m1nd-set shows post-COVID shopper conversion on the rise

International travelers in the post-COVID-19 context are more likely to convert into buyers than they have been in recent years according to the latest consumer research from Swiss travel and travel retail market research agency m1nd-set.

m1nd-set’s latest analysis compares shopper behavior in airports over the past 5 years, through the pre-COVID-19 era to present day, comparing the evolution of footfall and conversion rates, changes in the categories purchased, as well as the evolution and variations over the years in why people purchase in travel retail, what triggered the purchase and some of the barriers to purchase.

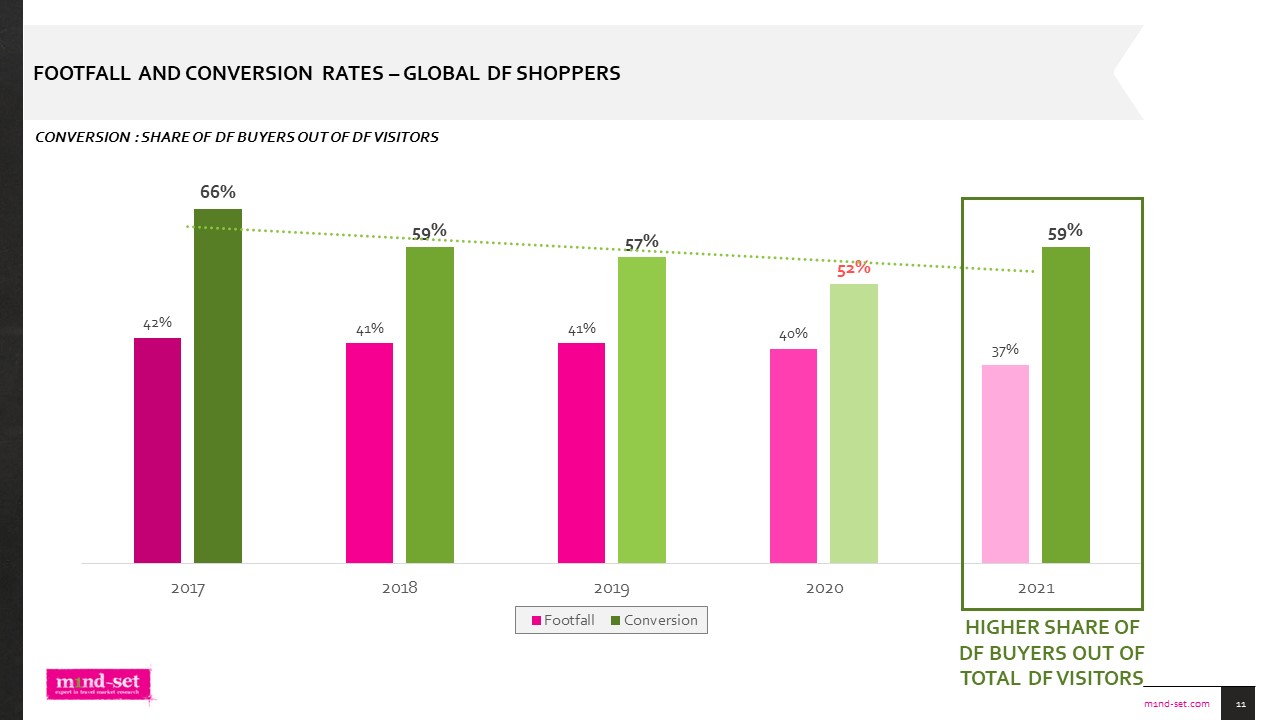

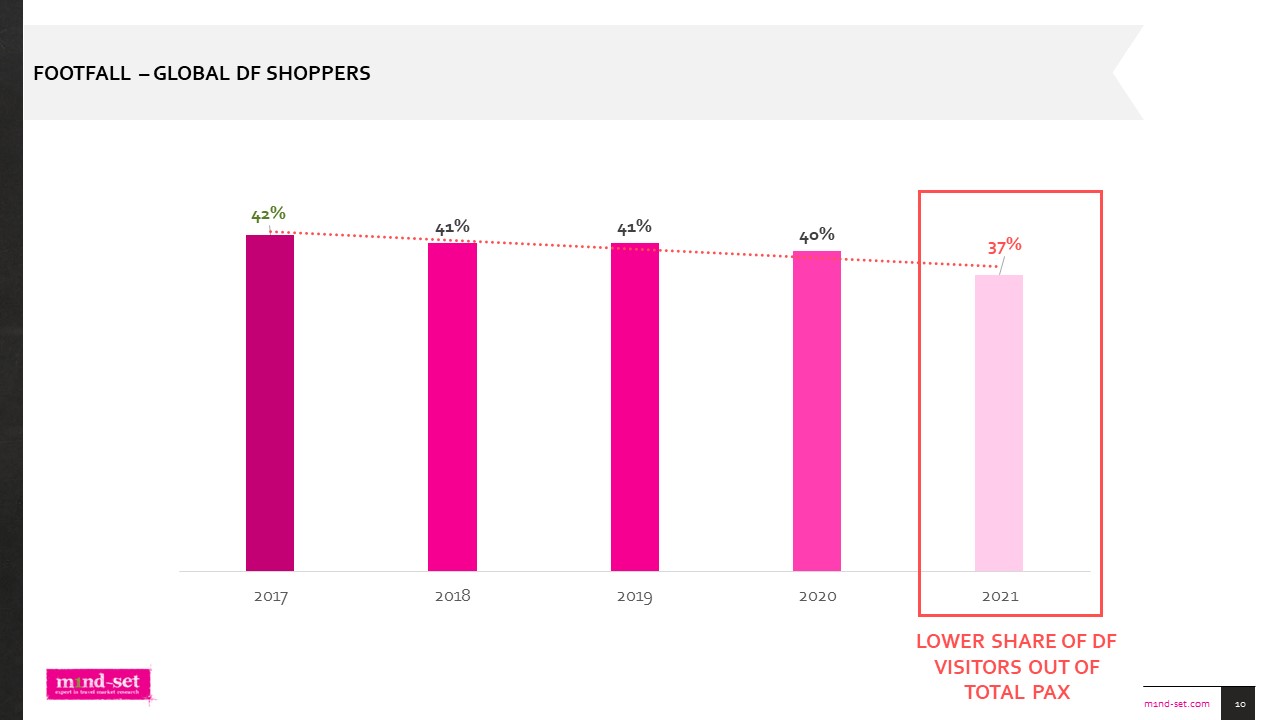

Among the key findings, m1nd-set reveals that while conversion (share of duty free buyers out of duty free visitors) had been decreasing since 2017, from 66% to 52% in 2020, the percentage of shoppers making a purchase in duty free and travel retail stores rose again in 2021 to reach the same levels as in 2018 (59%). Inversely however, the research demonstrates a clear downward trend in terms of footfall over this period among global passengers; airports have lost 5% of passengers according to the passenger feedback between 2017 and 2021. While 42% of travelers globally say they entered the duty free and other retail shops in 2017, this percentage has fallen to 37% in Q1 2021.

In 2021, global travelers are more likely to purchase categories that tend to be planned in advance

