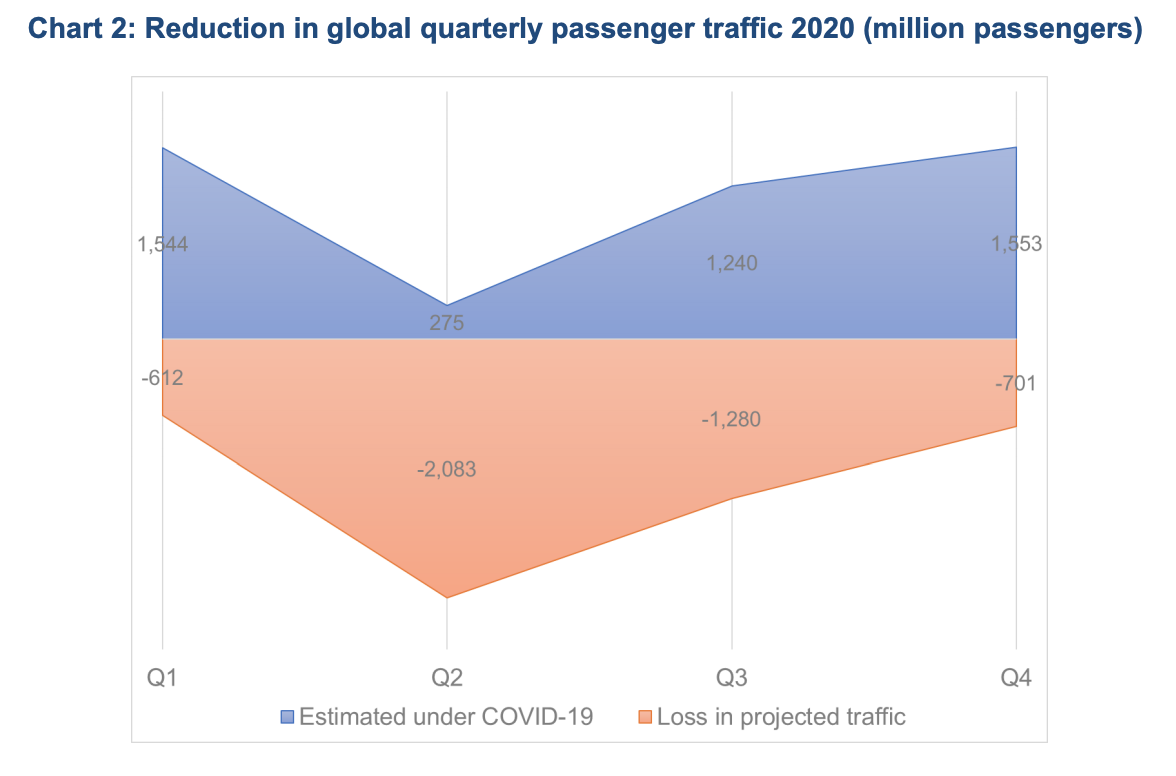

As ACI assumes only slight improvements in aviation activity with slow and expected gradual removal of travel restrictions in few aviation markets as we approach the summer months, the estimated passenger traffic volume decline is expected to dive further, with expectations now at -88.4% in the second quarter of 2020 versus pre-COVID-19 projections.

