m1nd-set highlights driving footfall, conversion and spend in Asia Pacific

“The sleeping giant awakes”. This is how travel retail research agency m1nd-set introduces its latest shopper insights report.

Before studying how to increase footfall, conversion and spend, m1nd-set says it is useful to understand the sheer scale of the passenger numbers in Asia Pacific. Drawing on the data from m1nd-set’s bespoke traffic and shopper behavior analysis tool, Business 1ntelligence Service (B1S), in which air traffic and forecast data are provided in partnership with IATA, the agency is able to harness the significant potential for the travel retail sector in the region.

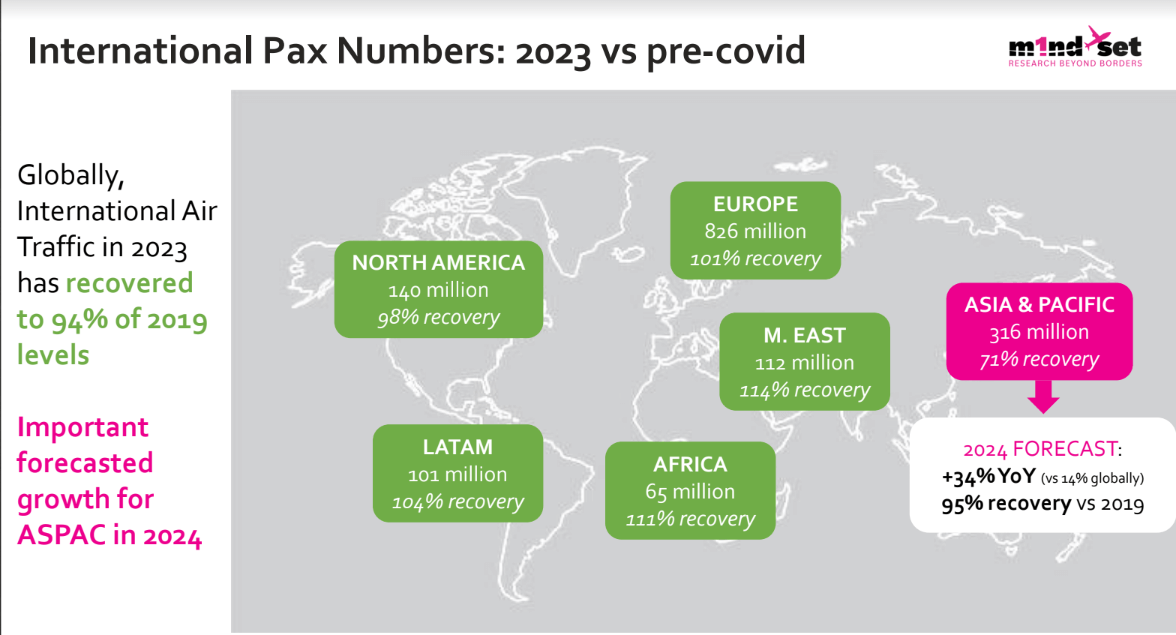

While all other world regions except North America had surpassed pre-COVID traffic levels in 2023 already, Asia Pacific was still only at 71% of 2019 air traffic with 317 million passengers. 2024 will see air traffic growth across the region significantly more robust than the global average however, with a 34% year-on-year growth forecast compared to 14% globally. Asia Pacific air traffic will still fall slightly short of 2019 levels though in 2024, with an estimated 95% recovery by the end of the year.

When looking at air traffic with Asia Pacific and other regions, m1nd-set sees that intercontinental traffic to and from Asia has for the most part recovered to 2019 levels. Between Asia and the Middle East, air traffic had recovered by 104% of pre-COVID levels to 86 million passengers. In Europe on the other hand, traffic was still at 76% of pre-COVID levels, at 78 million. Intra-Asia traffic had not quite reached two thirds of 2019 air traffic, at 217 million passengers at the end of 2023.