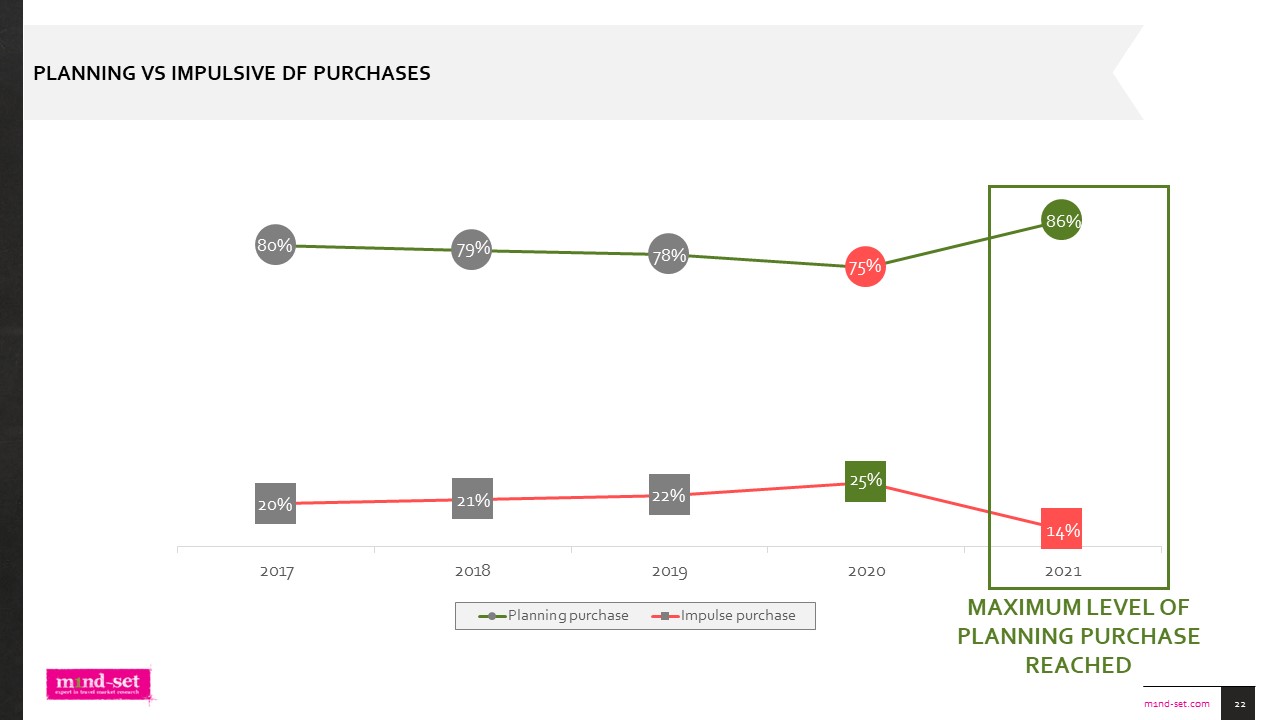

Another interesting finding that emerges from the analysis is the evolution of categories purchased and purchase planning. Global travelers in 2021 are more likely to purchase categories that tend to be planned in advance. For the Perfumes category, 41% of shoppers purchased in 2021 vs. 31% on average when considering all previous four years, an increase of 10%. For Fashion & Accessories, there is a 7% increase in 2021 compared to the previous years, (22% vs. 15%), 6% for Skincare (25% vs. 19%) and Jewellery & Watches (14% vs. 8%), 5% for Tobacco products (22% vs. 17%) and 4% for Make-up (20% vs. 16%). For all of these categories, the significant majority of shoppers – between 75% and 90% depending on the category – plan their purchases.

The percentage of shoppers in duty free and travel retail planning their purchases had been decreasing steadily since 2017, from 80% to 75% in 2020. In 2021, however, this trend has been reversed as 86% of shoppers say they will plan their purchases to at least some extent when traveling. They are less likely to purchase completely on impulse, however, with a decline from 25% of shoppers purchasing on impulse in 2020 to 14% in 2021.

“The global footfall and conversion trends over the past five years are very interesting to see, as there are still more than 40% of store visitors who need to be enticed to spend, not to mention the 63% of all passengers who do not enter the shops.

“However, more interesting are the non-visitor and non-shopper customer segments. In the post-pandemic environment, the reasons for not visiting or shopping at an airport have, without question, evolved and will be quite different to the reasons for not-shopping expressed in 2017.

“It’s important to underline though that while the global data demonstrated here paints a general picture, the realities will inevitably vary from one airport to another; even between terminals at the same airport. It is vital to approach these consumer insights from a regional-specific, market-by-market and even airport specific perspective. Each retailer and airport need to understand the reasons behind the barriers to visiting and shopping in the retail stores,” explains Peter Mohn, Owner & CEO, m1nd-set.

.jpg?&resize.width=322&resize.height=483)