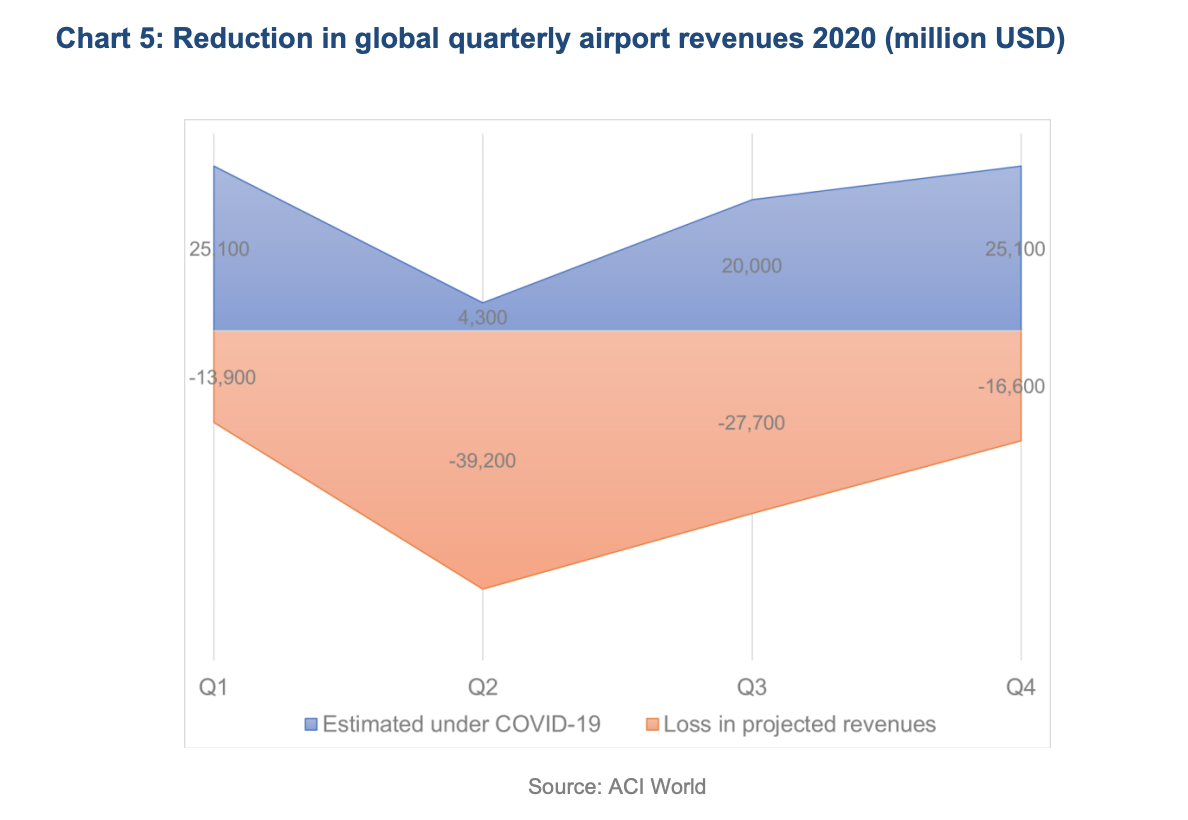

Current assumption is that Q2 will contain the greatest losses for the airport industry, assuming gradual alleviation of confinement measures and general reopening of the economies across the globe.

Globally, airports are expected to lose more than 2 billion passengers in the second quarter of 2020 alone and 4.7 billion for the whole of 2020. In all six regions, the decline exceeds -84% from the projected baseline in the second quarter. This goes beyond -90% in the Middle East, Latin America-Caribbean and Europe.

Traffic mix and seasonality

While all airports are experiencing grave losses, there are two important factors in the degree of loss:

