m1nd-set considers gender differences in travel retail shopping

The latest m1nd-set study disproves shopping sterotypes

Swiss research agency m1nd-set has released a new study on gender differences in travel retail shopping which disproves stereotypes.

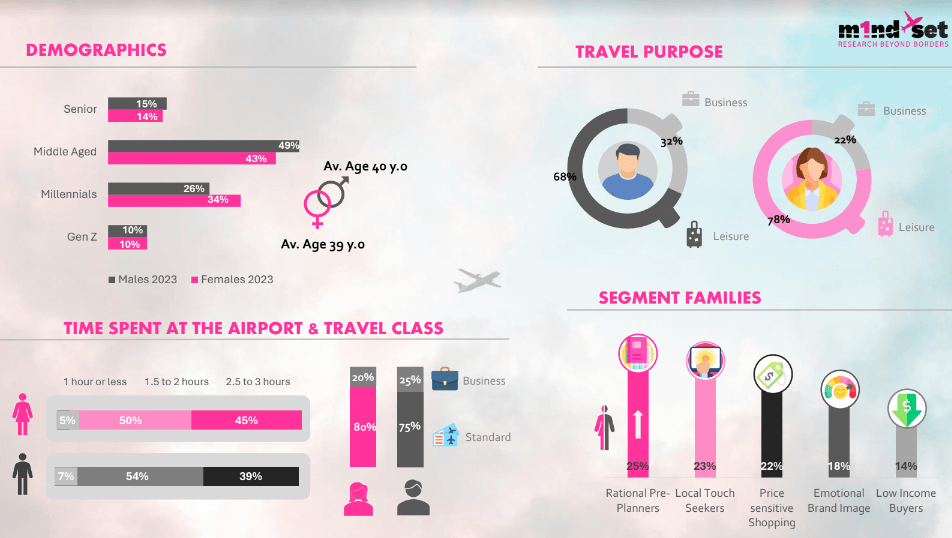

The latest shopper research on the differences between men and women’s shopping behavior in travel retail reveals that men tend to shop more in travel retail than women. The m1nd-set study reveals that contrary to common generalizations, in travel retail, men tend to shop more than women.

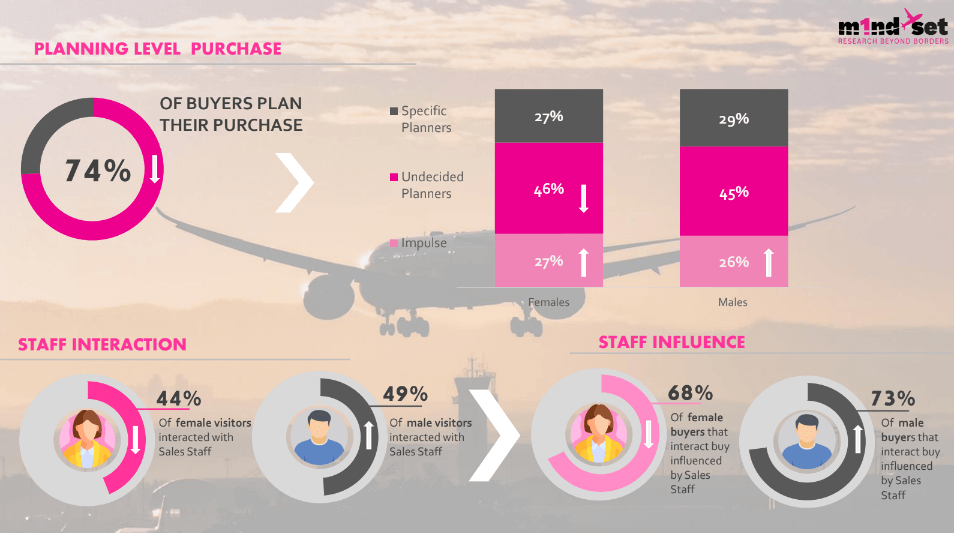

45% of men entered the duty free shops in 2023 compared to 44% of women and 29% of men purchased one or more products in the shops while only 26% of women purchased. According to m1nd-set, this leads to a conversion rate of 64% for men, five points higher than the conversion rate among women.

