“We are very satisfied”: Gebr. Heinemann reflects on a successful 2023

Presenting the latest financial report (from left to right) Raoul Spanger, Co-CEO, Inken Callsen, Chief Commercial Officer and Max Heinemann Co-CEO

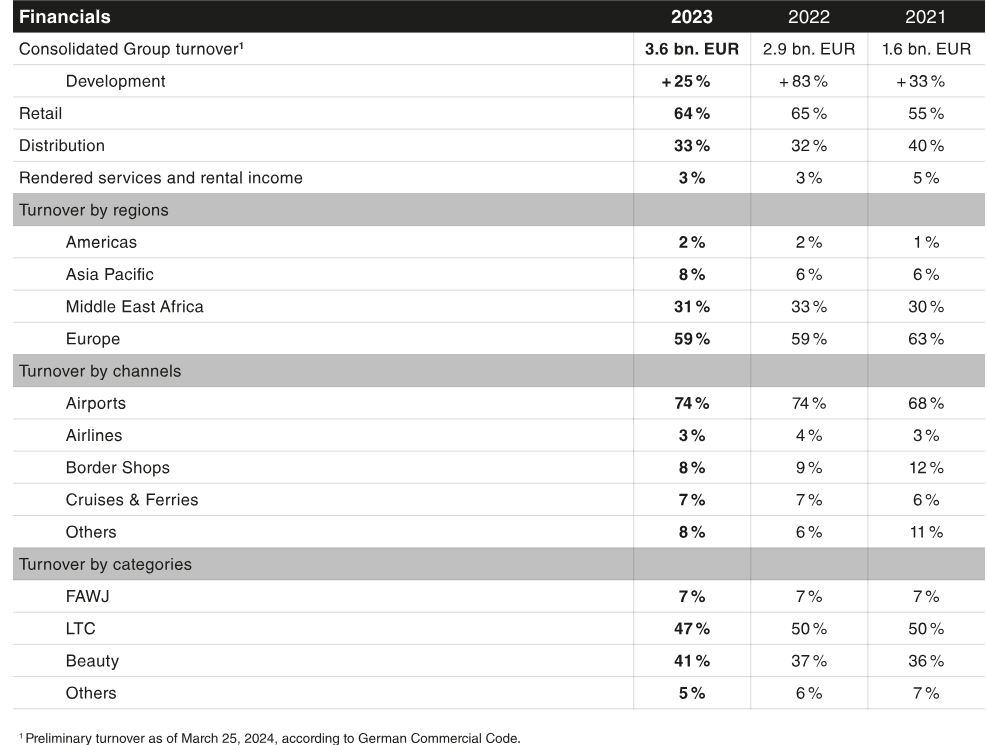

Gebr. Heinemann closed the 2023 financial year with a turnover of €3.6 billion compared with €2.9 billion for 2022.

Raoul Spanger, Co-Chief Executive Officer, said, “We are very satisfied with this year’s results. In comparison to the previous year, the company achieved a 25% percent increase in turnover. Furthermore, we were able to take important strategic steps in order to diversify our business.

“We had planned to grow in the Middle East Africa region in 2023 and achieved great success there by winning the concession at Jeddah Airport and signing the contract for the stores aboard AROYA, the first cruise ship of Cruise Saudi’s newly established cruise company.”

With this increase in turnover, Gebr. Heinemann reached the turnover level of 2019, which also amounted to €3.6 billion. The main reason for the turnover growth is the increase in passenger numbers after the final pandemic-related travel restrictions were lifted last year. Only the Asia Pacific region fell short of expectations. This positive development was offset by geopolitical challenges such as the ongoing war in Ukraine and the renewed conflict around Gaza following the terrorist attack by Hamas in October. Macroeconomic developments such as rising inflation, which impacted customers’ purchasing power, and currency volatility, which particularly affected business in Norway, also had repercussions.

2023 highlights

From a regional perspective, the identified growth region Middle East Africa was the main driver of turnover last year. Within this region, the location at Istanbul Airport, which Heinemann operates with its joint venture partners Unifree and ATU Duty Free, generated a turnover of more than 1 billion euros. Heinemann took another significant step in the region with its market entry in Saudi Arabia: the company won the retail concession at King Abdulaziz International Airport in Jeddah together with its joint venture partners Jordanian Duty Free Shops and the ASTRA Group. In collaboration with the airport, Gebr. Heinemann will create a unique shopping experience there. In addition, the company signed an exclusive contract with Cruise Saudi for the first ship of the new premium cruise line AROYA Cruises, which is also the first cruise company in Saudi Arabia.

The region with the largest share of turnover in 2023 remained Europe with the main locations being Amsterdam, Copenhagen, Frankfurt, Oslo, and Vienna. However, the Norwegian locations were negatively impacted by regulatory changes and the devaluation of the Norwegian krone. In the Asia Pacific region, Sydney and Kuala Lumpur in particular were severely affected by the delayed return of Chinese travelers and, despite solid turnover growth compared to 2022, only reached 62.3 percent of their precrisis turnover levels by the end of the year.

Heinemann achieved further success in diversification by acquiring 50% of the shares in the Noblis Group, the leading perfume distributor in the German-speaking domestic market. This strengthened the share of the wholesale business in Heinemann’s portfolio, so that it now accounts for a third of business sales. In contrast, the retail business accounts for 64% of sales.