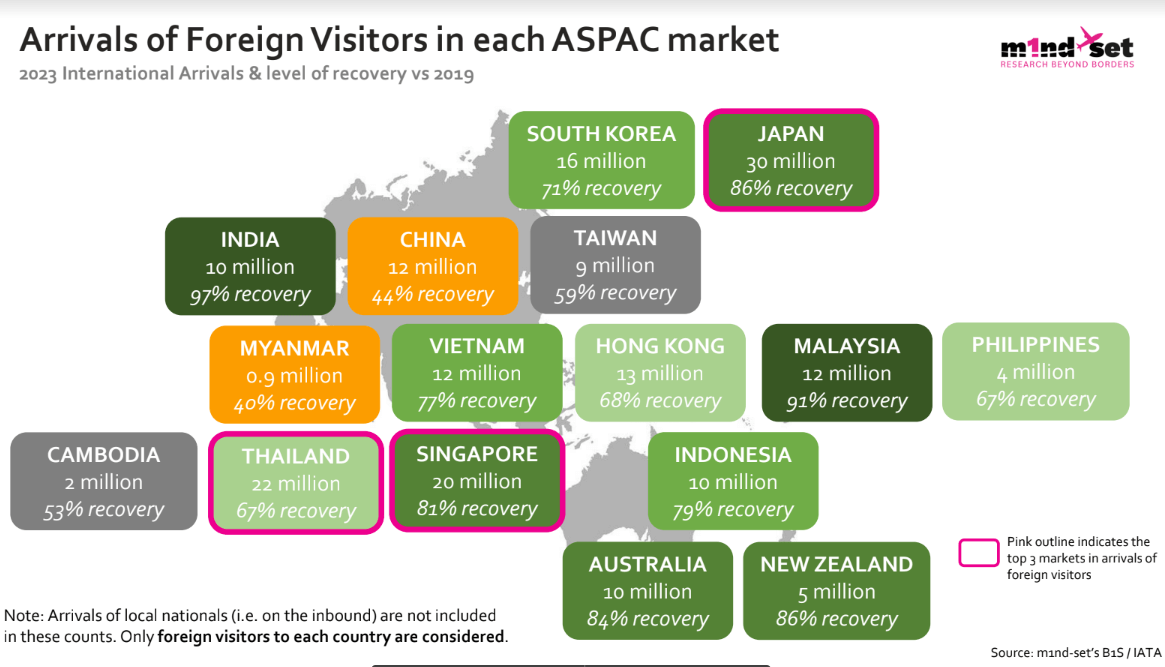

Turning to the arrivals of foreign visitors in each market across the Asia Pacific, m1nd-set notes that Japan, Singapore and Thailand lead the rankings, in terms of passenger volume. It is useful to note that these figures only include the foreign visitor numbers and not returning nationals. Japan received 30 million foreign visitors in 2023, 86% of the pre-COVID level, Thailand 22 million, -67% of 2019 levels, and Singapore 20 million –81% of 2019 levels. Thailand is still lagging at the two-thirds mark, due to its dependency on arrivals from China, which have still to see a robust revival.

In terms of recovery levels versus 2019, India leads the way with 97% recovery and 10 million foreign visitors, followed by Malaysia at 91%, with 12 million foreign nationals arriving in the country. At the other end of the scale are Myanmar, which has only recovered 40% of the pre-COVID traffic and China, with 12 million foreign visitors in 2023, representing 44% of the 2019 level.