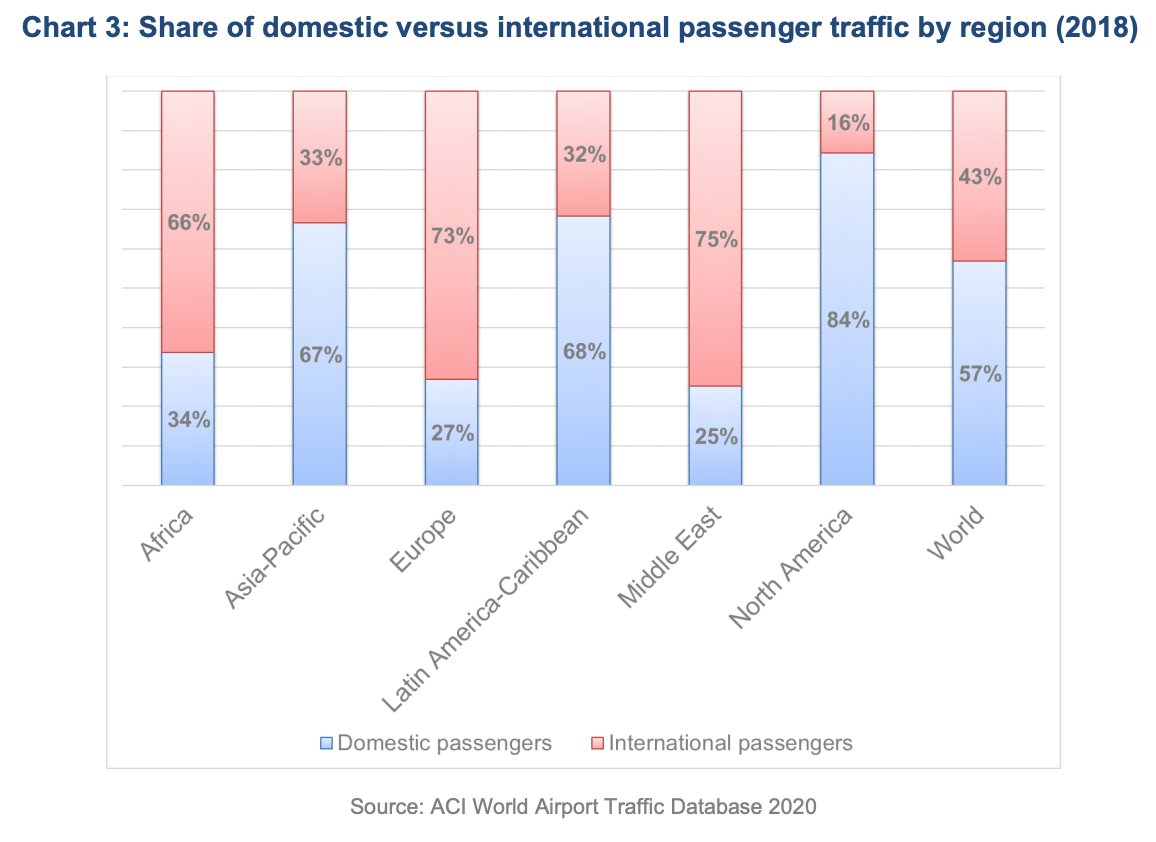

1. traffic mix in terms of relative proportions of domestic versus international traffic

2. seasonality patterns

Aviation markets with a higher proportion of domestic travel are more resilient; China and the United States exemplify this pattern, as both countries continue to display a modest number of domestic flights, while major international aviation markets demonstrate much deeper declines in traffic volumes.

