m1nd-set: 2020 traffic round-up and 2021 roadmap to recovery

The research reveals that when international travel restrictions are lifted, the majority of international travelers (79%) will be willing to travel by air again within the first six months

According to m1nd-set’s latest research, responsibility and sustainability, technology and online retail are fundamental to travel retail’s robust recovery. The company’s final report of this year reveals an in-depth retrospective on 2020 and the impact that COVID-19 has had on global air traffic. The research summarizes how international travelers will change the way they travel and how their shopping behavior will evolve, revealing both the global trend, as well as an analysis across each world region.

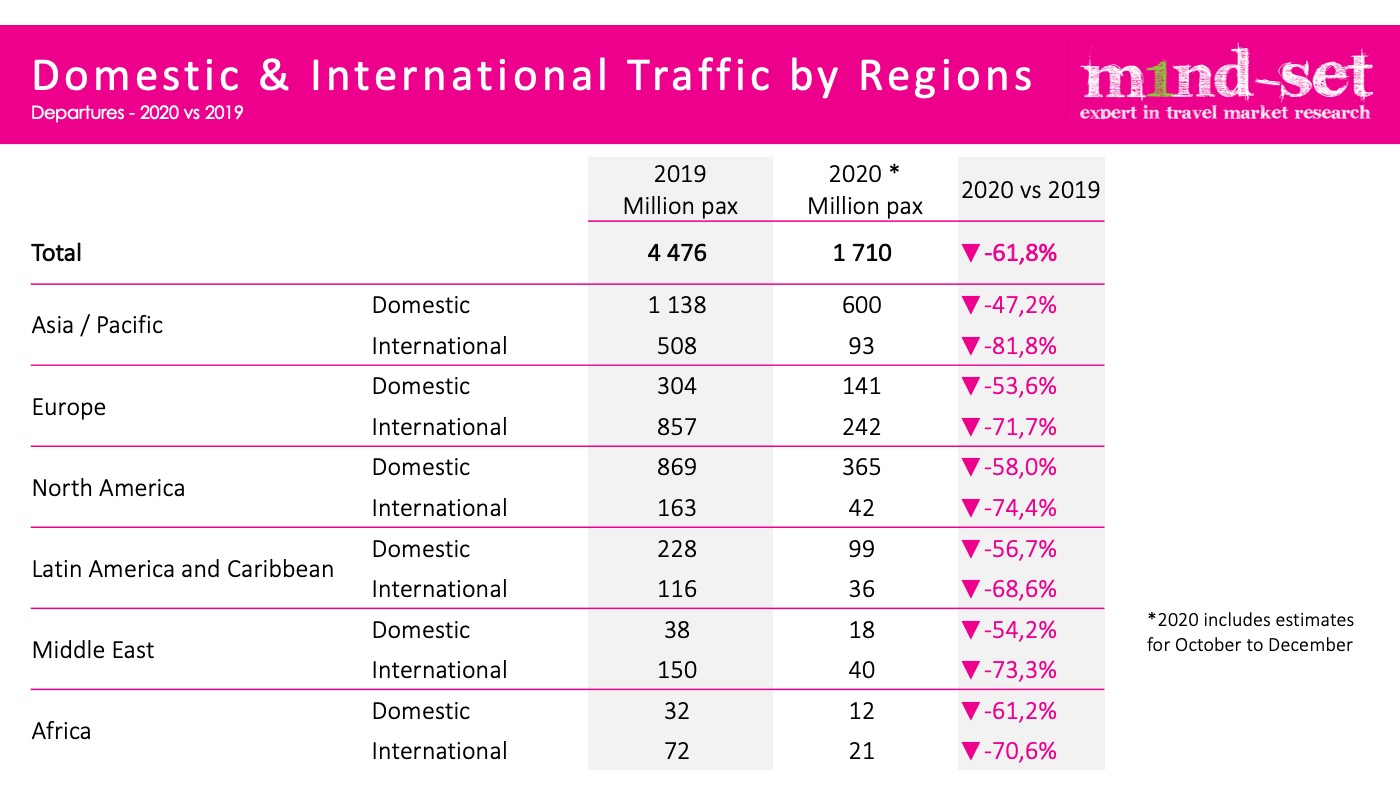

The research examines both international and domestic air traffic region-by-region for the full year of 2020, with forecast data from October to December. The data is drawn from m1nd-set’s traffic and shopper behavior insights tool, B1S, which features both current and forecast traffic from IATA’s air traffic database, DDS. As it complies not only actual flight, but also reservation data from over 850 airlines including 150 low cost carriers, the IATA database is the most comprehensive and precise air traffic and forecasting tool available.

