Dufry offers insight to future and suggests recovery is beginning

Dufry Group has just released its third quarter report. Organic growth continues to be down drastically from Q3 2019, but cost savings and other measures have helped stem the bleed.

TURNOVER

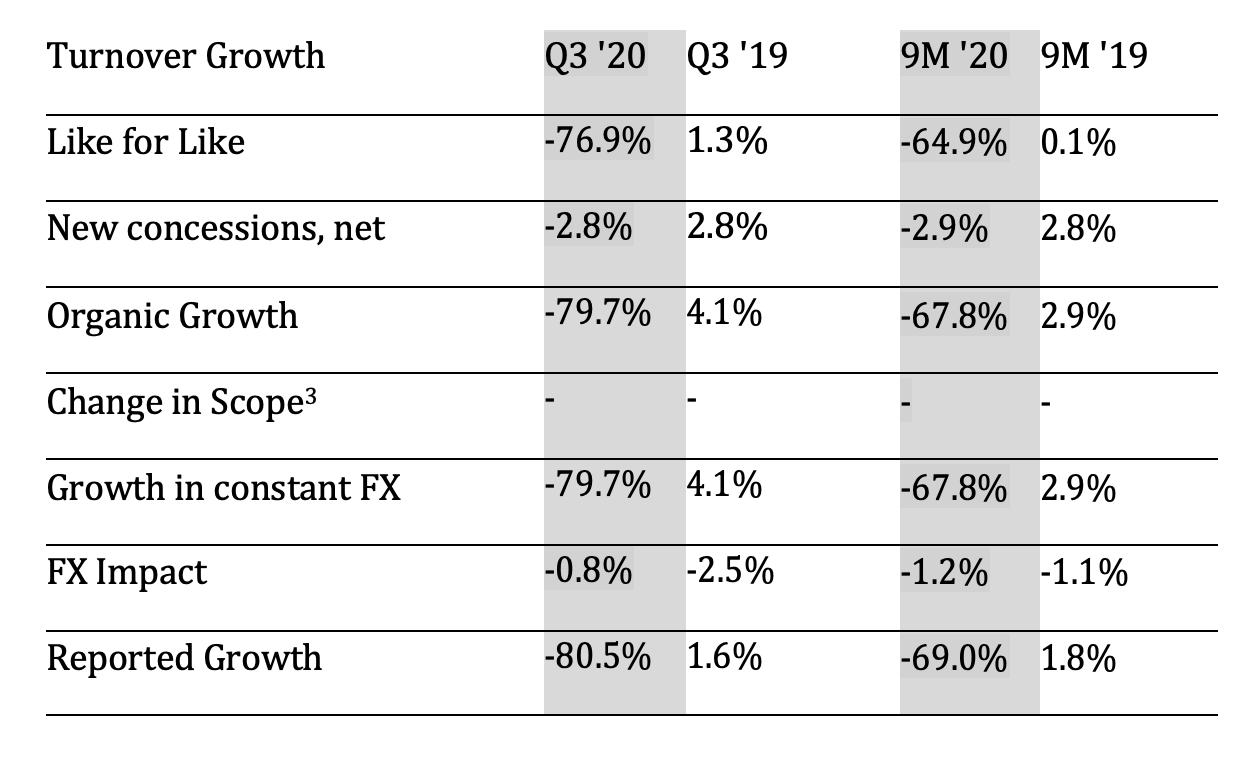

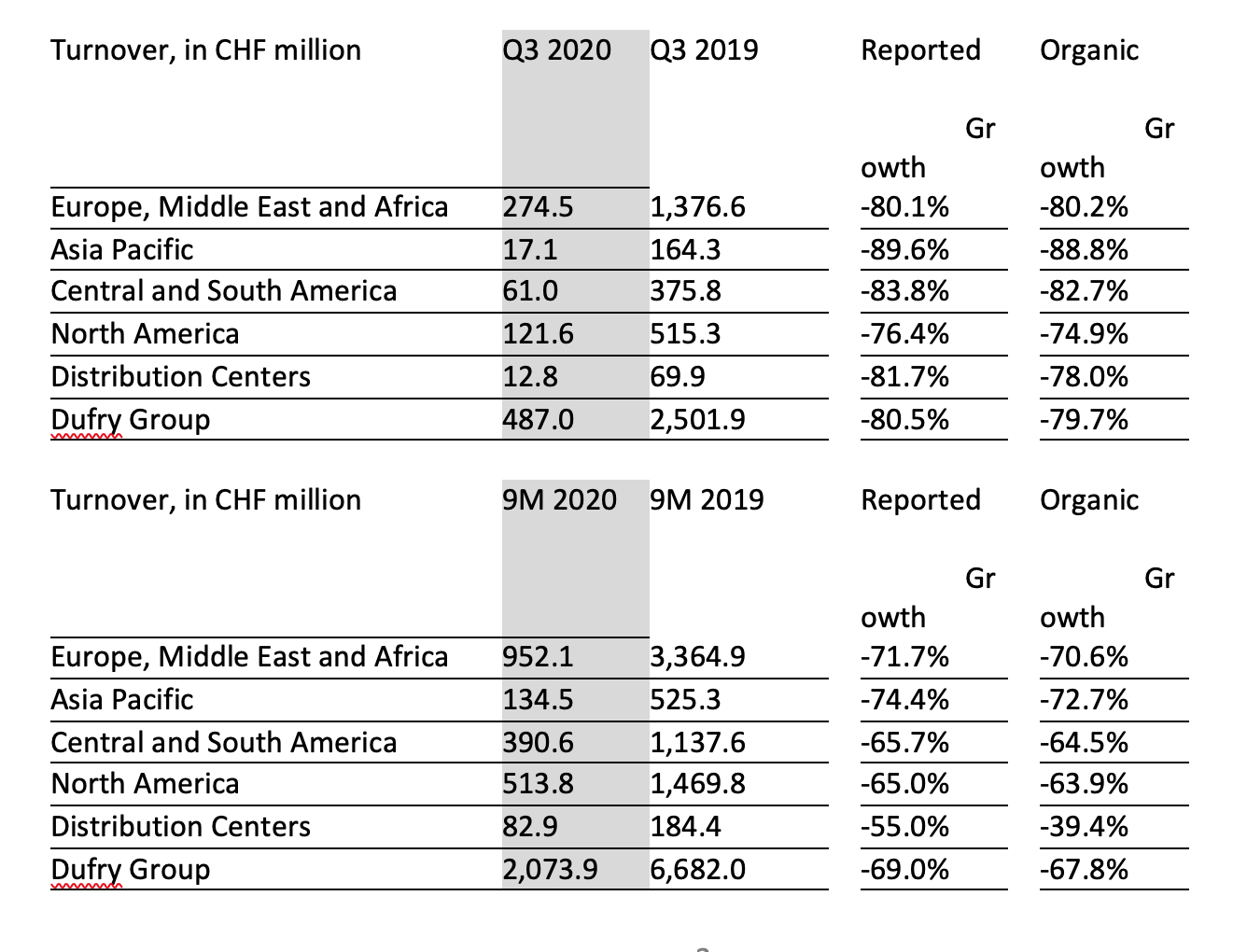

Turnover in Q3 2020 was CHF 487.0 million (US$533 million) as compared to CHF 2,501.9 million (US$2740 million) in Q3 2019, for a decrease of -79.7% YOY in constant exchange rates (CER). Organic grown was -79.7%, with like-for-like performance reaching -76.9%. Contributions from net new concessions amounted to -2.8%.

During the first nine months of 2020, turnover showed a decrease of -67.8% in CER. Turnover during the period was CHF 2,073.9 million (US$2272 million), whereas in 2019 the first three quarters saw CHF 6,682.0 (US$7320 million) in turnover. Organic growth during the first three quarters of 2020 was also -67.8%.

REGIONAL PERFORMANCE

Dufry realigned its regions under a new organizational setup as of September 1, 2020, to increase efficiencies and simplify the decision-making processes. Dufry will now give its regional reports under the new setup.

Europe, Middle East and Africa contributed 57% of Q3 2020 net sales, North America accounted for 25%, Central & South America offered 12%, Asia Pacific contributed 4%, and Global distribution centers accounted for 2%

Europe, Middle East and Africa

The organic growth in this region for Q3 2020 was -80.2% versus Q3 2019. Throughout Europe, July and August showed improved performance as restrictions were lifted and holidays began. COVID-19 cases began increasing again, however, which resulted in renewed travel restrictions. Thus, Q3 sales for the region reached CHF 274.5 million (US$300.7 million) in 2020 vs CHF 1,376.6 million (US$1508 million) in Q3 2019.

