ASUTIL webinar: Key industry players spell out the recovery challenges ahead

Industry collaboration, the importance of omnichannel and adapting to changing consumer behavior are among the challenges facing travel retail post-pandemic, a webinar organized by South American duty free association ASUTIL has heard.

On June 23, ASUTIL Secretary General José Luis Donagaray hosted the first of a series of online conference sessions for members and the press, titled “The Day After: New Beginnings”. The session brought together five key players from the airport, retail and supplier sectors to discuss what they see as the way forward for the industry post-COVID-19.

Rafael Echevarne, Director General of Airports Council International - Latin America and Caribbean (ACI-LAC), gave attendees a forecast of passenger traffic numbers, but first noted the “worrying situation” in Latin America, as contagion was growing “dramatically” in the region.

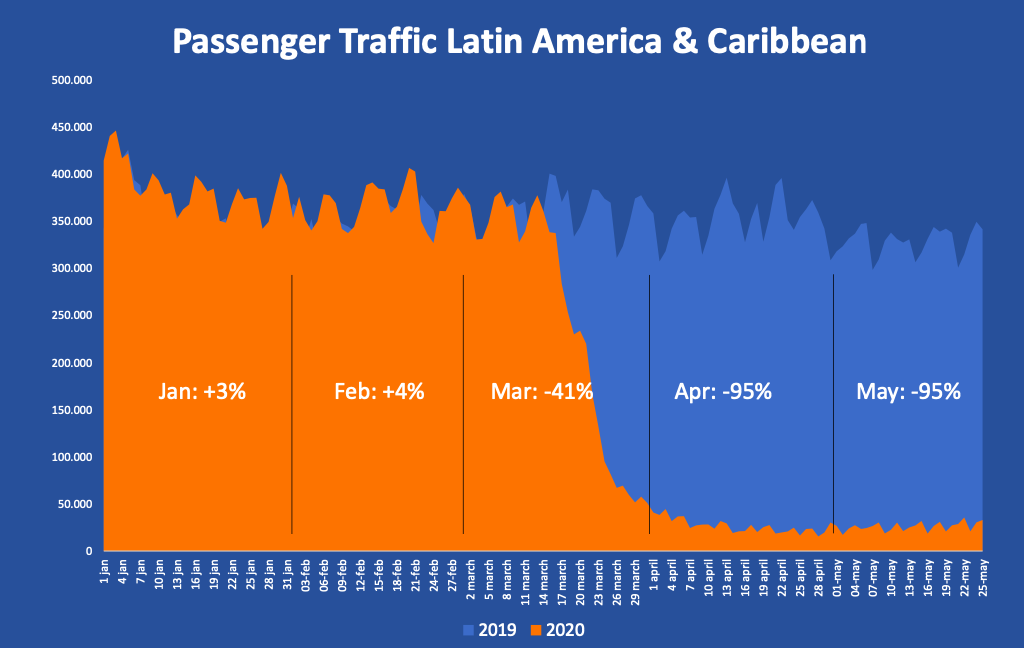

This year, passenger traffic grew 3% in January and 4% in February but then around March 15 countries in the region imposed travel bans and traffic collapsed dramatically. In both April and May traffic was 95% down on the previous year, and for June passengers numbers would also be off by approximately 95%, Echevarne said.

Passenger traffic in Latin America and the Caribbean grew in January and February 2020 but collapsed in March

He noted that Mexico was the only country in the world that had no restrictions imposed on travel for both incoming and outgoing passengers. In Chile and Brazil there is domestic activity but not at the same level as before.

Ecuador was the first country to restart aviation on June 1, where domestic and international travel is allowed, but quarantine rules are in place, which had killed tourism. However, he added that Quito International Airport had seen “tremendous” sales in arrivals duty free.