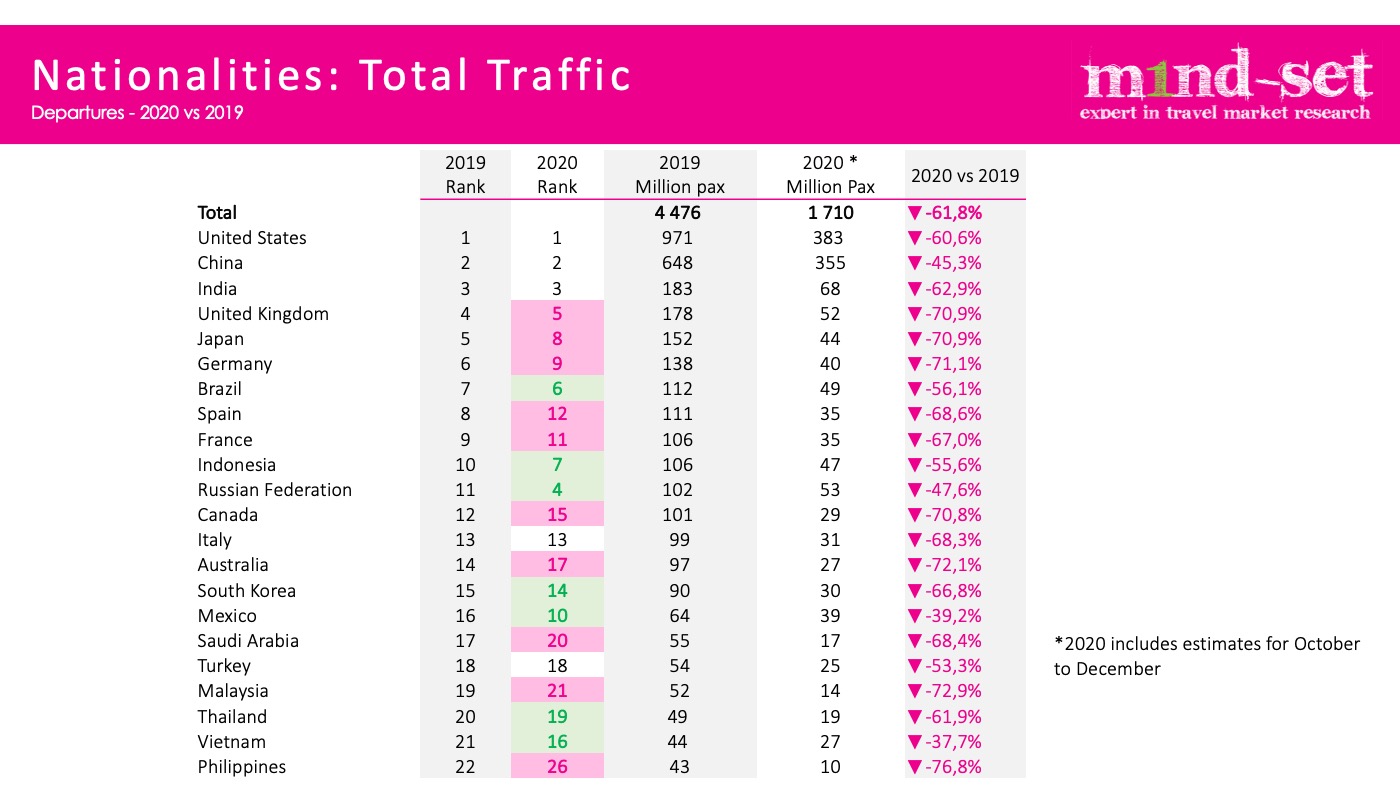

Referencing the data, traffic declines during 2020 vary from -47% to -61% for domestic travel and from -69% to -82% for international travel. Total traffic fell from 4.48 billion travelers in 2019 to just over 1.7 billion travelers in 2020 globally, an overall (global average) decline of 62%.

According to m1nd-set, total traffic fell from 4.48 billion travelers in 2019 to just over 1.7 billion travelers in 2020 globally, an overall (global average) decline of 62%

The research details the fluctuations both by airport regions and nationalities. The most significant decline is seen in Asia Pacific where international travel has decreased from 508 million passengers in 2019 to 93 million in 2020. The hardest hit region for domestic travel in 2020 is Africa where passenger numbers have dropped by more than 61%, from 31.8 million in 2019 to just over 12 million in 2020. The most significant losses in traffic among the top-ranking nationalities for air travel were seen in China’s international market where passenger numbers have decreased by almost 88%.

