“We are in the abyss”: ACI expert forecasts at least three-year recovery from pandemic

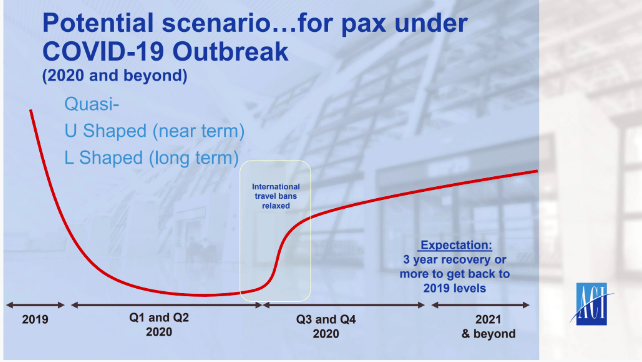

The aviation industry is in “an abyss” and it will take at least three years for airport passenger traffic to get back to 2019 levels.

That’s the grim view of Airports Council International (ACI) World Economics Director Patrick Lucas, who was speaking during the Duty Free World Council’s (DFWC) Planning to Restart webinar on June 3, which presented updates on the current state of the duty free and travel retail industry, reviewed air traffic data and highlighted the measures taken by the DFWC and the regional associations to restart business.

Lucas ruled out a bounce-back similar to that experienced after the SARS outbreak in 2003. He said: “Many aviation economists believed that the COVID-19 crisis was going to resemble something like SARS where you would be a six-month episode and then you would bounce back. We now know that is definitely not the case.

“We are looking at something like a quasi-U-shaped-L-shaped recovery and it will take at least three years to get back to 2019 levels. Some regions will take even longer. One of the regions we expect to recover faster is Asia Pacific, which is good, because it does have a huge weighting in terms of the global marketplace.

“In the coming months, in the Asia Pacific region, international routes are starting to open up and intra-European Union routes will be opening up.”

A compounding effect

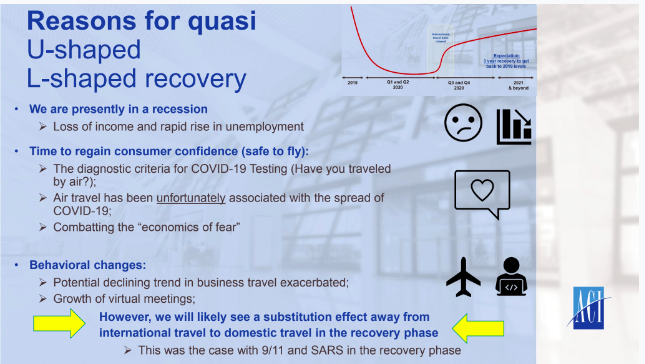

Explaining why ACI was predicting a quasi-U-shaped-L-shaped recovery, he said: “You have two things happening simultaneously. We have a pandemic, a loss of consumer confidence, and we also have a global recession, so this has a compounding effect.

“On the consumer confidence side, unfortunately, aviation has been associated with the global spread of the pandemic, so one of things we have to do as an industry is really combat the economics of fear, and of course take mitigation measures to make sure the virus is not spread, but showing that the industry is safe to participate in.”

ACI had been predicting year-on-year growth of 6% in the airport sector for 2020, but because of the pandemic, he said, “we are in one of the worst recessions since the 1930s. Both advanced economies and emerging markets are contracting. This is an across-the-board decline because of the global lockdown.”

He continued: “We move from the good to the bad in 2020. In March, we saw a decline in passenger traffic in the realm of about 60%. Right now, we’re in the abyss. We have really sunk deep into the crisis and in Q2 we are seeing declines of up to 90% globally in terms of passenger traffic. This represents a loss of over 2 billion passengers in a single quarter.”

Lucas noted the “huge loss” from non-aeronautical revenues and from high-yield Chinese passenger revenues. ACI is forecasting overall airport revenue losses of just under US$97 billion, a 57% decline in 2020. This is the equivalent of having the revenues of the 75 busiest hubs in the world completely wiped out in a single year.

“We were expecting about US$170 billion for the airport industry as a whole and now you have this massive shortfall and big decrease in the non-aeronautical side. At the same time, you have these huge costs. Airports are known for their high fixed costs. It’s an infrastructure-intensive business; they’re not designed to be closed because a lot of these costs need to be serviced. Their cash flow needs to be there.”

He said that airports were now cutting back on costs and industry bodies such as ACI and DFWC were seeking relief on fixed costs (such as the tax component), as well as loans, cash injections, and waivers on concession fee payments.

Duty free allowances

On the non-aeronautical side, he stressed: “Now is not a time to be very restrictive on duty free allowances. There are different areas where governments could help out with the industry.”

Turning to consumer confidence and their propensity to fly, Lucas cited the example of China, which was first in and first out of the pandemic. “If we go back to February, there was 43% optimism regarding the Chinese economy, and by May we see this incrementally increasing to 57%. These are some good indicators of one of the biggest markets in the world in terms of the feeling about recovery - consumer sentiment.

“If we look at scheduled seat capacity, we’re looking at a recovery that’s inching upwards. Bear in mind that June and July data will get adjusted, and this is scheduled seat capacity, so it doesn’t necessarily mean a full aircraft - there are in some cases social distancing measures - but if we look at this in March and April, we see that there has been an uptick in the Chinese domestic market.”

