Brexit offers significant new potential for UK & EU DF business

According to m1nd-set, following changes to British and EU regulations at the end of the Brexit transition period, as of January 1, 2021, the number of travelers eligible to purchase duty free goods at British and European airports is set to increase by more than 60%

In a special post-Brexit analysis study, m1nd-set, Swiss research agency, assesses impact of the return of duty free allowances on excise goods for travelers between EU countries and the UK. The research examines the potential gains in regards to passenger numbers market by market, focusing on the major airports and showing the individual gains in passenger numbers eligible to purchase duty free goods when traveling between the UK and each respective EU market before and post-Brexit.

Through m1nd-set’s proprietary traffic and shopper insights tool, Business 1ntelligence Service (B1S), the research agency measures the volume of duty exempt passengers, departing from any of the 1500 airports covered in B1S based on their unique flight path.

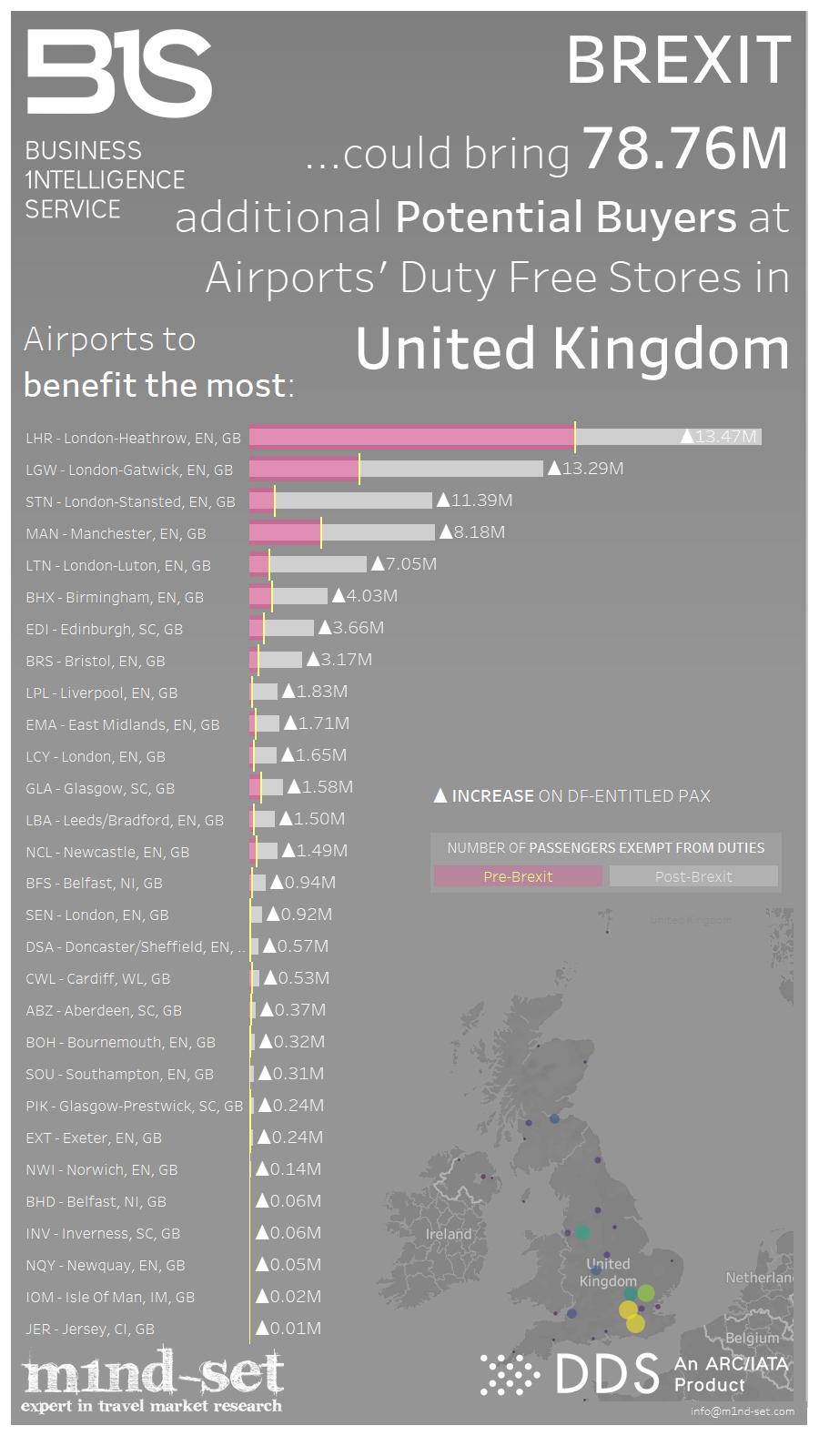

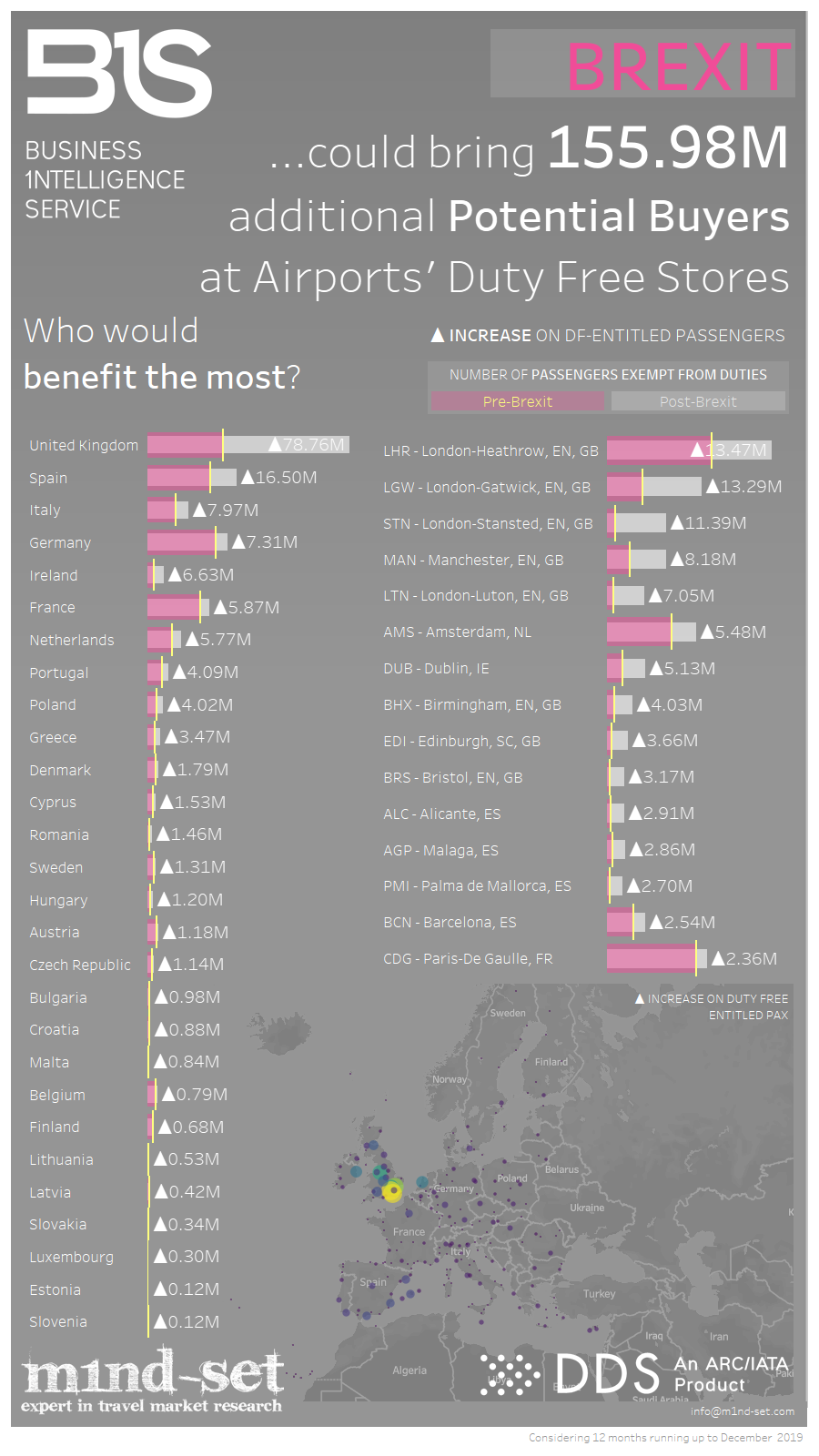

According to m1nd-set, British and European airports will see a potential increase of 156 million eligible customers into their stores, as of January 2021; these are essentially travelers between the UK and EU countries who were not previously eligible to purchase excise goods duty free at airports on departure or arrival.

