Dufry announces first quarter trading update

Dufry’s performance was significantly affected during the first three months of the year, with impacts caused by the unprecedented drop in passenger numbers in all regions of the world due to the COVID-19 virus and travel restrictions based thereof.

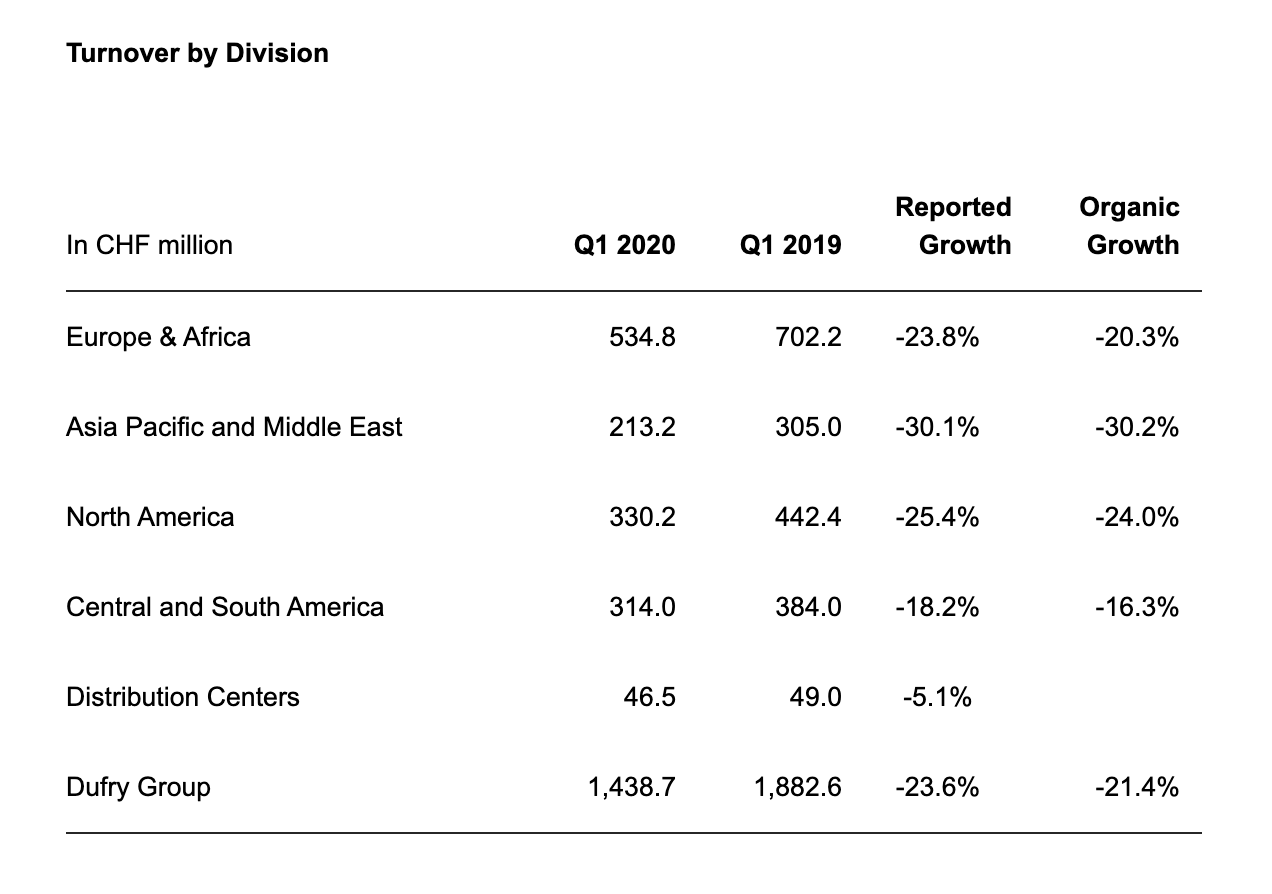

Turnover in the first quarter equalled -20.8% in constant FX versus the same period last year, and organic growth amounted to -21.4%. Turnover in the first three months of 2020 reached CHF 1,438.7 million versus CHF 1,882.6 million in the same period in 2019, representing a decrease of -23.6%.

Month by month

January was a positive month for Dufry, with an organic growth of +0.8%. The slowdown began in February, especially in Asia. This resulted in organic growth reaching -2.3% in the year. The severe downward trend began in March as many countries began implementing travel restrictions. Airport closures, border closures and flight cancellations helped sales performance to drop to -55.9% for the month.

All divisions reported negative organic growth during the quarter. Asia-Pacific and the Middle East were hardest hit, followed by Europe and Africa. The steep decline reached North, Central and South America in March.

Changes in Scope, which includes the positive contribution of the acquisitions of Vnukovo and Brookstone, amounted to 0.6%. The translational FX effect in the period was -2.8% as effect of the strengthening of the Swiss Franc versus the main currencies.

