Domestic tourism continues to outpace int’l in APAC & the Americas

The one region to watch in terms of recovery appears to be APAC with the region down by 54.3% in bookings compared to the MENA region, which has been hit the hardest at -79%

Data indicates that if travel restrictions make it too complicated to travel abroad, most people will invest locally

ForwardKeys, a world-leading travel analytics firm, has conducted recent studies of July flight data and airport traveler volumes that reveal the world is splintered into two spheres: the increasing of domestic tourism and the rising importance of lesser-known airports.

The most resilient airports by volumes in July

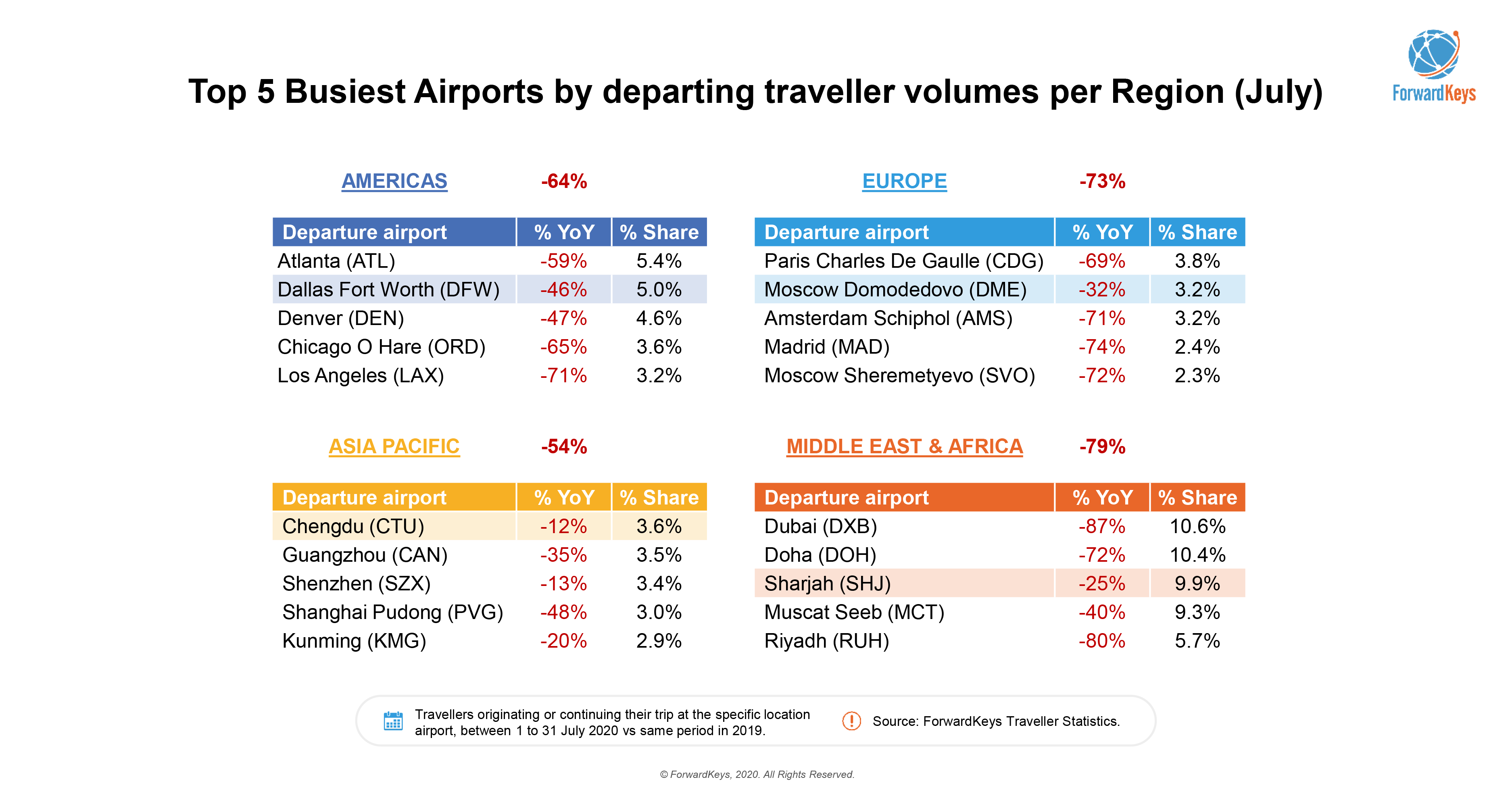

When examining the regional airports worldwide to determine the busiest airports according to departing traveler volumes: Dallas (USA), Chengdu (China), Moscow Domodedovo (Russia) and Sharjah (UAE), despite being in the minus, are still ahead of the pack of other major airport hubs.

The one region to watch in terms of recovery appears to be APAC with the region down by 54.3% in bookings compared to the MENA region, which has been hit the hardest at -79%. It’s possible that this is due to the passenger numbers depending greatly on international travelers.

The growth of domestic travel during Covid-19

“More often than not, the travel data we’ve been collecting in the recent weeks is showing a similar pattern. People still want to travel and if travel restrictions make it too complicated to venture abroad, they're spending their hard-earned cash, locally,” says Lorena Garcia, Senior Analyst at ForwardKeys.

