Passenger numbers remain low for September, according to IATA

While most parts of the world saw a very slight improvement in passenger air traffic from August’s year on year numbers (with the exception of Europe), this improvement was so slight that Alexandre de Juniac, IATA’s Director General and CEO, said: “We have hit a wall in the industry’s recovery.”

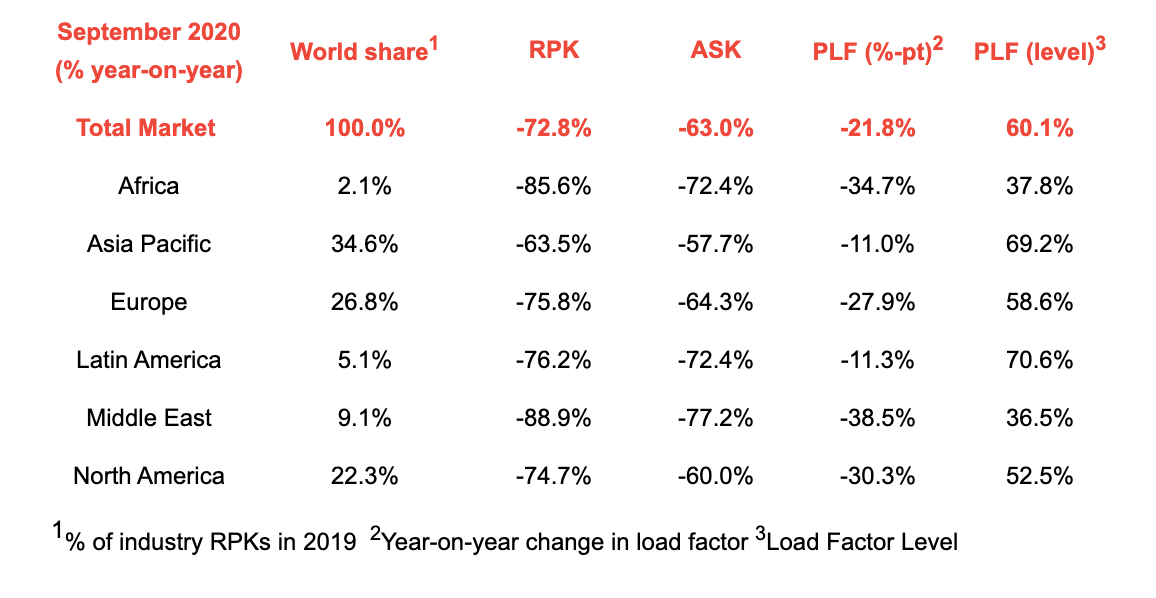

Total global demand (measured in revenue passenger kilometers or RPKs) came in at 72.8% below September 2019 levels, which was a slight improvement over August, which showed 75.2% year on year decline.

Overall capacity was down 63% over the same month last year, while the load factor fell 21.8 percentage points to 60.1%.

With international borders remaining under varying degrees of travel restrictions, it’s no surprise that international passenger demand is in a worse state than domestic. International travel in September was 88.8% lower than in September 2019, basically unchanged from the 88.5% decline recorded in August. Capacity was at 78.9% down, with a load factor 38.2 percentage points lower than in September 2019, to 43.5%.