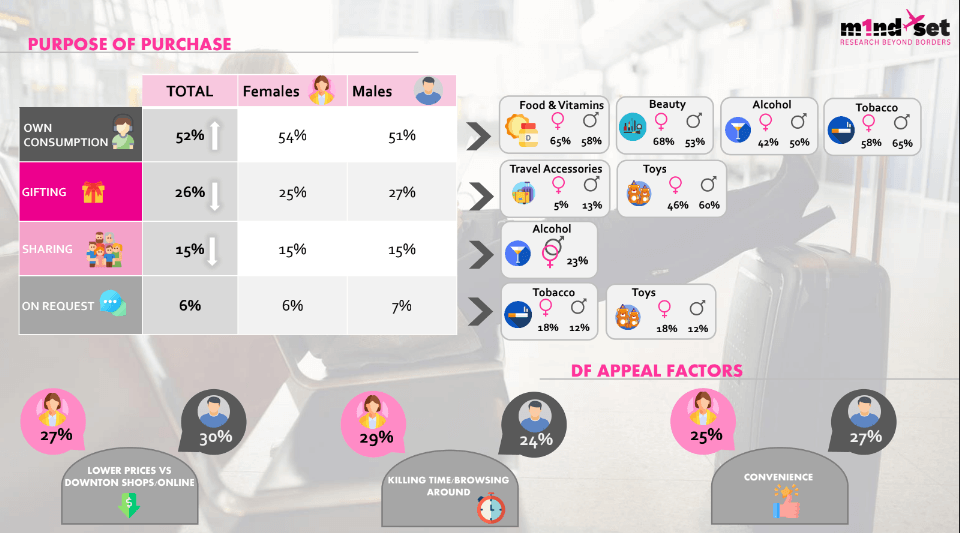

m1nd-set considers the purpose of purchase and duty free appeal factors

In terms of spend, men also spent more on average in total than women in travel retail in 2023: US$148 vs US$137. These spend levels in total are both lower than the pre-pandemic levels of US$166 for men and US$155 for women, according to the research.

The research, which was conducted among more than 10,000 male and female shoppers across all world regions, focuses on the distinct travel and shopping behavior of men and women, and highlights the areas where shopping behavior differs significantly between the genders. It provides detailed insights on footfall, conversion and spend, categories purchased, share of wallet by category, purpose of purchase and purchase destination, planning vs impulse buying behavior, staff interaction and purchase drivers as well as barriers to purchase.

The major differences in shopping behavior across the categories occur in the core Beauty, Food & Confectionery, Alcohol and Tobacco categories.

Owner and CEO at m1nd-set, Dr. Peter Mohn commented, “It comes as no surprise that women purchase Beauty significantly more than men; 48% of women purchased either skincare, perfumes or make-up compared to 32% of men. The percentage of men purchasing Beauty in 2023 has fallen since before the pandemic, however, by 5%.”

Mohn noted the same tendency in the Food & Confectionery category, as 40% of women say they purchased the category in airports in 2023 while only 34% of men purchased the category. Categories that are more frequently purchased by men include Alcohol and Tobacco.

According to the research some behavior in travel retail does fall in line with the general high street shopping behavior. A higher percentage of men say that they are attracted to the duty free shops by the convenience factor. Men are more prone also to be attracted by the more advantageous prices in duty free than women but are less stimulated than women by the opportunity to kill time and browse around the stores.

The research also demonstrates the key differences between men and women in terms of share of wallet in travel retail. The most significant difference according to m1nd-set can be observed in the Beauty category. Men on the other hand dedicate a significantly higher proportion of their spend to Alcohol purchases than women. Similarly, Jewelry & Watches commands a notably higher proportion of men’s wallets than that of women.

The study also considers how many travelers plan their purchases and the role of staff interaction

There are also diverging trends between the genders when analyzing purchase destination, according to m1nd-set. A higher percentage of women purchase Beauty for their own consumption than men. The same trend is observed in the Food & Confectionery category, but the opposite is seen in Alcohol and Tobacco; men tend to purchase both these categories for their own consumption more than women.

Other notable differences between gender behavior are seen in the gift purchasing behavior for the Travel Accessories and Toys categories, both of which are purchased more frequently by men than women as gifts. Women however are more solicited than men to purchase both Tobacco and Toys by friends and family. The research also demonstrates that men are more likely than women to engage with the sales staff in the duty free stores. The tendency to engage has risen from the pre- to post-pandemic era among men, while the opposite trend can be seen among female shoppers. Men are also more prone to be influenced by the interaction with the sales associates than women.

Commenting on the barriers to purchase, which the research provides detailed insights on, Mohn said, “The main barrier to purchase for both men and women equally is the negative price perception as 50% of both men and women said that the lack of motivating promotions and higher prices than in their home market were the main reasons for not purchasing in the duty free shops. The product assortment and lack of new products is the second most common reason for not purchasing, by both genders. A regular rotation of the product mix and a renewal of the product range to offer newness is therefore advisable to entice browsers to purchase instore.”

Mohn said clearer communications, either through instore touch points and POS signage, as well as through the well-trained staff, is also advisable to remove another barrier to purchasing, namely the uncertainty about customs regulations and allowances, which is cited by one quarter of both men and women. “Customs allowances should be made blatantly clear across all touch points, as this is a barrier that can be easily removed,” Mohn concluded.