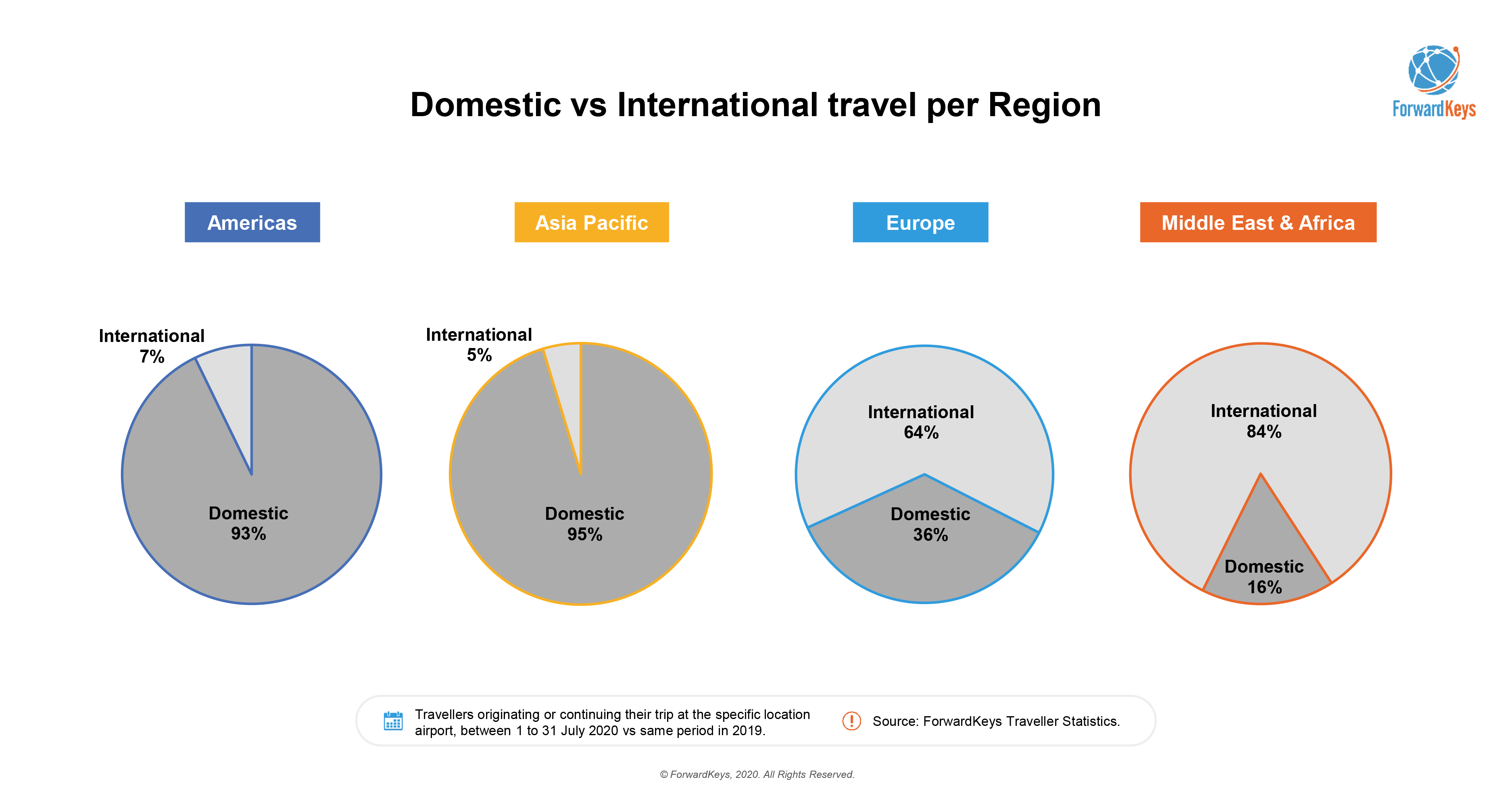

In North America, domestic travel accounted for around 93% (vs. 77% July 2019) of total travel within the region for this month. Dallas served as the busiest airport this year, closely followed by Denver.

To clarify the US trends, the busiest in terms of volumes was Atlanta, but Dallas performed better in July as “it registered the lowest YoY amongst the listed top 5.”

Within the APAC, where also domestic travel registered around 95% of total travel (vs. 66% July 2019), Chinese travelers contributed 68% of total air travel in the region. Non-tier 1 Chinese city airport Chengdu (CTU) proved to be the most resilient among the top 5 departing airports in the region, followed by Shenzhen (SZX). The airport registered a year-on-year decline of approximately -12%, far below the regional average for July (-54%).

Chengdu’s resilience might be down to its low percentage and reliance on international traffic, when compared to the other regional airports. Pre-Covid19, Shanghai Pudong, Beijing and Guangzhou international routes represented 45%, 25% and 23% of their total traffic, respectively. Chengdu international routes only accounted for 9%.

Lifted duty free allowances may be another complementary factor. “The increase in duty free allowances and discounted flexible air passes is working a treat in China. It gives us hope that this can transpire in other countries too,” adds Garcia.

Not surprisingly, Europe demonstrated a different landscape with international traffic accounting for around 2/3 of total air travel 64% (vs. 79% July 2019). Even more so for the Middle East and African region, where international departures registered 84% of total departures in the region.

Among the top 5 airports, Moscow Domodedovo (DME) experienced by far the lowest decrease of departing passengers this July in Europe, when compared to last year (-32%); as was the case for Sharjah (SHJ) airport (-25%) in the Middle East and Africa region.

.jpg?&resize.width=322&resize.height=483)