Asia-Pacific

While this region is showing perhaps more recovery than most, Dufry’s footprint in the region is geared towards international travel, which is still highly impacted. Most of Dufry’s locations in the region continued to be closed throughout Q3, though Dufry benefitted from China’s improved domestic travel numbers through its duty paid businesses. Therefore organic growth in the region during Q3 saw a drop of -88.8%, with turnover of CHF 17.1 million (US$18.7 million) versus CHF 164.3 million (US$18 million) in the same period in 2019.

Central & South America

The Caribbean Islands and Mexico are performing better than other subregions given more flexible travel restrictions, but the cruise industry is remains shuttered, and Central and South America border restrictions remain strong. Organic growth came in at -82.7% for the region in Q3 2020 vs Q3 2019, with turnover of CHF 61.0 million (US$66.7 million) as compared to CHF 375.8 million (US$411.7 million) in 2019. South America did, however, begin to see some demand with border-shop openings and duty paid business in the region.

North America

The duty paid business in the US helped this region during Q3, as domestic flights increased during this time. Turnover in the region reached CHF 121.6 million (US$133 million) in Q3 2020 compared to CHF 515.3 million (US$564.5 million) in Q3 2019, and organic growth for the period was -74.9%.

BUSINESS DEVELOPMENT

During 2020, Dufry opened four new shops, in Odessa (UKR), Singapore (SG), Salt Lake City, and Boston (US). The company also refurbished a number of shops, including but not limited to shops in Corfu, Mykonos, Thessaloniki (GR), Antalya (TUR), Belgrade (SRB) and Nashville (US).

