African airline industry sees major losses

Airlines the world over have been hard hit by the border shutdowns and travel warnings associated with the COVID-19 virus, and nowhere is that truer than in Africa.

Extreme losses

The International Air Transport Association (IATA) is calling for greater government relief measures for the African airline industry as the crisis deepens, resulting in far greater losses than had been anticipated. The region’s airlines are now expected to lose US$6 billion of passenger revenue compared to 2019, a figure 50% greater than had been forecast.

Without aid, the region’s expected job losses in aviation and related industries are expected to top 50% more than had been anticipated. The previous estimate had been 2 million, but that has now increased to 3.1 million — a full half of the region’s 6.2 million employed in aviation-related jobs.

Other related estimates are falling in line with these worse scenarios. Air traffic is expected to fall 51% on last year’s traffic, revised from an estimate of -32%. The region’s GDP is now expected to fall by US$28 billion, or half of its total in 2019, whereas the previous estimate was US$17.8 billion.

These revised estimates are based on the likely scenario of severe travel res restrictions lasting for three months, with a gradual lifting of restrictions in domestic markets, followed by regional and then intercontinental.

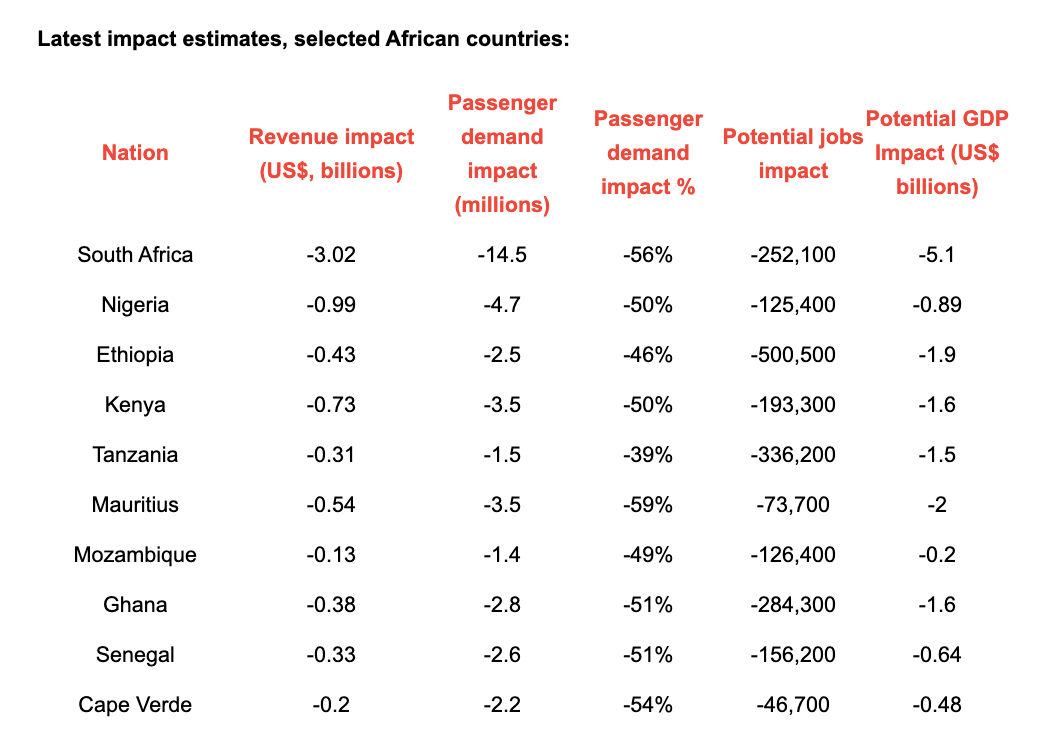

Countries hardest hit include:

South Africa:14.5 million fewer passengers, US$3.02 billion revenue loss, 252,100 jobs lost, US$5.1 billion lost in contribution to the nation’s economy

Nigeria: 4.7 million fewer passengers, US$0.99 billion revenue loss, 125,400 jobs lost, US$0.89 billion lost in contribution to the nation’s economy

Kenya: 3.5 million fewer passengers, US$0.73 billion revenue loss, 193,300 jobs lost, US$1.6 billion lost in contribution to the nation’s economy

Mauritius: 3.5 million fewer passengers, US$0.54 billion revenue loss, 73,700 jobs lost, US$2 billion lost in contribution to the nation’s economy

Ghana: 2.8 million fewer passengers, US$0.38 billion revenue loss, 284,300 jobs lost, US$1.6 billion lost in contribution to the nation’s economy

Senegal: 2.6 million fewer passengers, US$0.33 billion revenue loss, 156,200 jobs lost and US$0.64 billion lost in contribution to the nation’s economy

Ethiopia: 2.5 million fewer passengers, US$0.43 billion revenue loss, 500,500 jobs lost, US$1.9 billion lost in contribution to the nation’s economy

Cape Verde: 2.2 million fewer passengers, US$0.2 billion revenue loss, 46,700 jobs lost, US$0.48 billion lost in contribution to the nation’s economy

Tanzania: 1.5 million fewer passengers, US$0.31billion revenue loss, 336,200 jobs lost, US$1.5 billion lost in contribution to the nation’s economy

Mozambique: 1.4 million fewer passengers, US$0.13 billion revenue loss, 126,400 jobs lost, US$0.2 billion lost in contribution to the nation’s economy

IATA is asking regional governments to step up their efforts to aid the industry to minimize the impact on jobs and the broader economy.

These African governments have already taken direct action to support local aviation:

• Senegal has announced US$128 million in relief for the Tourism and Air Transport sector

• Seychelles has waived all landing and parking fees from April to December, 2020

• Cote d’Ivoire has waived its Tourism Tax for transit passengers

• South Africa is deferring payroll, income and carbon taxes across all industries, which will also benefit airlines domiciled in that country

More help needed

But more help is needed, from more countries. The IATA is requesting a combination of the following:

• Direct financial support

• Loans, loan guarantees and support for the corporate bond market

• Tax relief

Africa’s air transport sectors are on the verge of collapse. The IATA has therefore appealed to development banks and other sources of finance to support them. “Airlines in Africa are struggling for survival. Air Mauritius has entered voluntary administration, South African Airways and SA Express are in business rescue, other distressed carriers have placed staff on unpaid leave or signaled their intention to cut jobs. More airlines will follow if urgent financial relief is not provided. The economic damage of a crippled industry extends far beyond the sector itself. Aviation in Africa supports 6.2 million jobs and $56 billion in GDP. Sector failure is not an option, more governments need to step up,” said Muhammad Al Bakri, IATA’s Regional Vice President for Africa and the Middle East.

Looking ahead

The airline industry in Africa is not only concerned about surviving the crisis, it has to collectively plan how to re-start the industry when governments and public health authorities allow. To that end, a series of virtual regional summits are taking place, bringing together governments and industry stakeholders with the objectives of understanding what is required to re-open closed borders, and finding agreement on solutions that can be scaled and operated efficiently.

“As governments struggle to contain the COVID-19 pandemic, an economic catastrophe has unfolded, said Al Bakri. “Re-starting aviation and opening borders will be critical to the eventual economic recovery. Airlines are eager to get back to business when and in a way that it is safe. But starting up will be complicated. We need to make sure that the system is ready, have a clear vision of what is needed for a safe travel experience, establish passenger confidence and find ways to restore demand. Cooperation and harmonization across borders will be essential to restart aviation.”

.jpg?&resize.width=322&resize.height=483)