m1nd-set outlines barriers to purchase in recovery of MEA duty free

According to the MEADFA Q2 recovery monitor, published for the Middle East and Africa Duty Free Association by Swiss research agency m1nd-set, airlines’ one bag policy is among three barriers to purchase that have significantly increased in importance in 2021 versus previous years. The recovery monitor shows three key barriers to purchase affecting the revival of duty free sales.

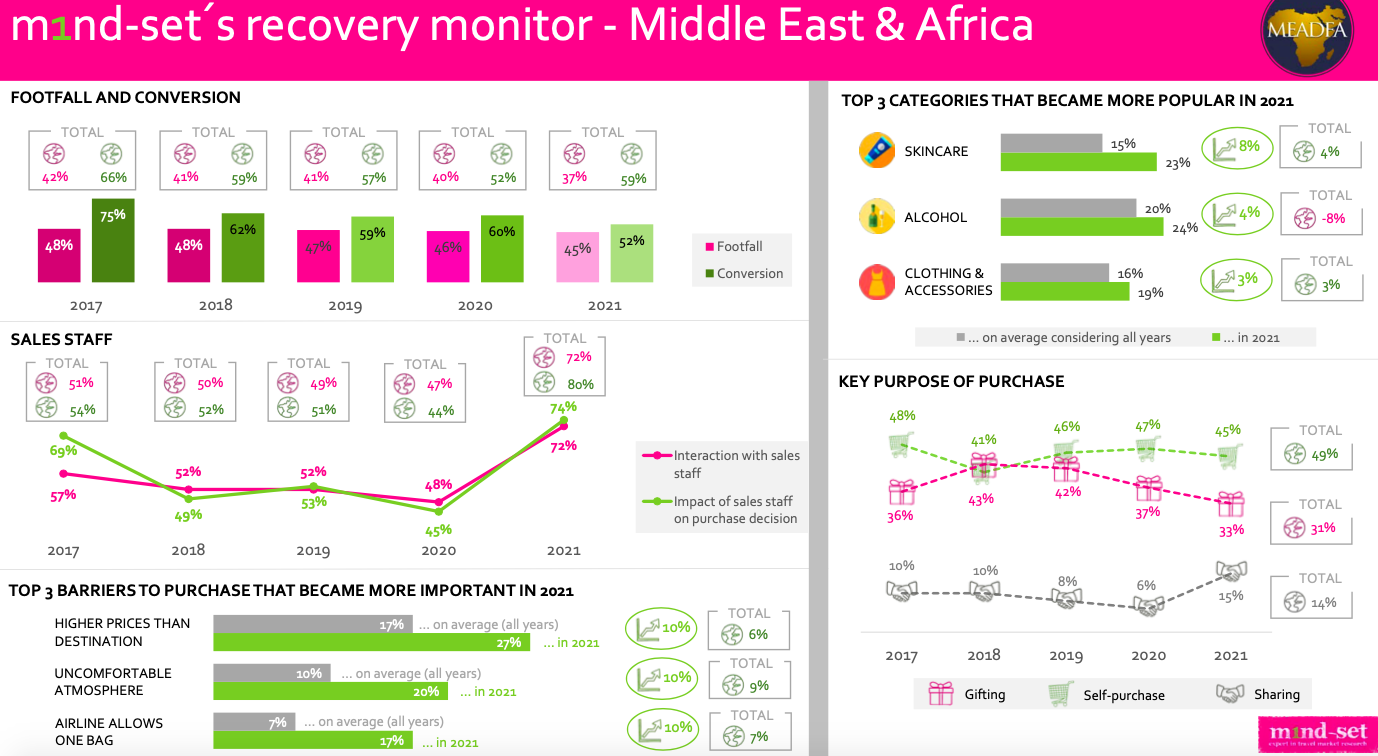

The recovery monitor reveals that 17% of passengers from the Middle East and Africa region state the one bag rule is a dissuasive factor in their decision to purchase; this is 10% higher than in the previous four years and 10% higher than the global average. Other barriers cited by MEA passengers include higher prices than at their destination and an uncomfortable atmosphere in the airport shopping environment. The issue of price was mentioned by 27% of passengers from the region, up 10% on the average across the previous four years and 21% higher than the global average. 20% of passengers from the MEA region mentioned that the uncomfortable atmosphere was a barrier to purchase, up from 10% in the previous four years and 11 points more than the global average.

The recovery monitor indicates that footfall and conversion levels in the region reflect the increasing unease with airport shopping in the post-COVID context. Footfall has been on a consistent decline among MEA passengers since 2017, falling from 48% in 2017 to 45% in 2021, while conversion has dropped more steeply, from 75% in 2017 to 52% in 2021. The footfall level remains higher than the global average (37%) while the conversion level has dipped below the global average (59%) for the first time in five years.