However, he noted that in May, 100% of global destinations had some form of travel restriction and as many as 50% of countries had some type of ban on incoming foreign travel.

DFWC: Key wins

DFWC President Sarah Branquinho, who hosted the webinar, explained what the Council had been doing at global level.

One key area has been the Council’s engagement with the International Civil Aviation Organization (ICAO), the UN agency that regulates civil aviation worldwide. ICAO had established a COVID-19 Aviation Recovery Task force (CART) and moved at speed to define and publish measures and guidelines that have just been announced.

DFWC and regional representatives fed into the task force early, Branquinho explained. “We wanted to avoid unworkable regulations being imposed upon us due to a lack of understanding of the revenue-generating role in the aviation sector.”

She said she was “extremely pleased” with guidelines and listed some key wins for the industry: “There are some key wins for the duty free and travel retail industry: opening of duty free shops as traffic returns; there are no ‘essential retail only’ rules that we had seen proposed in many countries; recognition that shopping areas are part of the airport infrastructure and should be used fully to ensure physical distancing; flexibility as to how measures are implemented - there’s no mention of limiting numbers or entry and exit points, which allows us to work with our airport partners to make sure that the most sensible measures are taken, depending on each individual airport; no strict one-bag rule, although there is a comment that during the early stages of the restart phase that carry-on baggage that would require the use of the overhead bins should be limited to facilitate a smooth boarding process.”

She added that ICAO had suggested the temporary suspension of inflight duty free sales. “We will need to raise this with our airline partners and get them to work with us to bring this back at the first available opportunity.”

The next step is to encourage duty free retailers to bring the guidelines to the attention of their airport partners and national aviation safety regulators in each country.

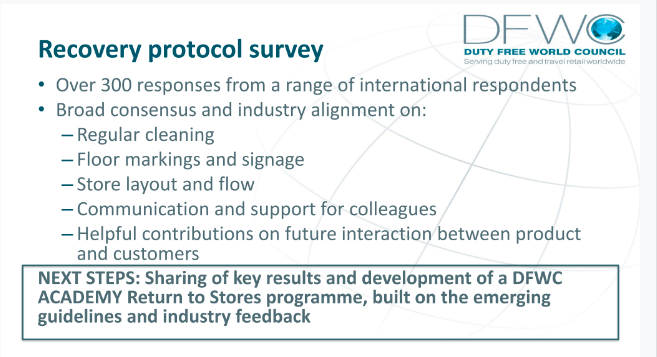

Branquinho said that there had been more than 300 responses from the industry to its stores recovery process review.

She said the DFWC Academy would develop a return-to-stores training program for all companies across the world, taking into account the ICAO guidelines and the feedback from the industry survey.

MEADFA: Government and landlord engagement

Middle East & Africa Duty Free Association (MEADFA) President Haitham Al Majali said the association had appointed an advocacy working group and had adopted a position paper tailored to the region for engaging with key governments and regional organizations.

Two letters had been sent. The first was a political engagement letter asking for financial support from regional governments. The second aimed to engage with landlords and asked for a rent relief strategy to support retailers.

He listed the many health and safety measures that will be implemented in-store.

APTRA: Phased recovery

Asia Pacific Travel Retail Association (APTRA) Executive Director Christina Oliver predicted a phased recovery in the region, with two or three stages before everything reopens.

She gave the example of Singapore opening up to transit passengers, before full tourists are allowed in.

The association thinks that corridors of travel will open up first in New Zealand-Australia, as well as its ASEAN neighbors, e.g. Malaysia, Singapore, Vietnam, Thailand and Hong Kong.

IAADFS: Financial relief efforts

Turning to the Americas, International Association of Airport & Duty Free Shops (IAADFS) Chairman René Riedi said the association had been focused on trying to obtain financial relief through lobbying and educating legislators on the unique aspects of the duty free industry.

“We hope in one of the upcoming stimulus and relief packages to get an allocation that is currently being discussed in the House and the Senate,” he said.

IAADFS has advocated for financial support in the form of loans, loan guarantees and/or grants to assist airport concessionaires. It has worked closely with airport partners to obtain relief from MAGs and other contract requirements with the advent of essentially no passenger traffic,

The association has coordinated with other airport concessionaire organizations and associations representing duty free products to raise awareness about the industry and the need to provide support.

FDFA: Border closure extension

Frontier Duty Free Association (FDFA) Executive Director Barbara Barrett spoke about the situation in Canada, where the US/Canada border has been closed to all but essential workers since April 21 and closure has been extended to at least June 21 - and is likely to extend well beyond.

Approximately 75% of land border stores are closed and those open to essential workers have very little traffic.

Among its activities, the FDFA has engaged with the Canada Border Services Agency (CBSA) for assurance that temporary store closures would not trigger a re-tender.

ASUTIL: Duty paid becomes a focus

ASUTIL President Gustavo Fagundes said the association was keen to learn from what other regions were doing in their recovery efforts.

He said the association wanted to gather information and benchmarks in order to pick up the pace of recovery.

He said the bankruptcies of major airlines in the region was a challenge. “Some of the most important airlines are facing problems. They are based in emerging markets and the governments are not ready to support the airlines in the way the West or European countries are able to. This makes it a little bit more challenging.”

ASUTIL believes that the recovery will come first from domestic flights and that duty paid will become more important in the region. He called on the industry to take a better look at the duty paid business so that travel retail can make itself more relevant in the short term.

.jpg?&resize.width=322&resize.height=483)