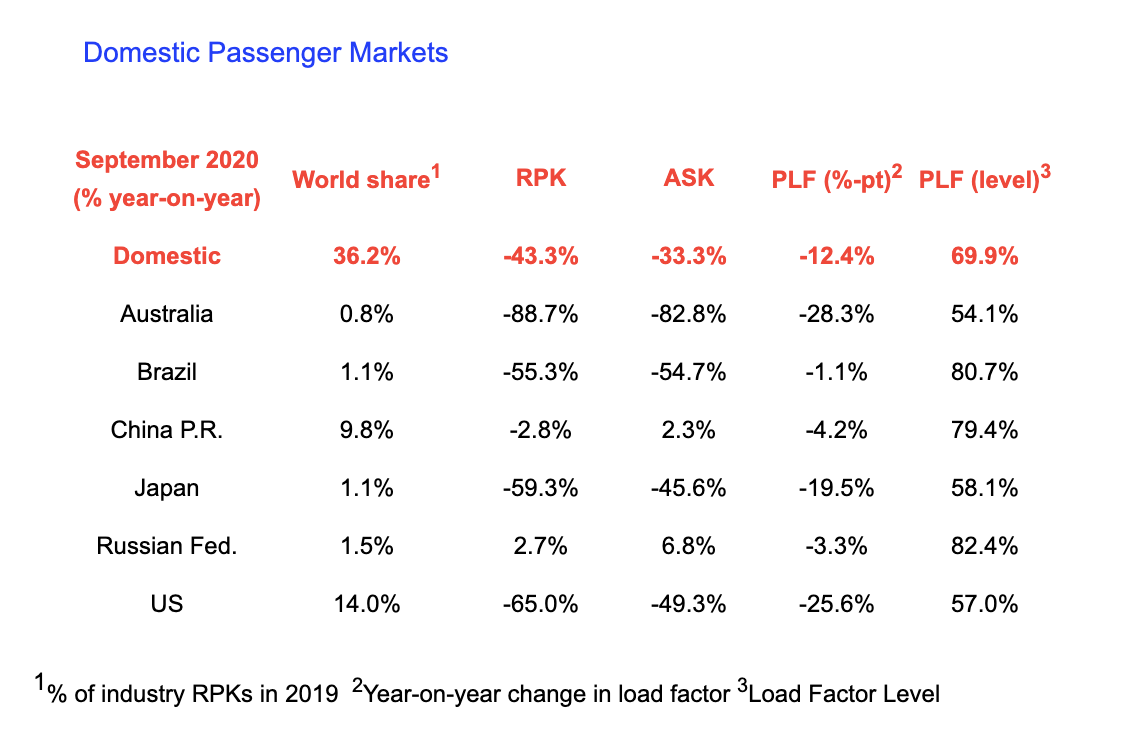

Domestic demand in September improved somewhat more than interntional, with RPKs down 43.3% compared to 2019, up from a 50.7% decline in August. Capacity was 33.3% lower than last year, and the load factor was down 12.4 percentage points to 69.9%.

“A resurgence in COVID-19 outbreaks — particularly in Europe and the US —combined with governments’ reliance on the blunt instrument of quarantine in the absence of globally aligned testing regimes, has halted momentum toward re-opening borders to travel,” said deJuniac. “Although domestic markets are doing better, this is primarily owing to improvements in China and Russia. And domestic traffic represents just a bit more than a third of total traffic, so it is not enough to sustain a general recovery,” he added.

International Passenger Markets

Europe

The one exception to an improved September over August, European airlines showed 82.5% less demand than September of 2019 whereas August’s decline was 80.5%. This was because of COVID-19 cases increasing dramatically after the summer holidays, leading to renewed border restrictions. Capacity contracted 70.7% year on year, and load factor fell by 35.1 percentage points versus last September, to 51.8%.

Asia Pacific

Air traffic rose just a hair in September for a drop of 95.8% over this month in 2019, after a 96.2% drop in August. Flight and border restrictions in the Asia Pacific region have remained stringent, with little chance of travel. Capacity plummeted 89.6% and load factor ended up the lowest of all regions with a drop of 46.8 percentage points to 31.7%.

Middle East

Showing the most increase between August and September, Middle Eastern airlines still showed a drastic 90.2% traffic decline for September, whereas the YOY drop was 92.3% in August. Capacity tumbled 78.5%, and load factor sank 40.9 percentage points to 34.4%.

North America

With a slight improvement, North American airlines saw a 91.3% traffic decline in September 2020 vs 2019, while August’s drop was 92.0%. Capacity was reduced by 78.3%, and load factor dropped 49.8 percentage points to 33.4%.

Latin America

Next to Asia Pacific, Latin American airlines showed the most drastic year on year drop, with September figures 92.2% lower than in 2019, This is an improvement from the 93.4% decline in August The capacity drop in the region also closed in on Asia Pacific at 87.9%, though the load factor was highest among the regions, dropping29.3 percentage points to 53.3%,.

Africa

Air traffic drop in Africa remained almost the same in September vs August, at 88.5% and 88.7% decreases respectively. Capacity contracted 74.7%, and load factor fell 39.4 percentage points to 32.6%, which was the second lowest among regions.

Australia’s strict containment measures meant little change in the country’s domestic market, with air traffic down 88.7% compared to September 2019; August figures were almost identical at 88.8% lower.

Brazil’s domestic traffic is the one area of the world outside of China where some real improvement is being seen, with a 55.3% YOY drop in September, which was 11.7% better than August’s YOY numbers.

“Last week we provided analysis showing that the airline industry cannot slash costs fast enough to compensate for the collapse in passenger demand brought about by COVID-19 and government border closures and quarantines. Some 4.8 million aviation-sector jobs are imperiled, as are a total of 46 million people in the broader economy whose jobs are supported by aviation. To avoid this economic catastrophe, governments need to align on testing as a way to open borders and enable travel without quarantine; and provide further relief measures to sustain the industry through the dark winter ahead. A broader economic recovery is only possible through the connectivity provided by aviation,” said de Juniac.

.jpg?&resize.width=322&resize.height=483)