Planned development slowed

Dufry slowed down its refurbishment program to reduce capital expenditure, though shops in London, Athens, Macau, Los Angeles and Guayaquil were renewed.

January and February saw expansion of Dufry’s operations, with new and expanded shops opened across several locations including Helsinki, Perth, Indianapolis, Calgary and Florianopolis.

Europe and Africa

Q1 turnover in the region dropped to CHF 534.8 million from CHF 702.2 million one year ago. Organic growth in the division reached -20.3% during this period.

Italy, Switzerland, UK and Spain showed negative growth in double-digits.

Turkey had good passenger traffic in January and February, and therefore posted a positive performance in the quarter despite a significant decline in March.

Performance in Africa was stable. Growth in the first two months of the year was offset by negative performance in March.

Asia-Pacific and Middle East

This hard-hit region saw Q1 turnover amounting to CHF 213.2 million versus CHF 305.0 million in the same period in 2019. Organic growth reached -30.2%.

North America

Duty free in this region is exposed to a high number of international and Chinese customers; organic growth therefore slumped -24.0% in the period. Turnover reached CHF 330.2 million, compared to CHF 442.4 million in the first quarter of 2019.

Central and South America

Central America, the Caribbean and South America did not begin to see restrictions until the calendar reached into March, so this region was not as strongly impacted as others. Turnover was CHF 314.0 million in the first quarter of 2020 as compared to CHF 384.0 million one year earlier, with organic growth coming in at -16.3%.

Further initiatives

As we reported earlier, Dufry immediately defined an action plan and implemented operational initiatives as of the end of January to drive sales, secure cash flow generation, save costs and safeguard liquidity.

The company has increased these initiatives, basing the action plan on different scenarios with full year sales declines ranging from 40% to 70%, and giving options for flexibility.

The main initiatives taken are:

• Maintain level of gross profit margin in collaboration with brands

• Renegotiate agreements with landlords to reduce rents and concessions

• Personnel expense efficiency program implemented, reducing costs at all levels and making use of government support schemes whenever possible as well as implement voluntary salary reduction schemes

• Reducing all operating expenses as much as possible and monitor payments at Group level with a dedicated team

• Dufry implemented several measures to reduce cash outflows to a minimum, which are controlled tightly by a dedicated team at Group level. These actions are expected to produce cash savings of around CHF 160 million in the full year of 2020.

Strengthened financial structure

In April, Dufry announced a comprehensive set of initiatives to strengthen its capital structure and liquidity position, enabling the company to sustain a prolonged period of severe business disruption and retain its competitive edge over the long term.

• New 12-month committed credit facility of CHF 425 million with two 6-months extensions; subject to final documentation

• Successful placement of 5.5 million shares out of existing authorized capital generating gross proceeds of CHF 151.3 million

• New convertible bond, which due to the strong demand, had its nominal amount of the issuance increased by CHF 50 million to a total size of CHF 350 million

• Signed agreement with banks to waive the existing financial covenants until end of June 2021 and a higher leverage covenant for the September and December 2021 testing periods

• Cancellation of the 2020 dividend, thus reducing short-term cash outflows

Dufry’s Board of Directors also proposes the creation of additional conditional share capital sufficient to enable the physical settlement of the new convertible bonds.

These financing initiatives will improve the company’s liquidity position from CHF 685.9 million as of March 31, 2020 to a pro-forma position of CHF 1,612 million.

CEO comments

Julián Díaz, CEO of Dufry Group, commented: “At the beginning of 2020, we first saw an acceleration of the business and an encouraging performance. Then the crisis started to impact the travel retail industry and our performance in several locations as of February, leading to a negative performance for the first quarter of 2020.

“We have immediately setup a special committee, who has developed and implemented a comprehensive action plan focused on driving sales, secure cash generation, reduce costs and safeguard our profitability. The action plan has adapted the company’s structure to the current environment and considers different scenarios of full-year sales declines ranging from 40% to 70% and allowing us to flexibly adapt the measures to the business performance.

“Looking forward, Dufry has already developed a recovery plan on a location-by-location basis and is ready to resume operations as soon as travel restrictions are lifted. The recovery plan is based on each location’s productivity and includes a whole set of global initiatives to drive sales through promotions and adapting the assortment focusing on new products and exclusivities.

“Furthermore, in April, we successfully implemented several financial initiatives to strengthen our capital structure and improve our liquidity position. This is an important step and together with our cost cutting initiatives, it will allow us to continue operations until the next cash generation cycle starts.

“Despite the currently challenging environment, we are strongly convinced that the business will recover as we have seen in previous occasions and we are well prepared to serve customers as soon as circumstances allow.”

Outlook

As expected, April was an even more difficult month as all countries in the world had by then imposed some type of travel restriction. Sales therefore dropped -94.1% c.

Giving the unprecedented global situation and lack of clarity as to the coming months, the company has withdrawn the full-year 2020 guidance previously disclosed on March 12, 2020.

.jpg?&resize.width=322&resize.height=483)