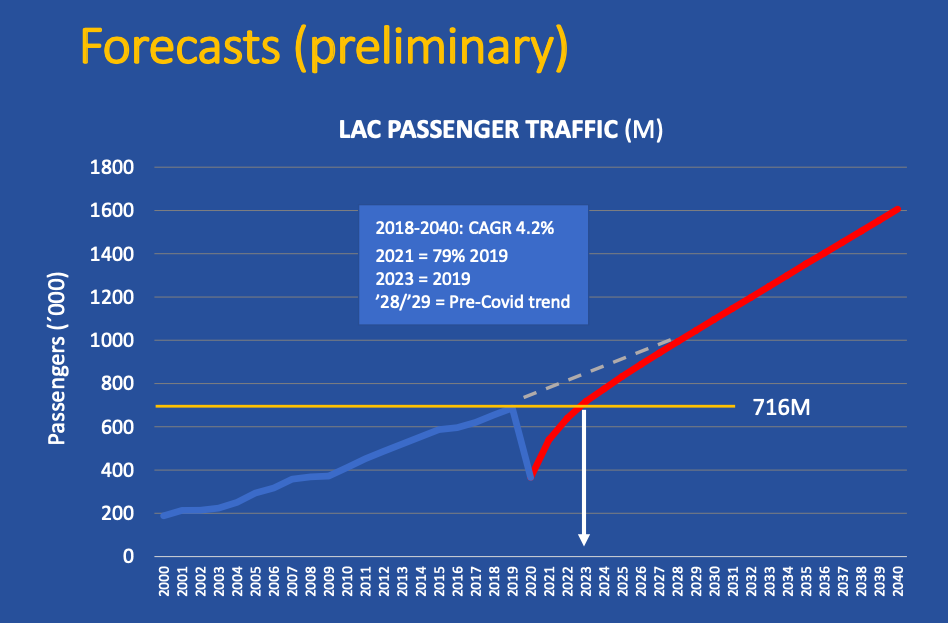

ACI-LAC is forecasting that the traffic for 2020 will be down by 50% compared to 2019, and that traffic will return to 2019 levels by 2023.

ACI-LAC is forecasting that passenger traffic will return to 2019 levels by 2023

This forecast is based on a number of premises that keep changing, he continued. They include when countries will allow people to travel abroad, noting that the governments of Argentina and Colombia won’t allow international travel until September; the airlines’ financial situation (citing carriers such as LATAM, Avianca and Copa Airlines) and the fact that there won’t be as many aircraft in service; and the economy, with the GDP growth in Latin America expected to be the lowest in the world in 2021. Another factor is when we will see the peak of COVID-19 cases.

“On the other side is what sort of incoming passenger restrictions we will see, because that will determine tremendously the type of passengers that we can expect. In other words, will we have tourism if we impose quarantines? We know that tourism will not materialize,” he warned.

Finally, he said ACI, along with the International Air Transport Association (IATA) and the International Civil Aviation Organization (ICAO) had approved strict protocols for airports and airlines to stop the spread of the virus and that these had been implemented in most airports.

State of alert

Dufry General Manager for South America Enrique Urioste began by painting a picture of changing consumer behavior in the face of the crisis.

“We are all being confronted by something that is absolutely new to all of us. Some of us have experienced economic, political or scientific crises, but never the combination of the three together on a global scale,” he said, adding that when people start traveling again, they will be in “a state of alert”.

“It means that people who used to feel comfortable testing, trying, talking to our BAs or to our store people, are now going to be in panic. This state of mental stress and wellbeing is a concern all parties need to address, because it’s going to be there.”

Urioste continued: “In order to address this, we have been working very closely with the airports. Airports and retailers are a key component in bringing a mental state of peace. From the moment the passenger arrives at the airport, he needs to feel safe.”

Dufry has been working on establishing protocols, to ensure the whole travel environment is safe. He believes that if the industry doesn’t address the health protocols properly, it will negatively impact retailing.

The leading operator is also working on omnichannel initiatives. “We need to be creative and find new ways. One thing we are working on is omnichannel within the airport. Our industry is highly regulated; in most countries they cannot sell online, but we can reserve online, we can start communicating with our passengers online and try to bring the retail experience [to the passenger] in advance. The airport, the retailer, the food and beverage operators will start to connect with the passenger before the passengers start traveling. That is one of the milestones that we have defined at airports in some of our locations.”

Dufry wants to achieve a systematic and consistent message for travelers, both online and offline. He also believes Dufry’s Red loyalty program will be a “great tool” in the omnichannel strategy.