In-store behavior is more active than ever in the region, as with all regions in the post-COVID era. Interaction with sales associates has increased by 50%, with 48% of visitors interacting in 2020 and 72% in 2021, while the impact of the interaction with sales staff on driving the purchase decision has increased further still, rising by 64% in the past year – from 48% of passengers claiming a positive impact of the interaction in 2020 and 74% in 2021.

Skincare, wines and spirits and fashion and accessories are the categories that have gained in popularity the most in 2021 in the MEA region, compared to the previous four years. 23% of passengers from the region are interested in purchasing skincare products in 2021, compared to 15% in the previous four years. The increase is double the increase the category has seen globally (8% vs. 4%). While alcohol has declined in popularity globally, falling 8% on the popularity scale, passengers in the Middle East and Africa are more interested in the category than before with 24% stating they are interested in purchasing wines and spirits in 2021, up 4% compared to the previous four years. The increase in popularity of fashion and accessories is less robust, with 19% claiming they are interested compared to 16% previously. Both gifting and self-purchasing have declined in 2021. The decline in gifting purchases is consistent with the global trend, while self-indulgence is becoming more popular in the airport retail environment in 2021 globally.

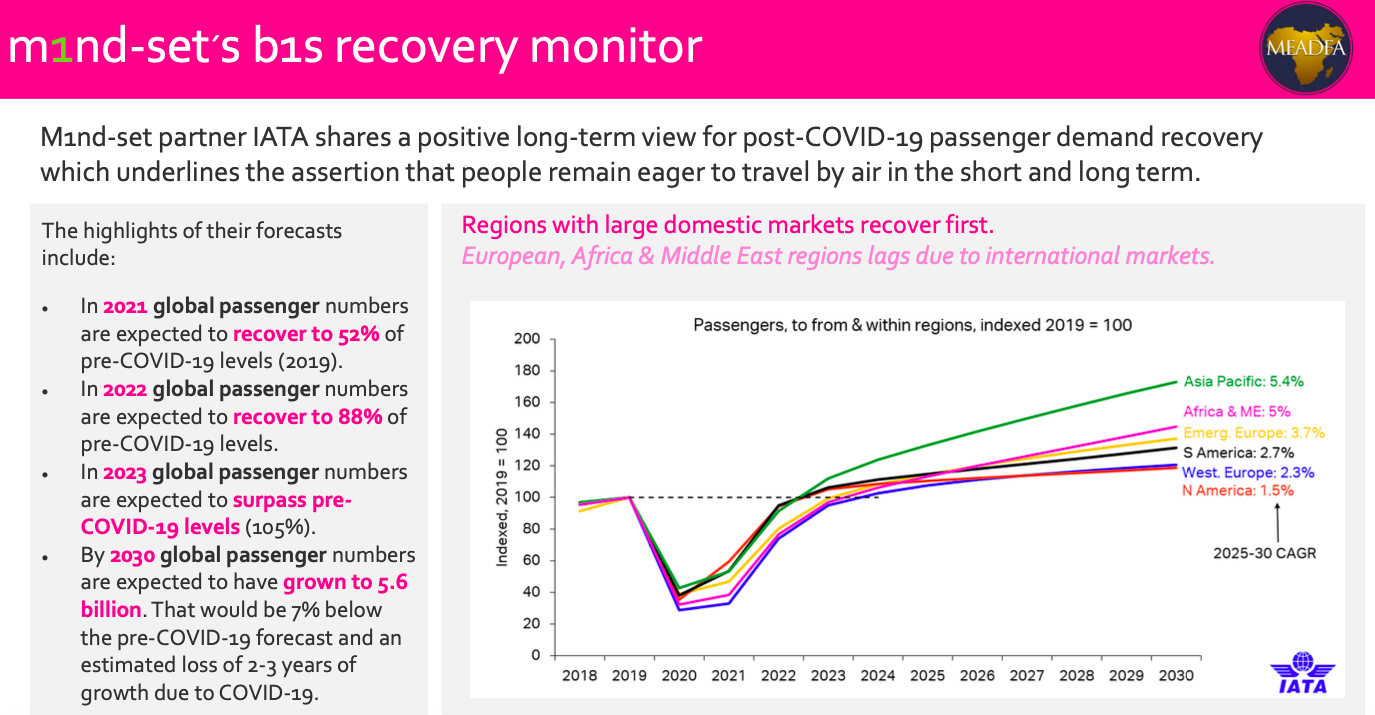

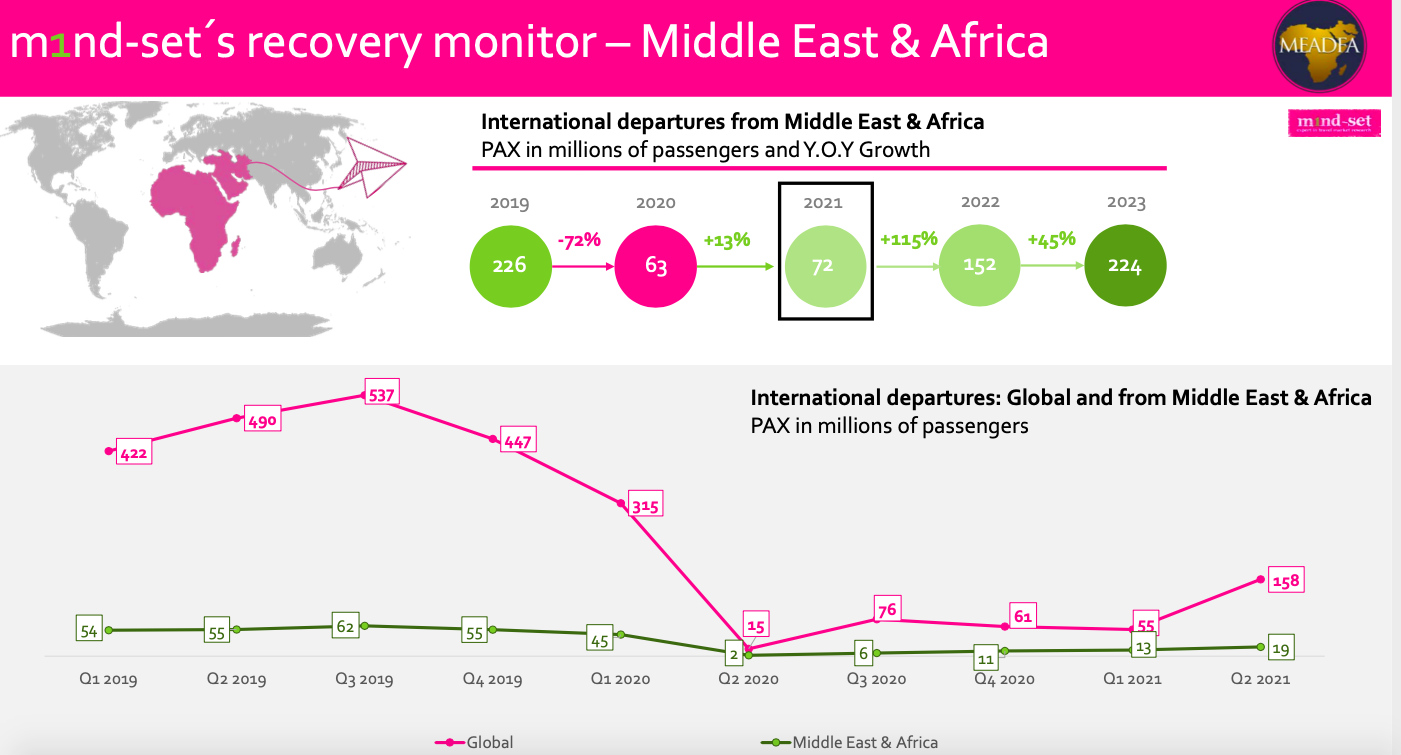