The company continues to deploy capital expenditures in accordance with its business requirement and recovery trajectory. By the end of 2020, Dufry will have spent approximately CHF 100 million, deliver around 23,000 square meters of new and refurbished space, consisting of around 90 shops and representing growth of around 5% compared to existing retail space, with much of it executed during Q3:

• 11,750 square meters of new space with 4,700 square meters executed YTD Q3 2020

• 11,250 square meters of refurbished space with 10,500 square meters executed YTD Q3 2020

Dufry also continues to bid for new contracts. Most recently, the company was awarded a new 12-year concession contract at Istanbul Sabiha Gökçen International Airport. Dufry will operate a total of 3,900 square meteres of duty-free and specialty shops at the airport, which will increase its operational capacity from today’s 41 million to 65 million passengers by 2024.

FINANCING INITIATIVES

Dufry is acquiring all remaining equity interest in Hudson for approximately CHF 295 million and delisting the company from the New York Stock Exchange. Dufry’s shareholders approved financing the transaction through a capital increase by way of a rights offering at Dufry’s Extraordinary General Meeting (EGM). The transaction and delisting are expected to conclude in Q4 of this year.

Dufry Group and Alibaba Group reached an agreement whereby Alibaba Group will invest CHF 69.5 million (US$76.1 million) in Dufry via mandatory convertible notes. In part these proceeds will finance the Hudson acquisition, as well as for general corporate purposes, including projects and partnerships supportive for the future growth of the company.

Upon closing of offering, Advent International owned 11.4% of Dufry and 6.1% of Alibaba. These deals will lock up within six months of the first day of trading the new shares.

As of September 30, 2020, Dufry’s net debt amounted to CHF 3,735 million (US$4,092 million) compared to CHF 3,659.4 million (US$4,009 million) compared as of June 30, 2020, and CHF 3,101.9 million (US$3,398 million) at the end of December 2019.

Dufry’s liquidity position amounted to CHF 2,065 million as of September 30, 2020 pro-forma, including:

Net proceeds from rights issue and mandatory convertible notes of CHF 867 million (US$950 million)

Cash outflow related to Hudson Transaction of CHF 295 million (US$323 million)

Cash and cash equivalents of CHF 748 million (US$820 million)

Available credit lines of CHF 745 million (US$816 million)

Cash consumption, defined as equity free cash flow, stood at CHF 51 million in Q3 2020. Including the above-mentioned proceeds related to the capital increase and the cash outflow for finalizing the Hudson Transaction, pro-forma net debt as of September 30, 2020, stood at CHF 3,171 million.

SET UP OF STRATEGIC JOINT-VENTURE WITH ALIBABA GROUP

Dufry announced a joint venture with Alibaba Group, to jointly invest in travel retail in China and improve Dufry’s digital presence. The joint venture will be set up by the end of 2020 as a Chinese incorporated entity with Alibaba Group holding an ownership of 51% and Dufry of 49%. First operations are expected to start in H1 2021.

Julián Díaz, CEO of Dufry Group, says the company is in a stronger position than it was. “Today, we are standing as a stronger and more resilient company than three months ago for three specific reasons. First, we have reached final stages in the implementation of our restructuring initiatives and group-wide reorganization, which include the full reintegration and delisting of our Hudson business in North America, which we expect to close in the fourth quarter of this year. Besides adding agility and simplifying the daily operational management of the company, these initiatives will allow us to reach significant cost reductions of CHF 1 billion in 2020, of which at least CHF 400 million are resilient structural savings also enduring in 2021 and beyond.

“Second, with the total gross proceeds of CHF 890 million we have raised through the rights issue process, we have considerably strengthened our financial position and increased our flexibility to act on growth opportunities including new concession contracts and strategic partnerships. I would like to thank our existing shareholders and our new partners Advent International and Alibaba Group for their trust and support of the company’s long-term strategy and path towards recovery to emerge as a more efficient travel retail company.

“Third, the collaboration with Alibaba Group, for which we are currently setting up a Joint-Venture company in China, will not only allow us to further develop travel retail in China but also to accelerate Dufry’s digital transformation globally. This is a considerable contribution in driving our e- \motion strategy to increase customer touchpoints and engagement along their journey. We will keep you informed on the progress of the collaboration and the opportunities identified. With respect to the current performance, our business and the travel retail industry remain particularly exposed to the dynamic macroeconomic situation and the travel restrictions.

“We have seen an encouraging travel uptake in July and August, with a plateauing in September caused by the increased quarantines imposed by certain countries. Nevertheless, the comprehensive set of actions implemented in 2020 in close alignment with our landlords, suppliers and other business partners as well as our current liquidity position will allow Dufry to comfortably endure even a prolonged recovery.

“I would like to express again my personal gratitude to our employees, who continue to support the company through this challenging time and are embracing the new organization and ways of working with a high motivation. Their resilience and commitment have allowed us to quickly adapt the company to the new environment while also engaging in opportunities and new partnerships. Sadly, we have colleagues who were infected and I want to remember them and their families globally. We will continue to take all necessary steps to provide our employees with a safe working environment.”