Major Asia Pacific travelling nationalities

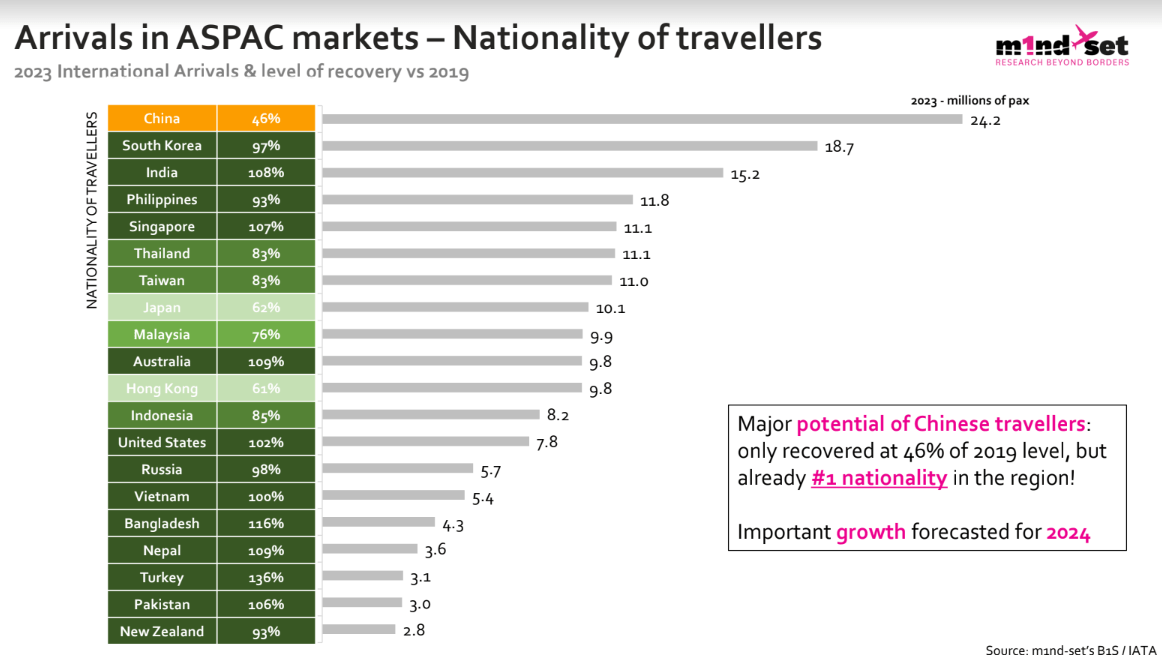

Considering the nationalities arriving in Asia Pacific however, m1nd-set underlined the potential with the Chinese passengers. While passenger numbers are only still less than half (46%) of pre-COVID levels, in terms of volume, the Chinese already surpass all neighboring markets and by a considerable margin. More than 24 million Chinese passengers took to the skies in 2023, travelling in Asia Pacific, circa 30% more than second-ranking South Korea. There were just less than 19 million passenger journeys by South Koreans travelling within Asia Pacific in 2023, which is only just short of the 2019 level.

This means that when intra-regional flights by Chinese passengers have fully recovered, we will see more than 52 million Chinese passengers, travelling within the region, nearly three times more than second place South Koreans. Indians, who rank in third place with 15.2 million passengers, have already fully recovered and surpassed pre-COVID traffic levels. But while the growth rate for Indian outbound travelers across Asia Pacific may well be less dynamic, as Chart 3 illustrates, Japan and Hong Kong still have considerable margin for growth to return to pre-COVID levels. Both markets are still circa 40% below the 2019 level in terms of outbound passenger numbers within Asia Pacific.

China focus

While outbound traffic is still lagging in China, domestic tourism among the Chinese has already surpassed the pre-pandemic levels. Similarly, overseas trips from China to Hong Kong, Macau and Taiwan have recovered more strongly than to other markets across the region, comprising circa 77% of all cross-border trips by Chinese travelers in 2023. As for travel to China among foreign nationals, the nationalities that have recovered the most for inbound traffic are Macau at 72% of pre-COVID levels with 800,000 arrivals into China, Singapore at 70% and 400,000 arrivals and Hong Kong with 62%; Hong Kong has the most significant volume among all nationalities travelling to China though, with 2.2 million arrivals in 2023. Thailand represents the second highest volume of foreign arrivals into China, with 1.6 million visitors in 2023, but recovery is still lagging at only 42%.

In addition to the strict COVID restrictions imposed in China and slow reopening of international travel, other reasons for the slow return of Chinese travelers include the complex visa application processes, which have created barriers to inbound tourism from China. As mentioned in the January edition of m1nd-ful which focused specifically on China, markets offering a visa waiver policy for Chinese nationals stand to benefit the most. Thailand, Singapore, Malaysia and the UAE are all examples of tourism destinations that have benefitted from greater inbound Chinese traveler numbers, thanks to a relaxation of the visa policy for Chinese tourists.

While international arrivals from China will continue to rise steadily, greater efforts will be required to convert Chinese travelers into visitors and browsers into shoppers. Shopping spend has declined in some markets as Chinese travelers switch their spend from goods to services and experiences in particular. In view of this behavioral shift, how travel retail stakeholders reposition their offering to Chinese travelers to provide more experiential retail and services, will determine the footfall, conversion and spend among the Chinese. Given the growth curves and volumes to come, as we have seen earlier, a rethink of the retail offering is essential if travel retail wishes to woo the returning Chinese traveler.

Chinese GenZs’ key experiential drivers

According to m1nd-set, not only are Gen Z travelers from China on the rise, they are also leading the way in terms of experiential consumption while travelling. They are increasingly seeking adventure activities and more sporting and leisure activities. Does travel retail’s offering meet these expectations?

Chinese shoppers, GenZs in particular once again, are keen to share their shopping experiences with their peers on social media – almost two thirds of Chinese GenZs are actively sharing their experiences and more than half say they discovered new products and services thanks to post on social media by peers in their network. Travel retail stakeholders with robust online presence and proactively marketing their online stores to Chinese consumers are reaping the benefits. The savviest among them are also present on social commerce platforms such as WeChat.