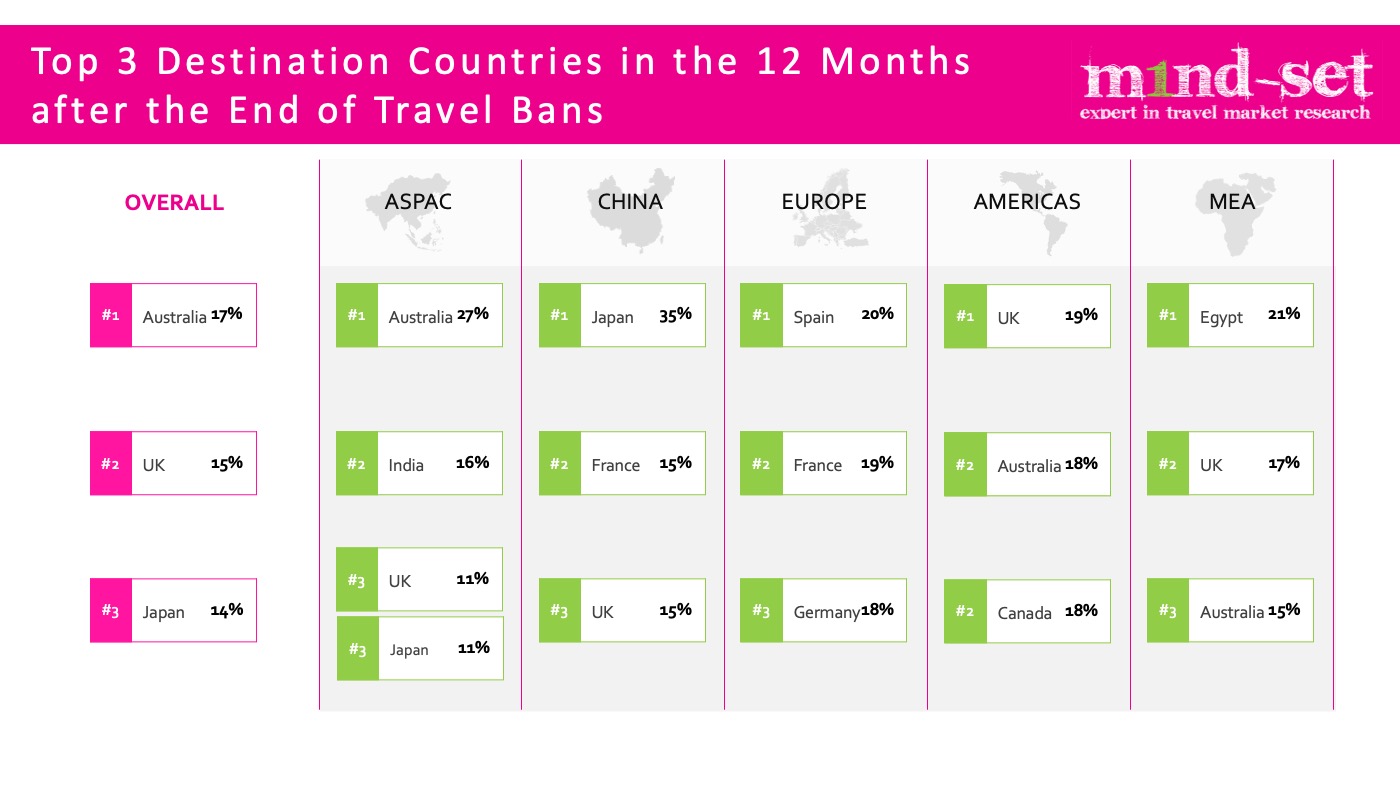

The research reveals that when international travel restrictions are lifted, the majority of international travelers (79%) will be willing to travel by air again within the first six months. However, more than eight out of ten travelers will change their travel frequency on average.

Asia Pacific travelers will be the most likely to change (and reduce) their travel frequency (87%); the Chinese slightly less so (83%).

While 65% of international travelers plan to spend less time at the airport, less than one sixth of travelers will avoid the duty free shops. According to the team at m1nd-set, approximately one in three shoppers will spend less time in the duty free shops and the percentages of travelers considering not purchasing products in the duty free shops on their next international trip remain low across the categories, varying from tobacco (8%) to toys (17%).

Since it’s predicted that 65% of international travelers plan to spend less time at the airport, retailers will need to improve the airport shopping & dining experience through active consumer engagement high performance of social and environmental responsibility

“With around two thirds of global travelers planning on spending less time at the airport on their next international flight, retailers and other commercial operators are going to have to make the airport shopping and dining experience all the more enticing in order to engage and excite passengers and draw them into the stores and restaurants.”

The additional time that will be required to pass through security and immigration due to social distancing, means passengers will need to be encouraged to arrive earlier than usual at the airport so there is sufficient time for them to browse the shops, grab a coffee or wine and dine,” says Peter Mohn, Owner & CEO, m1nd-set.

The research concludes with some concrete recommendations for adapting and ensuring the business remains relevant to the post-pandemic consumer mindset.

“We have identified three key steps that will be essential for a robust recovery for travel retail. The inexorable shift toward online needs to be embraced by the industry more concretely and holistically, firstly. Investments in state-of-the-art technology to provide a seamless contactless in-store experience to entice all consumers back to shop is another essential ingredient.

Of equal importance – and perhaps of utmost importance for some customer segments – is how businesses perform on social and environmental responsibility. In the future, this will be one of the main drivers of customer and brand loyalty, as consumers will be more attentive to ethical and environmental values including how a product is sourced, whether the packaging is compostable, the impact of a product on physical health and whether the brand or retailer is placing planet over profit.

It will be essential for all stakeholders to anticipate these changes and adapt to remain relevant to the post-pandemic consumer,” adds Mohn.

.jpg?&resize.width=322&resize.height=483)