“We can take advantage of the social distancing at the check-in process by having our team with digital tools starting the retail experience at this stage, as the process will be much longer than before. We can also do that after they have been through security. The idea is to identify all of the touchpoints where we can interact with customers,” he said.

Aggressive promotions and offers

Dufry is also working on the product assortment, the promotional plan, and pricing strategy.

“Our customer numbers are going to be much lower than before,” he said, noting that there would be fewer business and leisure travelers for some time. “We need to be, in an intelligent way, aggressive with promotions, aggressive with offers, aggressive with product mix and go back to that uniqueness of the packaging of the product in this channel. If we are still competing with the Amazons of this world who are now more and more all offering the same product and more or less the same prices, we need to bring something unique, something different, and something that made our industry what it is.”

He stressed the need for the industry to work together to make the comeback successful and wrapped up by saying: “We have as the travel retail industry the unique opportunity to redefine things that we have all been talking about, but because of the state of the business, we have never done.”

He said that for many years the industry had been advocating redefining concession contracts and the relationship between the airports, airlines and retailers. “This is the unique opportunity. It’s a chance to take what is good out of a very bad situation.”

A tipping point

Travel retail is one of the key battlegrounds globally for the leading spirits supplier Pernod Ricard, according to its Global Travel Retail Strategy & Insights Director Anuj Roy. The company believes the travel industry has always been resilient and will recover eventually from the unprecedented situation. “We believe people want to travel and travel is a fundamental part of modern life.”

The company monitors consumer sentiment and social media and believes it saw a “tipping point” from April to May, in which people’s willingness to travel has been improving. “People are now looking forward to traveling,” he said, noting that people are talking about airports and duty free on social media.

But people have changed their behavior, including their shopping behavior, he said, citing social distancing. They will also change how they travel, so the industry needs to adapt to this. Things will normalize eventually but some changes will be permanent.

People will be under stress when traveling and will need clarity and guidance. Addressing needs about safety and hygiene and messaging around these issues will be important for retailers, he noted.

Emotional rollercoaster

L’Oréal Travel Retail Americas Strategic Business Development Director Gabriela Rodríguez called on the industry to work together and focus on the consumer.

“Right now, the only certainty is the uncertainty,” she said. “We need to work all together, we need to focus on the consumer, because we’re seeing a consumer that has been going through a rollercoaster and we see that this emotional rollercoaster is the same all over the world. It doesn’t matter if you’re Chinese, Brazilian or British, you’re going from panic to ‘I don’t know what to do’ to national solidarity. You’re trying to find comfort, you’re trying to be part of a group.”

There will be four major trends, Rodriguez said, including digital acceleration. Wifi is the most important need. “We need to combine the implementation of new technologies with how to welcome the passenger into the store. We’re working on a strong plan to combine phygital and digital, but we cannot do it by ourselves and we need to work together with the retailers, and the retailers will need to work together with the airport.”

Other trends include transparency in front of the consumer and the need for meaningful experiences.

“The key challenge that we will have is, we have been talking about the Trinity. I think we can do ‘quaternity’ discussions, because it’s the brand, the retailer, the airport authority and the associations,” she concluded.

Travel retail exclusives

Markus Suter, Sales & Market Manager for Americas Duty Free at Lindt & Sprungli, who is based in Brazil, said the Swiss confectionery company has a market share in Latin America of around 24% and 44% in Brazil for confectionery.

Lindt plans to focus more on travel retail exclusives and core products and perhaps reduce the assortment.

The chocolatier also aims to adapt more to local needs, and has already launched dulce de leche, which is popular in Argentina and Brazil.

Souvenir and destination products such as Lindt’s travel suitcase tin will also be key. The company won’t launch a lot of new items in the next one or two years.

Another important factor for consumers will be the issue of sustainability and the fact that Lindt produces its chocolate from bean to bar.

In his summing up of the session, Donagaray spoke about the importance of sharing information as an industry: “This is the moment for all of us to share and to be very transparent and see how we can all be in the same boat, rowing in the same direction.”

.jpg?&resize.width=322&resize.height=483)