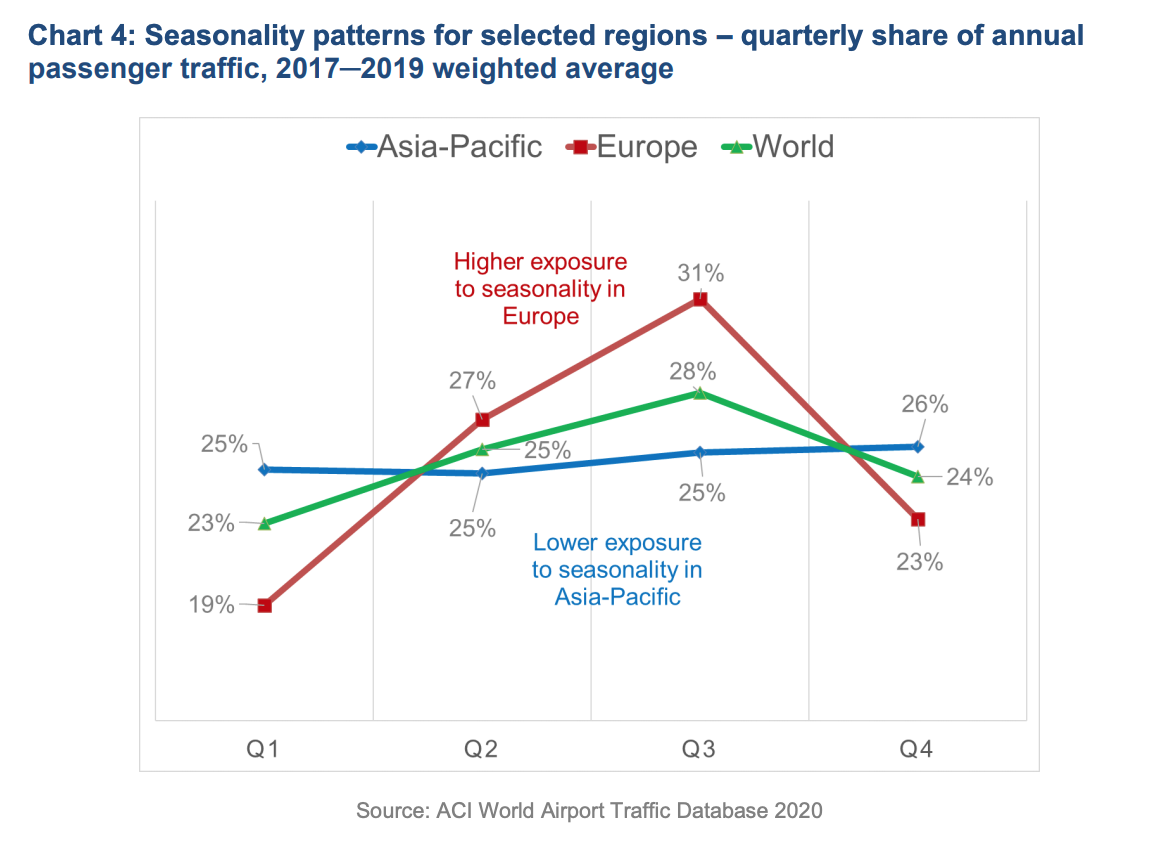

Seasonal patterns also have a large effect on passenger numbers. In Europe, monthly passenger traffic variations reflect the mainstream holiday period from May to September and movements from north to south. Asia-Pacific, on the other hand, is known for a relatively stable seasonality pattern and most major airports show negligible seasonal variations. As the COVID-19 continues to unfold in Europe and North America, which are the second and third largest aviation markets respectively and are tightly interrelated with transatlantic routes, there is an additional downside risk to the recovery. Without a major and unlikely drop in cases in the immediate future, Europe may lose its summer travel season. Airports in North America and the Caribbean are also highly seasonal and will show similar patterns.

Chart 4 illustrates higher exposure of Europe to seasonality and hence a higher potential impact of COVID-19 on the year-end traffic results.

Impact on airport revenues

Airports are highly capital-intensive operations, and both aeronautical and non-aeronautical business has been paralyzed by the unprecedented reductions in aviation and commercial activity. All airport revenue generation has plummeted.

In order to stay afloat, airports are reducing variable costs by closing portions of infrastructure, furloughing staff, and postponing capital expenditure, to bring operating costs as low as possible. These decisions seriously impact the communities that airports serve.