Heinemann also continued to invest in the diversification of its sales channels. For example, the Hamburg-based company acquired all the shares of its previous joint venture partner in Travel FREE Czech and is now the sole shareholder of this border-shop company.

Max Heinemann, Co-Chief Executive Officer, commented, “We are very proud that we have been able to grow as a global group of companies: by entering into carefully selected new partnerships, expanding existing partnerships and making strategic investments in other business segments and channels to push the collaborative envelope of our entire industry and beyond.

“We continue to become more international, expanded our retail space and hence grow our Heinemann Group’s headcount with impressive talent and skillset – always with our vision in mind to be the most human-centric company in global travel retail, to turn travel time into valuable time.”

With a turnover of €2,565 million, the airport business remained the strongest sales channel. The border-shop business was the second strongest channel with a turnover of €280 million, followed by cruises and ferries with a turnover of €239 million, and airlines with a turnover of €102 million. In addition, other channels such as the diplomatic business, free trade zones, military bases, and the NOBILIS GROUP generated a turnover of 277 million euros.

Heinemann was able to renew important concessions and generate new business across all channels. Examples included the opening of four duty-free and travel value stores with a total area of around 3,700 square meters at Düsseldorf Airport, the reopening of the tax-free and travel value stores at Oslo Airport following extensive modernization, and the extension of the long-standing partnership with Copenhagen Airport for a further ten years.

A highlight of the distribution business in 2023 was the extension of the partnership with Ryanair, Europe’s largest airline in terms of passenger numbers, for the in-flight business. In January 2024, Royal Caribbean International’s Icon of the Seas, currently the largest cruise ship in the world, set sail on its maiden voyage with 14 retail venues on board, operated by Heinemann Americas. This is the fourth Royal Caribbean ship to be awarded to Heinemann, which is currently operating the ships Icon of the Seas, Wonder of the Seas, Odyssey of the Seas and Independence of the Seas.

Looking at the split of turnover by category, 47% percent of turnover was attributable to liquor, tobacco and confectionery (2022: 50%), followed by the beauty category with 41% (2022: 37%) and fashion, accessories, watches and jewelry with 7% of turnover (2022: 7%).

Identifying trends and innovations continues to play a major role within all categories. Heinemann has been carrying out ‘Test & Learn’ pilot projects for new brands. These brands have the opportunity to present their products to travelers for a limited period of time and thus enter the travel retail market. For shoppers, it means that they can discover products from brands that they would not normally find in travel retail or that are only available in a very limited number of locations.

Within the liquor, tobacco and confectionery (LTC) category, travel exclusives that were developed in cooperation with industry partners and in some cases launched via the loyalty program Heinemann & ME, were highly successful and contributed to the realization of Gebr. Heinemann’s value proposition of a spectacular assortment. In addition, innovative promotions and shop-in-shop concepts were introduced, attracting attention and creating unforgettable experiences on the shop floors.

A major trend in the beauty category are niche fragrances. At Istanbul Airport, for example, niche fragrances achieved a 42% increase in turnover compared to 2022, already accounting for 20% of the total share in the perfume segment.

A success story in the fashion, accessories, watches and jewelry (FAWJ) category are second-hand goods. Second-hand luxury is a growing market and Heinemann has had great success with the vintage luxury concept, which was introduced at Royal Caribbean with a dedicated shop on the Icon of the Seas. Furthermore, the FAWJ category contributed significantly to the company’s success at Istanbul Airport with a large variety of boutiques that offer a luxurious shopping experience for travelers.

Inken Callsen, Chief Commercial Officer, added, “We want to develop the market with the individual strengths of our partners and create added value for travelers. We attach great importance to partnerships and cooperation and want to be successful together. This is what I call the power of collaboration.”

Ambitious Sustainability Goals Embedded within the Group Strategy

In addition to the financial key figures, Gebr. Heinemann also focuses on nonfinancial key figures of sustainability. For Gebr. Heinemann, sustainability has been an integral part of its development for more than 140 years, and the company sees sustainability as a foundation of its corporate identity and mission.

Spangler said, “We have defined ambitious sustainability goals for environmental, social, governance, and responsible value chain action fields and have embedded them in our group strategy. In order to develop and implement this ambitious sustainability strategy, we need to work hand in hand with our customers, partners, and suppliers.”

For example, in the environmental area of action, it is the company’s goal to achieve net zero emissions in Scope 1 and 2 by 2030 and achieve a 50% reduction per ton of sales volume in Scope 3 by 2030 as well. In addition, the company is paying very close attention to compliance with human rights in its supply chain and aims to cover at least 80 percent of its purchasing volume through independent supplier assessments by the end of 2024. Furthermore, the newly developed global strategy for diversity, equity, and inclusion as part of the social action field is supposed to be confirmed by ISO certification in 2025.

The aim of fulfilling these ambitious targets plays a significant role in all the actions taken within the Gebr. Heinemann group of companies. For example, in the beauty category, Heinemann has entered a unique and forward-looking sustainability partnership with L’Oréal, which was announced at the 2023 TFWA World Exhibition & Conference in Cannes. The partnership is based on a joint business plan that defines actions in the areas of assortment, point of sale, supply, and social engagement. Both companies will also develop sustainable point-of-sale materials and work together to make the supply chain more sustainable. Gebr. Heinemann is already working on entering other sustainability collaborations with partners in the other categories.