The UK will benefit the most from the return of duty free alcohol and tobacco sales between the EU and UK, with an additional 78.7 million additional eligible travelers. The other top-ten markets set to benefit include Spain, Italy, Germany, Ireland, France, the Netherlands, Portugal, Poland and Greece.

The total number of additional eligible potential duty free shoppers across Spain’s airports is estimated at 16.5 million. With just below 8 million additional shoppers eligible to purchase duty free products, it’s expected that Italy will experience the third largest gain in potential duty free shoppers.

Among the other top ten markets, France’s airports will see an increase of 5.87 million passengers eligible to purchase duty free, the Netherlands +5.77 million, Portugal +4.09 million, Poland +4.02 million and Greece +3.47 million. The special post-Brexit analysis study provides a detailed analysis of the potential increases of eligible passengers by individual airport as well as by market.

“Thanks to m1nd-set’s partnership with IATA, the B1S data is the industry’s only comprehensive traffic data tool that compiles actual passenger data based on flights taken, as opposed to other tools, which provide only booking information. This, combined with m1nd-set’s comprehensive database of shopper insights means B1S provides a unique, detailed and accurate picture of the post-Brexit shopper behavior, with quantifiable impact based on the traffic data and forecast information.

This is already enabling a significant number of m1nd-set partners to map out what the post-Brexit potential growth trajectory might look like for their category and brands,” shares Clara Susset, Travel Retail Research Director, m1nd-set.

.jpg?&resize.width=322&resize.height=483)