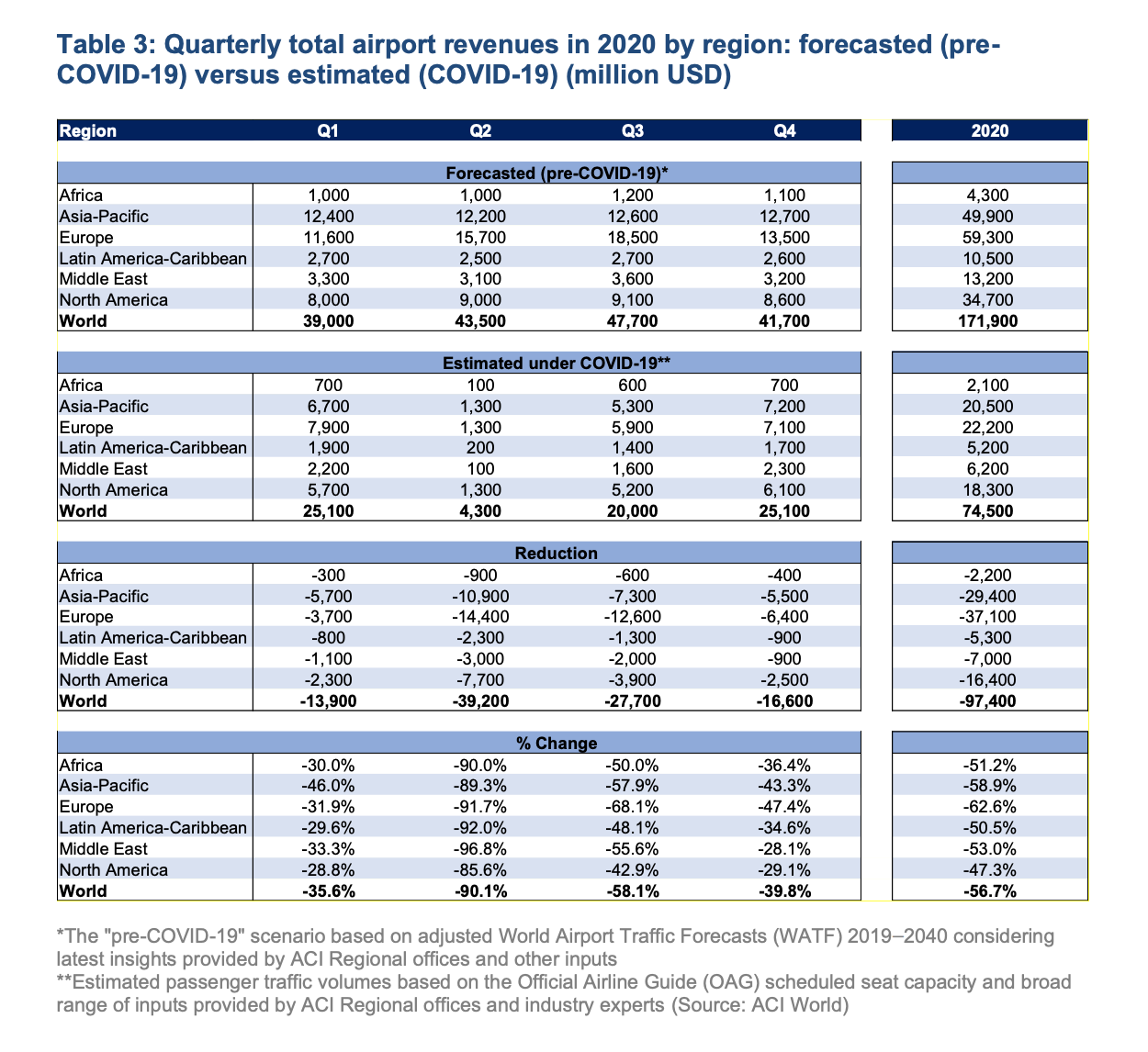

As can be seen in Table 3, the reduction of revenues from the projected baseline is likely to reach -90% on a global level in the second quarter of 2020.

Europe is expected to be the hardest-hit region as it may lose close to $37 billion (figures in US Dollars) in revenues or more than 60%, followed by Asia-Pacific with $29.4 billion or -59%.

As for the 2020 year-end, estimates point to a decline of $97.4 billion or -56.7%.

Methodological notes

• ACI World estimated the impact of the coronavirus outbreak 2019 (COVID-19) on the airport industry in terms of potential losses in traffic and revenues based primarily on two key data elements: estimated traffic considering the latest COVID-19 statistics and unit revenues derived from the Airport Key Performance Indicators 2020, as total airport revenues are largely a function of traffic, while unit revenues have remained stable in the recent years.

• Traffic estimates for Q1 2020 were generated using data collected by ACI World from airports for that period.

• The impact has been measured as a difference between the “business as usual scenario” (BAU) for Q1 2020 as well as year-end 2020 and the “COVID-19 scenario” with estimated traffic and revenues for Q1 2020 and year-end 2020, on a regional basis.

• The Q1 2020 traffic estimates, and hence the revenue figures, take into account the seasonality patterns for the year 2019 calculated on a regional basis.

• The BAU forecasts were calculated using the latest data up to December 2019 and projecting 1 year ahead. A combination forecast approach was used, which shows to be consistently performing adequately (mean absolute percentage error—MAPE < 2%) in cross-validation exercises.

The impact of COVID-19 on passenger traffic for year-end 2020 was estimated under the assumption that most containment measures and flight restrictions will be lifted by the end of summer 2020. This implies a difficult second quarter for the aviation industry, with a partial recovery in Q3 and Q4.

However, the impact on passenger traffic is assumed to be long lasting, implying a slow and steady recovery possibly spanning far beyond the end of 2020.

• The revenue per passenger indicators (unit revenues) were calculated for airports on a country-by-country basis. In cases where the indicators were unavailable, regional indicators were applied as an approximation for the country level indicators.

• Considering limited information on the impact of disease outbreaks on unit revenues, airport revenues were estimated under an assumption of slightly reduced unit revenues as agreed by a panel of experts.

Considering these points, the estimates stated represent an optimistic scenario, as it is highly likely that unit revenues will be more adversely impacted, both on the aeronautical and non-aeronautical sides of the business. This is because the methodology does not consider additional factors such as macroeconomics and changes in consumer behavior.