In terms of international passenger traffic from the Middle East and Africa, while long-term traffic growth prospects are quite robust, the short-term situation is less dynamic. Over the past quarter, passenger growth increased by 46% from 13 million to 19 million outbound passengers compared to the global average of 187% growth, from 55 million to 158 million international passengers. The full year forecast for 2021 in the region has been revised from a 65% increase, forecast in Q1, to a 13% rise in passengers compared to 2020, from 63 million in 2020 to only 72 million in 2021. The 2022 growth forecast remains dynamic and pre-COVID levels are expected to be attained by 2023. Over the long term the picture is more positive; the region is expected to experience 5% annual growth in the five years from 2025 to 2030. This is the second fastest growth rate compared to other world regions, following Asia Pacific, which is forecast to see 5.4% annual growth over the same period.

“The beauty of the regular quarterly monitors is that we are able to home in on different trends that are emerging from one quarter to the next, as passengers take to the skies once again. The barriers to purchase are an essential aspect of this monitoring and help the associations’ members to understand and address specific issues. All stakeholders, airlines included, have suffered tremendously from the pandemic; the data is clear evidence that the industry needs to continue rallying behind the industry associations to address the various challenges to a healthy recovery,” says Peter Mohn, Owner & CEO, m1nd-set.

“As Peter states, the monitor provides us with essential tools to address the challenges of our business. While we are encouraged by the long-term scenario, it’s vital we address these immediate challenges such as declining footfall and conversion levels and ensure passengers feel comfortable purchasing in the airport retail space,” adds Sherif Toulan, President, MEADFA.